Talking Points

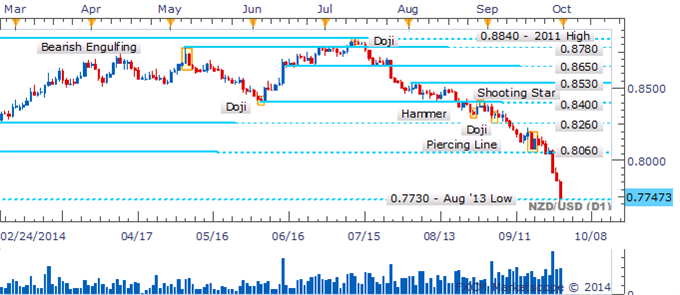

- NZD/USD Technical Strategy: Shorts Preferred

- Daily Remains Devoid Of Bullish Reversal Signals

- Breach of 0.7730 Would Open ’12 Low Near 0.7450

NZD/USD has taken another beating at the outset of the week with a void of reversal candlesticks - reducing the chances of a recovery for the pair. A revisit of the August 2013 low appears to be renewing some buying interest. A daily close below the nearby floor would set the scene for a descent on the 2012 low near 0.7450.

NZD/USD: Descent Leaves An Absence Of Bullish Candles In Its Wake

Daily Chart - Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

The four hour timeframe is similarly devoid of bullish candlestick patterns after an ensemble of Doji formations highlighted hesitation from traders. This casts some doubt over the potential for a corrective bounce over the session ahead.

NZD/USD: Absence of Bullish Signals Casts Doubt On Bounce

Four Hour Chart - Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

By David de Ferranti, Currency Analyst, DailyFX

Follow David on Twitter: @Davidde

To receive David’s analysis directly via email, please sign up here.

Learn how to read candlesticks to help identify trading opportunities with the DailyFX Candlesticks Video Course.

original source