Talking Points

- Next two weeks critical for USD/JPY

- USD/CHF loosing momentum

- Important day coming up for Crude

New to Currency Trading? Learn More HERE

Foreign Exchange Price & Time at a Glance:

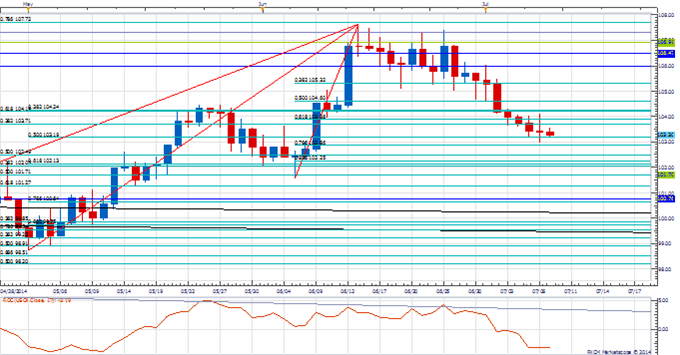

Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/JPY tested the 2x1 Gann angle line of the year’s high near 102.20 last week, but could not close above

- Our near-term trend bias is higher in USD/JPY while above last week’s low near 101.20

- A move through 102.20 is needed to set up a test of a critical pivot near 102.80

- An important cycle turn window is seen in a couple of weeks

- A move below 101.20 will re-focus lower in USD/JPY

USD/JPY Strategy: Flat, but looking to accumulate over the next couple of weeks.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

USD/JPY | *101.20 | 101.35 | 101.65 | 101.75 | *102.20 |

Price & Time Analysis: USD/CHF

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/CHF has moved steadily higher over the past week or so since finding support near the 50% retracement of the May/June advance

- Our near-term trend bias is higher in USD/CHF while over .8890

- A move back over .8960 is required to signal that a new leg higher is underway

- A cycle turn window was seen earlier this week

- A daily close below .8890 is needed to turn us negative on the dollar

USD/CHF Strategy: Square here.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

USD/CHF | .8845 | *.8890 | .8930 | *.8960 | .8990 |

Focus Chart of the Day: CRUDE

We have been negative on Crude since the important cycle turn window that we highlighted around the end of June (read HERE). A steady decline has followed in the commodity since then, but admittedly it has been far from impulsive. Another cycle turn window of importance is seen over the next day or so and with the overbought condition now fully worked off we are on the lookout for possible resumption of the broader underlying uptrend. A move back through 104.10 is needed to provide initial confirmation of such a renewed move higher. Failure to register a turn in the next day or so would be an extremely negative development for the commodity and set the stage for another leg lower in the weeks ahead. New trend lows in Crude after Thursday of this week would seriously undermine the potential for an immediate uptrend resumption.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

original source