Talking Points

- Price & Time covers key technical themes daily and can be delivered to your inbox by joining the distribution list:Price & Time

- EUR/USD stalls at key Gann level

- USD/JPY fails at Fibonacci retracement

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

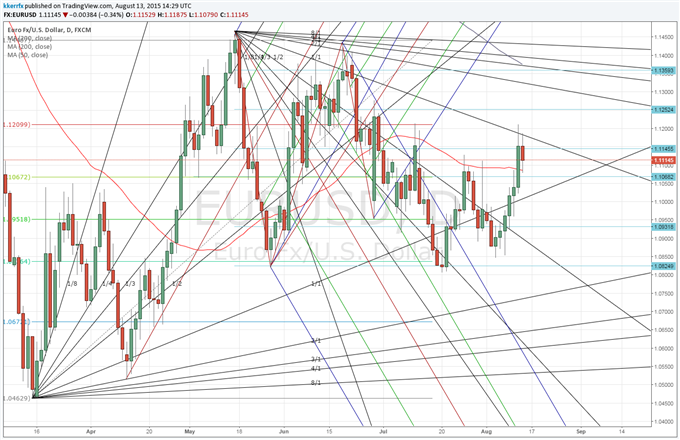

Price & Time Analysis: EUR/USD

ChartPrepared by Kristian Kerr

- EUR/USDtouched its highest level in a month yesterday before stalling out near the 1x1 gann angle line of the May high

- The close above 1.1100 has shifted our near-term trend bias higher in the exchange rate

- A push through the Gann level around 1.1180 is needed to set off a more important push higher

- A minor turn window is seen today

- A close under 1.1040 would turn us negative again on the euro

EUR/USD Strategy: Trailing stop triggered yesterday - Square.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

EUR/USD | *1.1040 | 1.1085 | 1.1115 | 1.1145 | *1.1180 |

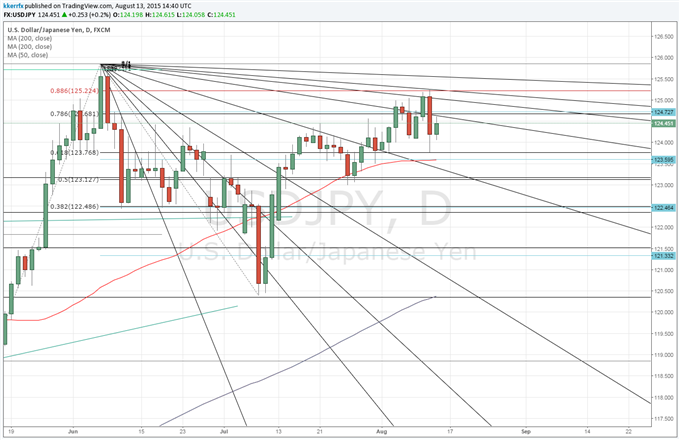

Price & Time Analysis: USD/JPY

ChartPrepared by Kristian Kerr

- USD/JPYtraded to its highest level in two months on Wednesday before reversing sharply at the 88.6% retracement of the June - July decline near 125.20

- Our near-term trend bias is still higher in the exchange rate while above 124.00 (closing basis)

- Traction over 124.70 is needed to alleviate some of the immediate downside pressure and re-instill upside momentum

- A minor turn window is seen tomorrow

- A daily close under 124.00 would turn us negative on USD/JPY

USD/JPY Strategy: Like the long side while over 124.00 (closing basis).

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

USD/JPY | 123.55 | *124.00 | 124.45 | *124.70 | *125.20 |

Focus Chart of the Day: DOW 30

There has been a lot of talk over the past few days about the purported “death cross” in the Dow Jones Industrial Average. I have never really been one for moving average crossovers, but I know that market pundits have it wrong here. A true death cross actually requires that both moving averages be sloping lower. In the case of the Dow this clearly isn’t the case as the 200-day moving average is still moving up. You could say that getting a crossover to occur after both moving averages have turned lower rarely ever happens, but that is precisely the point. A death cross as the name implies is supposed to be rare, but meaningful occurrence - not just a simple crossover. Supposedly it is an extra variable that helps determine when a meaningful trend shift is looming. We will leave that to the quants to decide. Like I said I am not a “crossover guy”, but it is just something to be aware of given all the recent hoopla.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

original source