Talking Points

- USDCAD at risk for further losses into Canada CPI

- Updated targets & invalidation levels

- Compete to Win Cash Prizes with FXCM’s Forex Trading Contest

USDCAD 120min

Chart Created Using TradingView

Technical Outlook: USDCAD broke channel support earlier this week with a break below the weekly opening-range low at 1.3134 shifting the near-term focus lower in the pair. We’re seeing a slight rebound off the 50% retracement here at the 1.30-handle but heading into Canada Retail Sales & the Consumer Price Index (CPI) releases, the focus remains lower while below 1.3134/48.

A break lower targets subsequent support targets at 1.2949 & the September low-day close / channel support at 1.2870/84-an area of interest for possible exhaustion / long-entries. Look for interim resistance at 1.3064 backed by the monthly open at 1.3104 & 1.3134/48. A breach close above basic trendline resistance extending off last week’s high would be needed to put the broader long-bias back in control.

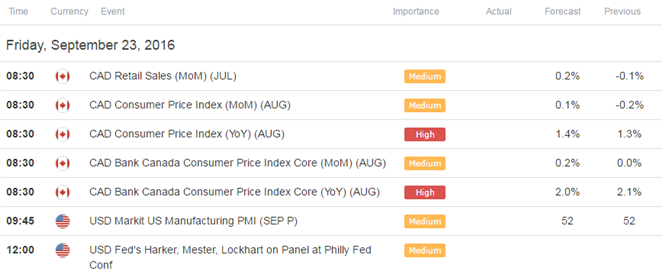

From a trading standpoint, the immediate risk remains lower into tomorrow’s event risk but ultimately I would be looking to fade weakness into structural support. Keep in mind this is the first time the core rate of inflation is expected to slow since May, a potential bearish development for CAD (bullish USDCAD). For the complete setup and to continue tracking this trade & more throughout the week- Subscribe to SB Trade Desk.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

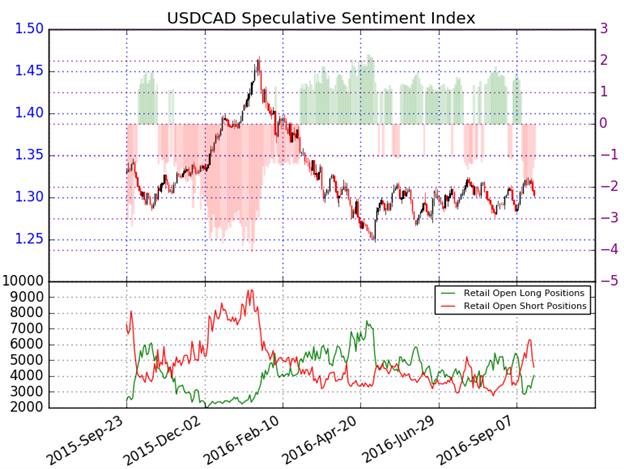

- A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are net shortUSDCAD- the ratio stands at -1.13 (47% of traders are long)- weak bullish reading

- Long positions are 22.0% higher than yesterday and 45.8% above levels seen last week.

- Short positions are 21.9% lower than yesterday and 16.1% below levels seen last week.

- Open interest is 6.0% lower than yesterday and 0.2% above its monthly average.

- Note that although the SSI ratio remains in negative territory, the recent build in long positioning suggests that a broader shift in sentiment may be underway. As such, the recent dynamic suggests that the risk remains lower for now as retail traders attempt to fade the recent loonie strength.

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

Relevant Data Releases This Week

Other Setups in Play:

- NZD/USD: Near-term Range Braces for RBNZ; Key Resistance 7450

- USD/JPY at Risk for Major Washout as Traders Gear Up For BoJ, FOMC

- Webinar: BoJ, FOMC, RBNZ to Drive Volatility Across Global Markets

Looking for more trade ideas? Review DailyFX’s Top Trading Opportunity of 2016

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)

original source