Talking Points

- EUR/USD in consolidation mode above key Gann level

- USD/CAD nearing important downside pivot

- AUD/USD downtrend stalling?

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

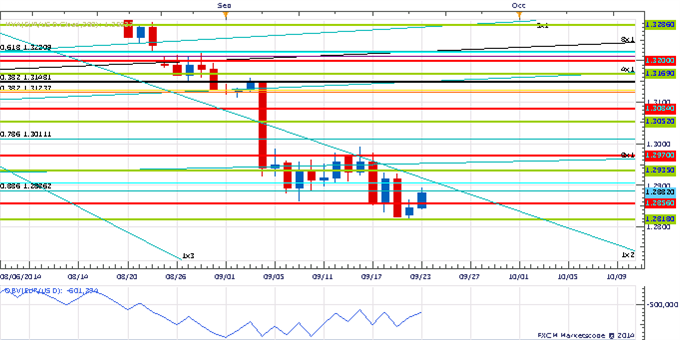

Price & Time Analysis: EUR/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

- EUR/USD recorded a new low for the year late last week before finding support near the 10th square root realtionship of the year’s high around 1.2820

- Our near-term trend bias remains lower in the euro while below 1.2990

- A close below 1.2820 is needed to re-instill downside momentume and expose key support around last year’s low in the 1.2750 area

- An important turn window is around the end of the week

- A close over 1.2990 would turn us positive on the euro

EUR/USD Strategy: Like holding reduced long short positions while below 1.2990.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

EUR/USD | 1.2750 | *1.2820 | 1.2885 | 1.2920 | *1.2990 |

Price & Time Analysis: USD/CAD

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/CAD reversed during a key cyclical turn window early last week near 1.1100

- Our near-term trend bias is lower in Funds while below 1.1100

- A close below 1.0930 is needed to trigger a more serious decline

- A minor turn window is eyed over the next couple of days

- A close over 1.1100 would turn us positive again on USD/CAD

USD/CAD Strategy: Like selling into strength against 1.1000.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

USD/CAD | *1.0930 | 1.0960 | 1.1000 | 1.1050 | *1.1100 |

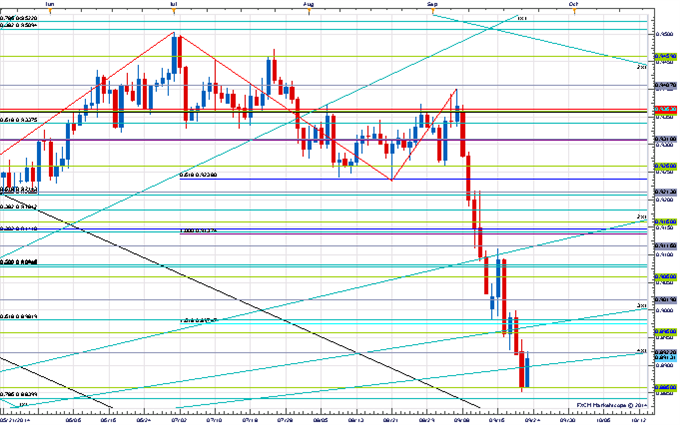

Focus Chart of the Day: AUD/USD

A few markets are attempting to reverse around the key Gann Equinox period we highlighted last week. The most notable are JPY, AUD and the S&P 500. All have been in very strong trends so the burden of proof is on USD bears as to whether this something more as opposed to the more likely scenario of just a minor reprieve. In AUD/USD the pair tested our key support zone at .8860/35 and this area should now hold if any sort of decent correction is to unfolding. A move through .8950 is needed to confirm at least a temporary low is in place, but traction over .8980 is really required to raise the possibility that a more serious turn is underway. USD/JPY is in a similar situation as the rate has become vulnerable after JPY bulls fell to 3% last week. Interim support is eyed around 108.40, but a move under 107.35 is really needed to turn the outlook more negative and set off a more serious correction. A move through 109.40 would obviously undermine this negative scenario. Lastly in the S&P 500 the key near-term level looks to be last week’s low near 1977/73, but only under 1932 warns that a more serious move lower is afoot.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

original source