Talking Points

- EUR/USD Technical Strategy: Longs Preferred

- Dojisignaled hesitation by the bears near critical support

- Sellers likely to re-emerge at the 1.3700 handle

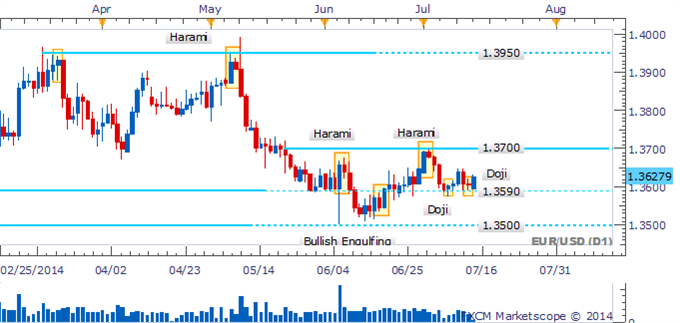

EUR/USD is powering higher after a Doji on the daily near key support at 1.3590 signaled a potential shift in sentiment amongst traders. With a strong up session underway, the close of the candle would yield a more noteworthy signal of a reversal in the form of a Morning Star pattern. Sellers are likely to re-emerge at the psychologically-significant 1.3700 handle.

EUR/USD: Doji Signaled Indecision Near Key Support

Daily Chart - Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

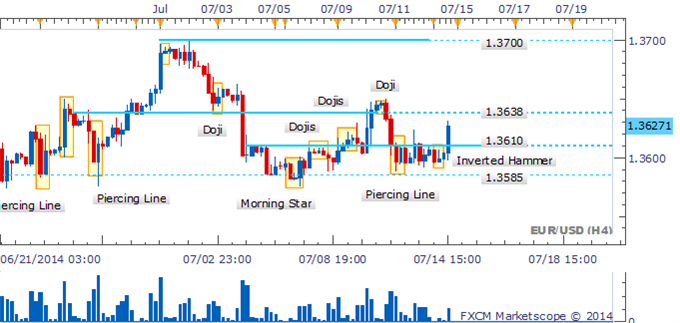

Drilling down to the four hour chart an Inverted Hammer formation offered an early indication of a recovery for EUR/USD. While there remain an absence of bearish patterns, new longs may be better served on a break of 1.3638 given the proximity to the level.

EUR/USD: Inverted Hammer Hinted At Intraday Recovery

4 Hour Chart - Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

By David de Ferranti, Market Analyst, DailyFX

Follow David on Twitter: @Davidde

To receive David’s analysis directly via email, please sign up here.

Learn how to read candlesticks to help identify trading opportunities with the DailyFX Candlesticks Video Course.

original source