Fundamental Forecast for GBP: Neutral

- British Pound: Interest Rate Expectations Drop, Sterling Hobbled

- GBPNZD Opening Range in Focus Ahead of BoE- 1.9722 Key Support

- For Real-Time SSI Updates and Potential Trade Setups on the British Pound, sign up for DailyFX on Demand

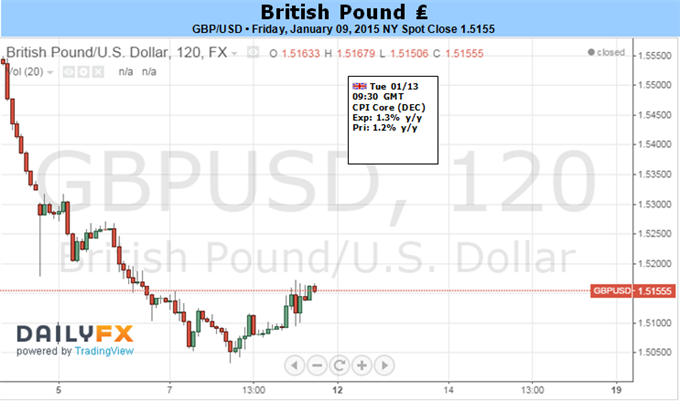

GBP/USD may struggle to hold above the 1.5000 handle in the week ahead should the fundamental developments coming out of the U.K. economy curb the Bank of England’s (BoE) scope to normalize monetary policy in 2015.

A marked slowdown in the U.K. Consumer Price Index (CPI) may further dampen the appeal of the British Pound and drag on interest rate expectations as the headline reading is projected to highlight the slowest pace of growth since 2002. However, market participants may show a greater reaction to the stickiness in the core rate of inflation as the BoE sees transitory effects driving the CPI below 1%, and the British Pound may face a near-term rebound should central bank Governor Mark Carney continue to prepare U.K. households and businesses for higher borrowing-costs.

With the BoE scheduled to testify on the Financial Stability report next week, we may see Mark Carney and Co. retain an upbeat tone for the region as the committee sees lower energy costs boosting private-sector consumption. As a result, the BoE may adopt a more hawkish tone for monetary policy as it anticipates a stronger recover in 2015.

In turn, the fresh batch of central bank rhetoric may limit the downside risk for GBP/USD and produce a more meaningful rebound in the exchange rate especially as the Relative Strength Index (RSI) comes off of oversold territory. The RSI signal paired with the monthly/yearly opening range suggests that a major low could now be in place, but the long-term outlook for GBP/USD remains bearish as the Fed is widely expected to normalize monetary policy ahead of the BoE.

original source