Keeping up with the 2013 forecast, the bearish trend for the EURGBP and the AUDNZD should continue to take shape in 2014 amid the deviation in the policy outlook.

It looks as though it will be a race between the Bank of England (BoE) and the Reserve Bank of New Zealand (RBNZ) as to who will be the first to start normalizing monetary policy, while the European Central Bank (ECB) and the Reserve Bank of Australia (RBA) may have little choice but to further embark on their easing cycle amid the growing threat for deflation.

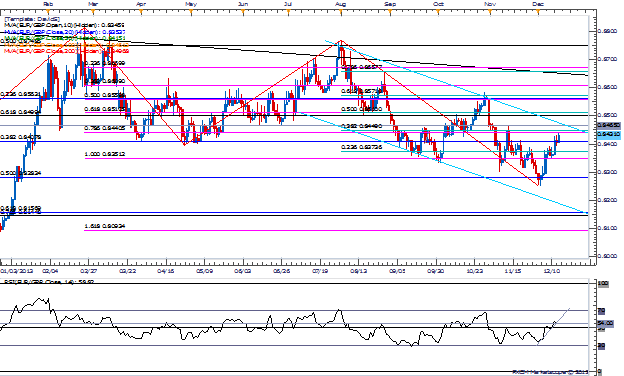

EURGBP Daily

Even though the EURGBP is a slower-burning trade, the long-term outlook remains tilted to the downside as it retains the bearish trend dating back to 2009. However, a steeper decline appears to be take shape as Mark Carney’s BoE moves away from the easing cycle. With that said, we will continue to look for a series of lower highs to sell the EURGBP, and the pair remains poised to face a pronounced decline in 2014 as the ECB prepares to implement more non-standard measures in the coming months.

AUDNZD Daily

The bearish trends in the AUDNZD should present more selling opportunities in 2014, and we will look to ‘sell bounces’ in the aussie-kiwi as the pair looks poised to mark fresh lows next year. The 2008 low (1.0616) will be a key focus as the AUDNZD clears the 78.6% Fibonacci retracement (1.1140-50) from the 2005 low (1.0428) to the 2011 high (1.3794), but we may see fresh record-lows over the medium-term as the RBNZ adopt an increasingly hawkish tone for monetary policy.

original source