Fundamental Forecast for Pound:Bullish

- GBP/USD Hits Fresh Session Highs, Breaks 1.7100 Handle After UK CPI

- British Pound is an Attractive Buy on Dips

- For Real-Time Updates and Potential Trade Setups on the British Pound, sign up for DailyFX on Demand

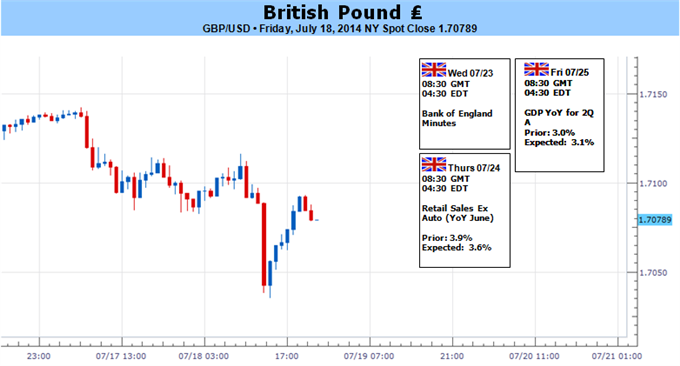

The Bank of England (BoE) Minutes and the U.K.’s 2Q Gross Domestic Product (GDP) report is likely spark increased volatility in the GBP/USD as market participants continue weigh the outlook for monetary policy.

The BoE policy statement may prop up the British Pound as a growing number of central bank officials show a greater willingness to normalize monetary policy sooner rather later, but we would need to see a greater dissent within the Monetary Policy Committee (MPC) to see fresh yearly highs in the GBP/USD as the pair retains the range-bound price action from earlier this month. With that said, a more hawkish statement along with a greater rift within the MPC may drive the British Pound higher ahead of the next quarterly inflation report due out on August 13, and the going shift in the policy outlook may continue to heighten the bullish sentiment surrounding the sterling as it boosts interest rate expectations.

However, the 2Q GDP print may undermine the bullish outlook for the British Pound as the economy is expected to retain a 0.8% rate of growth in the second-quarter, and we would need to see a more meaningful pickup in private sector activity to see a bullish reaction in the sterling as the BoE continues to mull the margin of spare capacity in the U.K.

With that said, we would need to see a series of positive fundamental developments to see a higher-low being carved ahead of the 1.7000 handle, but the GBP/USD may face a larger correction over the remainder of the month should the U.K. event risks drag on interest rate expectations.

original source