To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

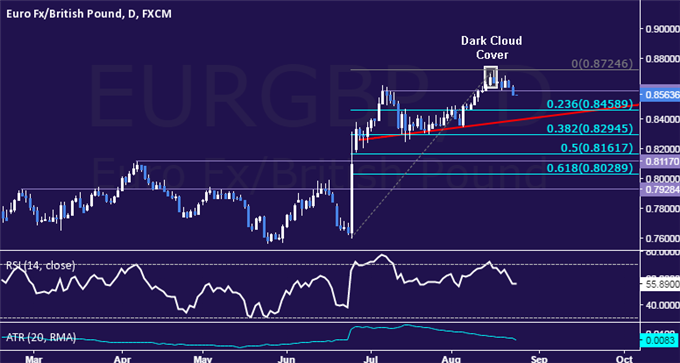

- EUR/GBP Technical Strategy: Short at 0.8631

- Euro drops to 2-week low vs. British Pound, hints at deeper losses

- Short position remains in play, initially targeting move below 0.85

The Euro turned lower against the British Pound as expected after prices put in a bearish Dark Cloud Cover candlestick pattern, dropping to a two-week low. The pair has overturned the break above July’s swing high, seemingly pointing to something more significant than just a corrective pullback in progress and warning of further weakness ahead.

From here, a daily close below the 23.6% Fibonacci retracementat 0.8459 paves the way for a challenge of rising trend line support at 0.8390, followed by the 38.2% level at 0.8295. Alternatively, a move back above support-turned-resistance at 0.8584, the July 6 close,opens the door for a retest of the August 16 high at 0.8725.

A short EUR/GBP trade was triggered at 0.8631.The trade remains in play, initially targeting 0.8459 with a stop-loss to be triggered on a daily close above 0.8725. Half one position will be booked and the stop-loss moved to breakeven when the first objective is hit.

Losing money trading EUR/GBP? This might be why.

original source