Talking Points:

- AUD/USD Holds Monthly Low Ahead of RBA Interest Rate Decision.

- Gold Fails to Retain Bullish RSI Momentum- Former Support in Focus.

- USDOLLAR Topside Targets Still Favored Despite Weaker-Than-Expected 4Q GDP.

For more updates, sign up for David's e-mail distribution list.

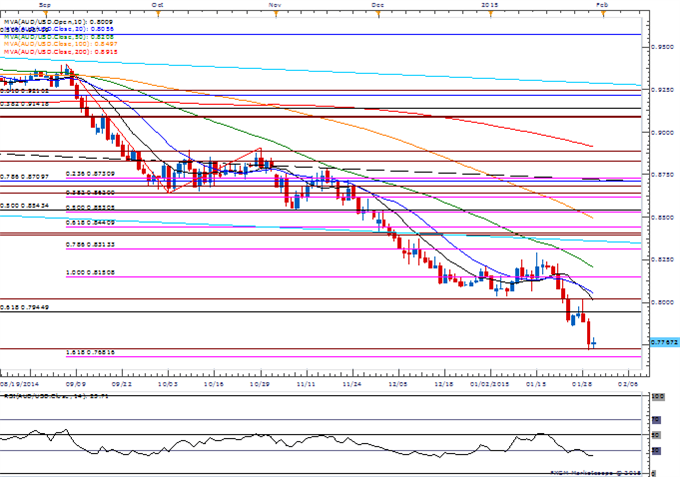

AUD/USD

Chart - Created Using FXCM Marketscope 2.0

- Looks as though AUD/USD will hold the January low (0.7718) ahead of the Reserve Bank of Australia (RBA) February 2 meeting, but remains at risk for a further decline as the Relative Strength Index (RSI) holds in oversold territory.

- RBA is largely anticipated to keep the benchmark interest rate on hold at 2.50%, but seeing speculation for a rate cut amid the global easing cycle.

- DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long AUD/USD, but seeing the ratio narrow going into February as it currently stands at +1.51.

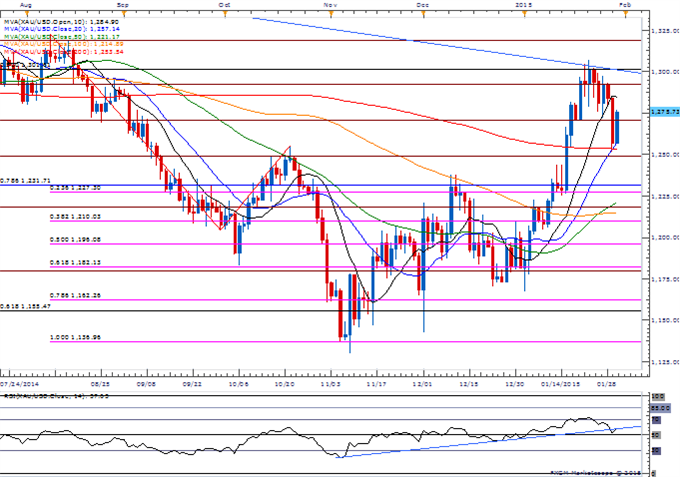

XAU/USD

- Gold remains vulnerable to a further decline after failing to close above $1301 (50% retracement); near-term top in place?

- As the RSI fails to preserve the bullish momentum carried over from back in November, the precious metal looks vulnerable to a further decline especially if it fails to close above 1.270 (50% expansion) going into February.

- Break/close below $1250 should expose the former resistance zones around $1227 (23.69% expansion) to $1231 (78.6% retracement).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

GBPNZD - Symmetry In Motion

USD/CAD Overloved?

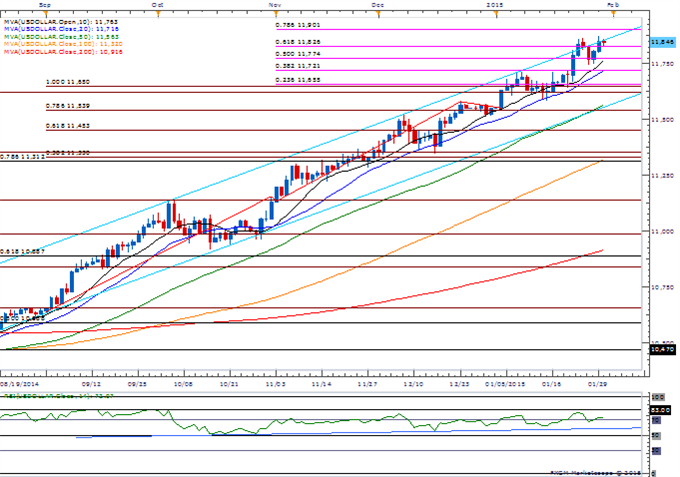

USDOLLAR(Ticker: USDollar):

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 11846.12 | 11860.61 | 11824.5 | -0.06 | 54.05% |

Chart - Created Using FXCM Marketscope 2.0

- String of higher-lows in Dow Jones-FXCM U.S. Dollar continues to foster a bullish outlook for February even as the advance 4Q Gross Domestic Product (GDP) report falls short of market expectations.

- Nevertheless, seeing greater willingness from Fed officials to raise the benchmark interest rate in mid-2015 as St. Louis Fed President James Bullard favors normalize monetary policy sooner rather than later.

- As the RSI holds in overbought territory, topside targets remain favored with the next level of interest at 11,901 (78.6% expansion).

Join DailyFX on Demand for Real-Time SSI Updates!

Release | GMT | Expected | Actual |

Gross Domestic Product (Annualized) (QoQ) (4Q A) | 13:30 | 3.0% | 2.6% |

Personal Consumption (4Q A) | 13:30 | 4.0% | 4.3% |

GDP Price Index (4Q A) | 13:30 | 0.9% | 0.0% |

Core Personal Consumption Expenditure (4Q A) | 13:30 | 1.1% | 1.1% |

ISM Milwaukee (JAN) | 14:00 | 58.00 | 51.60 |

Chicago Purchasing Manager (JAN) | 14:45 | 57.5 | 59.4 |

U. of Michigan Confidence (JAN F) | 15:00 | 98.2 | 98.1 |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source