Talking Points:

-Indian Rupee (INR) weakness favored in the second and third quarters.

-Seasonal trends do no benefit EM FX, INR.

-RBI confidence to fade on higher agriculture prices.

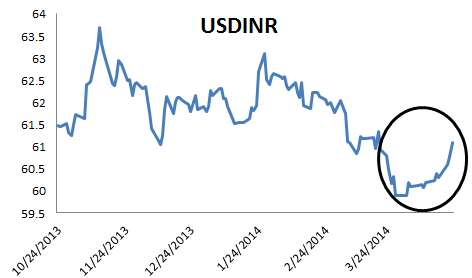

USD/INR Daily Line Chart

On Monday we detailed fundamental factors that could lead to a turnaround in USD/INR back to levels seen at the end of the fourth quarter. Since then we have gained 1.32% in USD/INR and we are 2.00% higher since the April and 2014 lows at 59.89. When we highlighted risks in the second and third quarterfor the Indian Rupee in 2014, we particularly stressed seasonality studies with Indian inflation, emerging markets and the USDINR rate. All signs on that front point to weakness moving forward in 2Q and 3Q. Not only that, but confidence in the RBI is likely to fade near term as higher food prices impact inflation data released over the next few months. If all these factors were not enough, there is a high likelihood that election optimism will fade after the results as we have seen time and time again.

Read more about EM, USDINR and Indian Rupee seasonality trends.

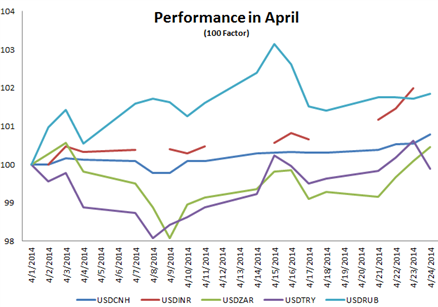

Emerging market currencies have been under pressure over the last few days as the greenback begins to gain strength once more after multiple weeks of hevay selling against EM FX and the majors. Indian Rupee strength has faded particularly quickly over the last few days and has even weakened more than the Russian Ruble month-to-date! The next week is most likely one of the most concentrated weeks of the year in terms of event risk and volaitlity. The majors, but especially EM FX and the Indian Rupee, should expect volatility as we close out the month.

Event risk next week: GBP GDP, EUR German Inflation/Unemployment, Euro-Zone CPI, USD GDP, CAD GDP, FOMC Rate Decision, BoJ, USD ISM, USD NFPs, CNH PMI.

Gregory Marks, DailyFX Research Team

Keep up to date on event risk with the DailyFX Calendar.

How does a Currency War affect your FX trading?

original source

By

By