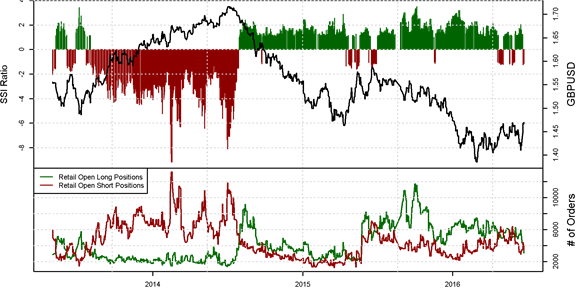

GBPUSD - The ratio of long to short positions in the GBPUSD stands at -1.13 as 47% of traders are long. Yesterday the ratio was -1.15; 46% of open positions were long. Long positions are 9.9% lower than yesterday and 44.0% below levels seen last week. Short positions are 11.3% lower than yesterday and 3.6% above levels seen last week. Open interest is 10.6% lower than yesterday and 31.0% below its monthly average. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are short gives signal that the GBPUSD may continue higher. The trading crowd has grown less net-short from yesterday but unchanged since last week. The combination of current sentiment and recent changes gives a further mixed trading bias.

Read more: Crowd Still Net-Short GBP/USD as YouGov Poll Shows Remain at 51%

--- Written by Christopher Vecchio, Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

original source