- EURGBP April decline at risk into key support confluence

- Updated targets & invalidation levels

- Compete to Win Cash Prizes withFXCM’s Forex Trading Contest!

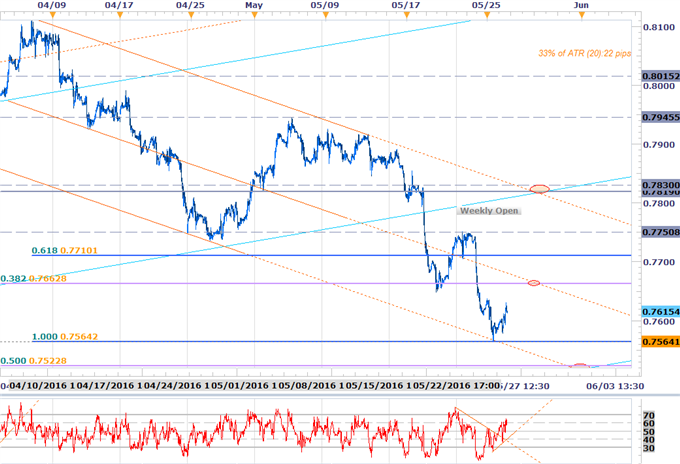

EURGBP Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook: A break below slope support and the monthly opening range shifted the focus lower in EURGBP. I highlighted this break on 5/18 and we’ve continued to track the move on SB Trade Desk, with the decline taking out initial targets at 7663 & 7564. A critical support barrier rests just lower at 7518/23 where the lower median-line parallel converges on the 200-day moving average, the 50% retracement of the July advance and descending channel support.

Keep in mind the break made earlier this month validates a broader head-and-shoulders formation with a measured move targeting a key support region at 7352/82. That said, the pair remains at risk for a near-term recovery on a move into the lower parallel with a rebound to offer more favorable short-entries higher up. Interim resistance 7663 backed by this week’s high at 7750. A breach above 7830 would be needed invalidate the broader short-bias. We’ll adjust this level as needed to account for time.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

EURGBP 30min

Notes: The pair has continue to trade within the confines of a well-defined descending channel formation off the 2016 high with yesterday’s low registering precisely at confluence support. Near-term divergence into the lows followed by a trigger-break in momentum shifted the immediate focus higher but the pair would need to clear 7663 to suggest a more meaningful recovery is underway. A break below today’s lows targets the key support zone at 7518/23.

From a trading standpoint, I would be looking for this rebound to offer a final drop into key support before any significant recovery materializes. Note that while the average true range (ATR) is rather tight, they are sterling pips. We’ll open up the profit targets to 33% of the daily range or 20-24 pips per scalp. The docket is pretty quiet until next week with the ECB interest rate decision on tap. Continue tracking this setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount.

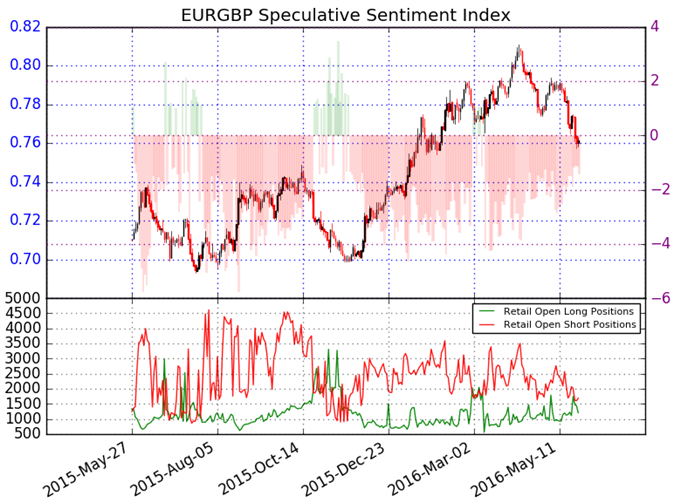

- A summary of the DailyFX Speculative Sentiment Index(SSI)shows traders remain net short EURGBP- the ratio stands at -1.40 (42% of traders are long)-weakbullishreading

- Yesterday the ratio was -1.19 (46% of open positions were long); long positions are 15.1% lower than yesterday and 3.1% above levels seen last week

- Open interest is 6.8% lower than yesterday and 11.7% below its monthly average

- A reduction in open interest & continued retail short interest on the decline off the April highs leaves a mixed picture from a sentiment standpoint. I would highlight that waning short interest does suggest that the break below key support would likely be swift & aggressive. That’s said, if the ratio starts to move further into net short positioning heading into support, be on the lookout for long triggers on a near-term recovery / rebound play.

Other Setups in Play:

- GBP/JPY Rally Approaching Initial Resistance Hurdle at 162

- GBP/USD Into Support- Shorts at Risk Above 1.44

- Webinar: USD Crosses in Focus as Index Eyes Resistance

- USDCAD Advance to Face Canadian CPI, Retail Sales- Key Support 1.2980

- USDOLLAR into Resistance- Rally at Risk Sub 11989

Looking for trade ideas? Review DailyFX’s 2016 2Q Projections!

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)

original source