To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- AUD/USD Technical Strategy: Flat

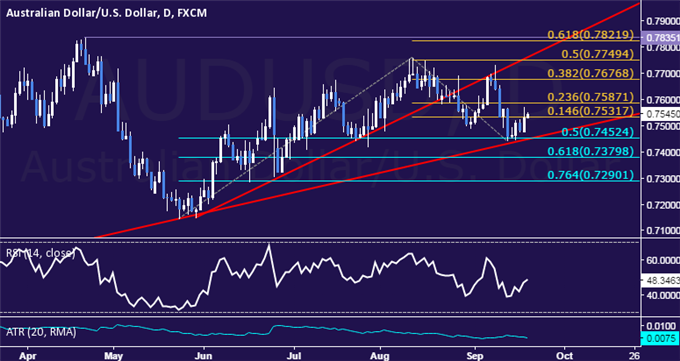

- Australian Dollar rebounds from 2016 rising trend support line

- Risk/reward parameters, looming event risk argue for the sidelines

The Australian Dollar is attempting to build higher against its US counterpart after finding support at a rising trend line set from late January. A sustained recovery looks far from assured however as critical event risk looms ahead, threatening to rekindle selling pressure.

Near-term resistance is at 0.7532, the 14.6% Fibonacci expansion, with a break above that on a daily closing basis opening the door for a test of the 23.6% level at 0.7587. Alternatively, a reversal below the 50% Fib retracement at 0.7452 paves the way for a test of challenge of the 61.8% threshold at 0.7380.

Prices’ proximity to near-term resistance argues against entering long from a risk/reward perspective while the absence of a clear bearish reversal signal hints taking the short side is premature. Finally, looming fundamental risk threatens to materially alter positioning. The sidelines look most attractive for now.

What do retail traders’ AUD/USD buy/sell decisions hint about the price trend? Find out here!

original source