To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

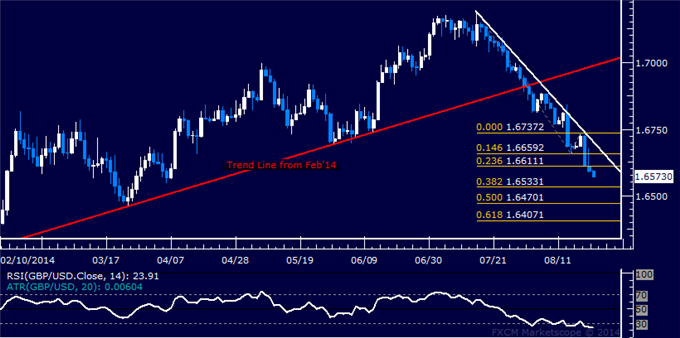

- GBP/USD Technical Strategy: Pending Short

- Support: 1.6533, 1.6470, 1.6407

- Resistance:1.6611, 1.6659, 1.6702

The British Pound renewed its push downward against the US Dollar, sinking to the lowest level in four months. Near-term support is at 1.6533, the 38.2% Fibonacci expansion, with a break below that on a daily closing basis exposing the 50% level at 1.6470. Alternatively, a turn above the 23.6% Fib at 1.6611 clears the way for a challenge of the 14.6% expansion at 1.6659.

Sterling is working on its seventh consecutive weekly decline, the first such losing streak since plunge at the onset of the global financial crisis in 2008. This comes on the heels of a surprisingly hawkish set of BOE meeting minutes, warning that momentum may be overshooting underlying fundamentals. With that in mind, we will tactically opt not to chase prices lower here, waiting for a correction higher to establish a short position.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

Daily Chart - Created Using FXCM Marketscope 2.0

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

original source