Talking Points

- Gold and Silver Set For Volatility With A String Of Top-Tier US Data On Tap

- Crude Oil Stands To Strengthen On Another Bullish Inventories Report

- Gold May Extend Recent Declines With Bearish Technical Signals Emerging

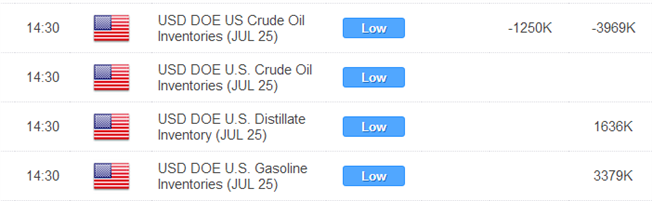

Crude oil and gold are set for a potentially volatile session with a string of noteworthy events on the horizon out of the US. Traders will be eagerly awaiting the release of ADP payrolls data, US Q2 GDP, as well as the FOMC rate decision which all stand to influence the commodity’s pricing currency, the US Dollar. WTI may be particularly susceptible to swings given the additional guidance offered by the DOE’s weekly inventories report.

Precious Metals Look To US Data For Guidance

Gold and silver are holding steady in late Asian trading, reflecting some hesitation amongst investors ahead of several key pieces of event risk on the calendar. The first in a procession of top-tier US economic data will be the ADP figures. The private measure of jobs added in the US over the month of July will offer an interim gauge of strength in the labor market ahead of the critical NFP data on Friday. An upside surprise could catalyze a spike higher for the greenback (and weakness for gold). However, follow-through likely hinges on a strong second quarter growth reading, and a less dovish tone from the FOMC.

With a further $10bn ‘taper’ widely expected and likely priced in at this point, the spotlight will be on the statement from policy officials. Evidence of a constructive discussion on a rate rise would offer the greenback the right remedy to sustain a meaningful recovery and not relapse into a stupor. However, recent addresses by policy officials suggest the FOMC has become quite adept at avoiding hints at the timing of an eventual hike. If the July meeting yields a similar result it would likely leave the US Dollar unimpressed, which in turn could ease some of the pressure on the precious metals.

Crude Oil Braces For Volatility With Inventories Data On Tap

The Department of Energy’s Weekly Petroleum Status Report is tipped to reveal the 5th consecutive drawdown for total crude stocks when released over the session ahead. As noted in prior commodities updates the US crude market is at a crossroads. The recent drawdown in stockpiles and ramp-up in refinery utilization suggest the supply glut that had built earlier in the year is being steadily mopped up. Another bullish set of inventories from the DOE could help crude oil recover some of the ground lost over recent weeks.

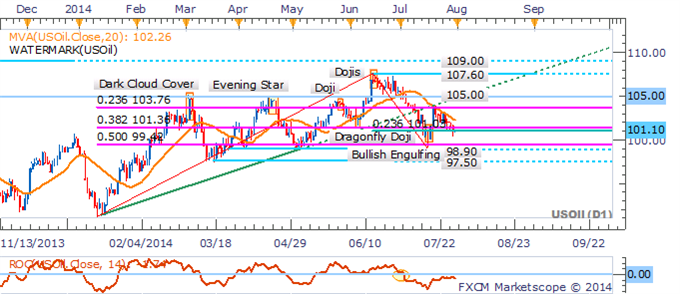

CRUDE OIL TECHNICAL ANALYSIS

The immediate risk remains to the downside for WTI with prices below the 20 SMA and ROC in negative territory. This puts the spotlight on the 99.42 figure, while a daily close back above 101.36 would invalidate a bearish technical bias and pave the way for a retest of 103.76.

Crude Oil: Spotlight On 99.42 With Bearish Signals Intact

Daily Chart - Created Using FXCM Marketscope 2.0

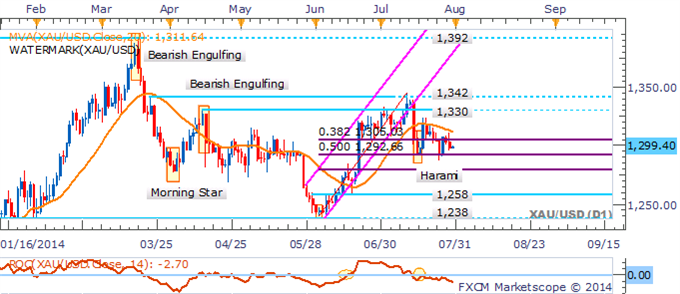

GOLD TECHNICAL ANALYSIS

The emergence of a short-term downtrend for gold casts the immediate risk to the downside with a break of 1,292 (50% Fib) to open 1,280. An absence of candlestick reversal signals casts doubt on a potential recovery at this point.

The DailyFX SpeculativeSentimentIndex suggests a mixed bias for gold based on trader positioning.

Gold: Descent To Continue In Absence Of Key Reversal Patterns

Daily Chart - Created Using FXCM Marketscope 2.0

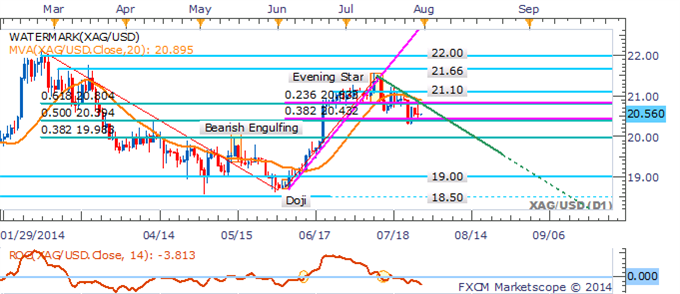

SILVER TECHNICAL ANALYSIS

Silver has regained its footing at the 20.43 mark (38.2% Fib Level) after crashing through former support-turned resistance at 20.83. The risk remains for a turn lower given a downtrend has emerged for the precious metal (signaled by the 20 SMA). Buyers are likely to emerge near the psychologically-significant 20.00 handle.

Silver: At Risk Of Further Falls, $20.00 Handle In Focus

Daily Chart - Created Using FXCM Marketscope 2.0

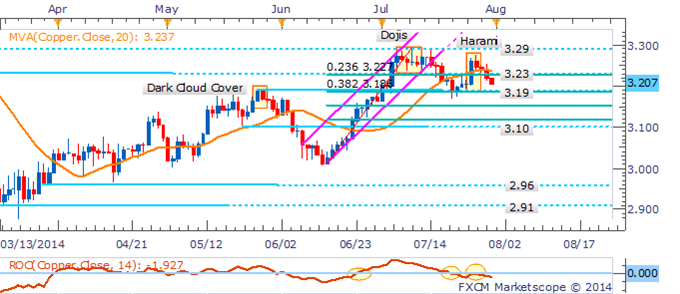

COPPER TECHNICAL ANALYSIS

Copper has demonstrated fairly choppy price action over the past several weeks which leaves a mixed technical bias for the commodity. A break of the 38.2% Fib Level at 3.19 would be required to shift the immediate risk to the downside.

Copper: Awaiting Break To Offer Directional Bias

Daily Chart - Created Using FXCM Marketscope 2.0

PALLADIUM TECHNICAL ANALYSIS

Playing palladium’s uptrend remains preferred with the prospect of a run on the psychologically-significant 900 handle over the near-term still looking likely. However, a several Doji candlesticks and decline for the ROC indicator offer warnings signs that upside momentum may be fading, which will be closely monitored.

Palladium: Longs Remain Preferred With Uptrend Intact

Daily Chart - Created Using FXCM Marketscope 2.0

PLATINUM TECHNICAL ANALYSIS

While platinum has maintained a slight upward trajectory over recent months, more recent price action has been relatively rough, which leaves a mixed technical bias for the commodity. A Piercing Line formation offers a bullish signal however a push above the 20 SMA would be required before suggesting a run on the channel top.

Platinum: Bounce Off Trend Channel Bottom Sees Bullish Pattern Emerge

Daily Chart - Created Using FXCM Marketscope 2.0

Written by David de Ferranti, Currency Analyst, DailyFX

To receive David’sanalysis directly via email, please sign up here

Contact and follow David on Twitter: @DaviddeFe

original source