Talking Points

- GBP/USD Technical Strategy: pending short

- Dark Cloud Cover formation in intraday trade offers warning

- Shooting Star looks to be forming on the daily

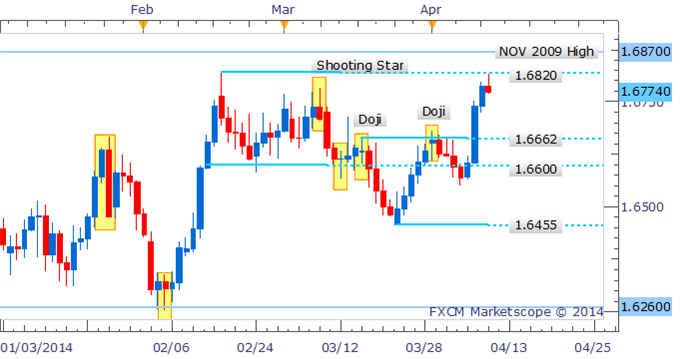

GBP/USD is giving back some ground after staging an exceptional run to its 2014 high near 1.6820 in recent trading. The retreat by the bulls looks to be prompting a Shooting Star pattern to form during intraday trade. However, the candle has yet to close and receive confirmation from a successive down period before being validated.

GBP/USD: Bulls Make A Run on 2014 High

Daily Chart - Created Using FXCM Marketscope 2.0

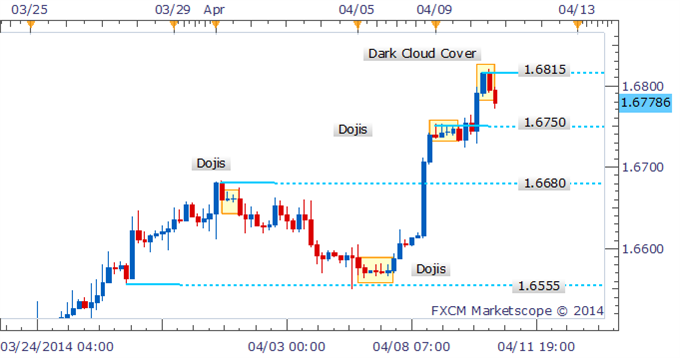

Examining intraday price action using the four hour chart below; there are signs the bears are re-emerging. A Dark Cloud Cover formation near resistance at 1.6815 is suggesting a potential dip towards 1.6750 in the session ahead.

GBP/USD: Dark Cloud Cover Offers Warning

4 Hour Chart - Created Using FXCM Marketscope 2.0

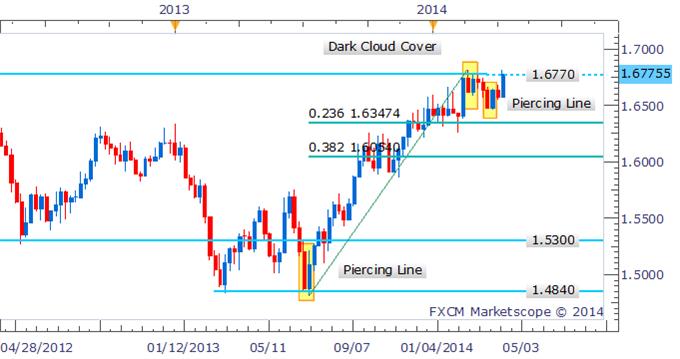

This week’s gains for the pound have acted to negate the Dark Cloud Cover formation that had appeared near multi-year resistance for GBP/USD. The rally has arisen following a Piercing Line pattern which signaled the bulls were returning to the Cable.

GBP/USD: Bulls Return As Piercing Line Forms on Weekly

Weekly Chart - Created Using FXCM Marketscope 2.0

By David de Ferranti, Market Analyst, FXCM

Follow David on Twitter: @Davidde

To receive David’s analysis directly via email, please sign up here.

original source

By

By