- Federal Open Market Committee (FOMC) Expected to Drop ‘Considerable Time’ Phrase

- Will There Be a Larger Dissent as the Fed Looks to Normalize Policy Mid-2015?

Trading the News: Federal Open Market Committee (FOMC) Interest Rate Decision

The Federal Open Market Committee (FOMC) interest rate decision may heighten the bearish outlook surrounding EUR/USD as the central bank is widely expected to implement a more hawkish twist to the forward-guidance for monetary policy.

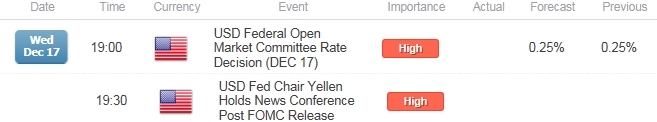

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:Indeed, the FOMC may remove the ‘considerable time’ phrase as the central bank shows a greater willingness to normalize monetary policy in mid-2015, but we may see Chair Janet Yellen strike a more balanced tone this time around as the central bank head appears to be in no rush to remove the zero-interest rate policy (ZIRP).

Expectations: Bullish Argument/Scenario

Release | Expected | Actual |

Advance Retail Sales (MoM) (NOV) | 0.4% | 0.7% |

Non-Farm Payrolls (NOV) | 230K | 320K |

Durable Goods Orders (OCT) | -0.6% | 0.4% |

The resilience in private sector consumption along with the ongoing improvement in the labor market may spur a material shift in Fed rhetoric, and the bullish sentiment surrounding the greenback may gather pace in 2015 should we see a growing number of central bank officials show a greater willingness to implement higher borrowing-costs next year.

Risk: Bearish Argument/Scenario

Release | Expected | Actual |

Producer Price Index (YoY) (NOV) | 1.4% | 1.4% |

Personal Income (OCT) | 0.4% | 0.2% |

Personal Consumption Expenditure Core (QoQ) (3Q P) | 1.4% | 1.4% |

However, the Fed may try to anchor interest rate expectations as falling commodity prices paired with subdued wage growth undermines the outlook for inflation, and the dollar may face a larger correction over the near-term should we get more of the same from the central bank.

Join DailyFX on Demand to Cover the Entire FOMC Rate Decision!

How To Trade This Event Risk(Video)

Bullish USD Trade: FOMC Implements Hawkish Twist to Forward-Guidance

- Need red, five-minute candle following the policy statement to consider a short EUR/USD position

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bearish USD Trade: Committee Shows Greater Willingness to Retain ZIRP

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same strategy as the bullish dollar trade, just in the opposite direction

Read More:

Price & Time: Key Levels to Watch Ahead of the FOMC

COT: US Dollar Index Small Speculators Hold Record Net Long Position

Potential Price Targets For The Release

EUR/USD Daily Chart

Chart - Created Using FXCM Marketscope 2.0

- Failure to retain the bearish momentum in price & RSI raises the risk for a larger rebound in EUR/USD.

- Interim Resistance: 1.2600 pivot to 1.2610 (61.8% expansion)

- Interim Support: 1.2280 (100% expansion) to 1.2290 (38.2% expansion)

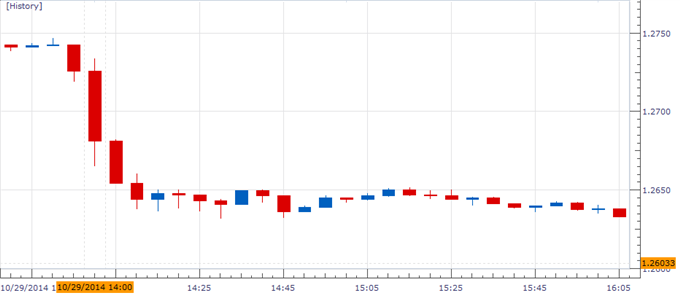

Impact that the FOMC rate decision has had on EUR/USD during the last meeting

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

OCT 2014 | 10/29/2014 18:00 GMT | 0.25% | 0.25% | -81 | -109 |

October 2014 Federal Open Market Committee (FOMC) Interest Rate Decision

As expected, the Federal Open Market Committee (FOMC) concluded the quantitative easing (QE) program in October, but retained a dovish tone for monetary policy as the central bank looks to retain the highly accommodative policy stance for a ‘considerable time.’ Nevertheless, it seems as though the Fed remains well on its way to normalize monetary policy next year as the central bank further discusses the exit strategy. The dollar strengthened following the end of QE , withEUR/USD dipping below 1.2650 and ending the day at 1.2617.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source