To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- USD/CHF Technical Strategy: Flat

- Prices Pause to Consolidate, Snapping Three-Day Win Streak

- Risk/reward Considerations Argue Against Taking a Position

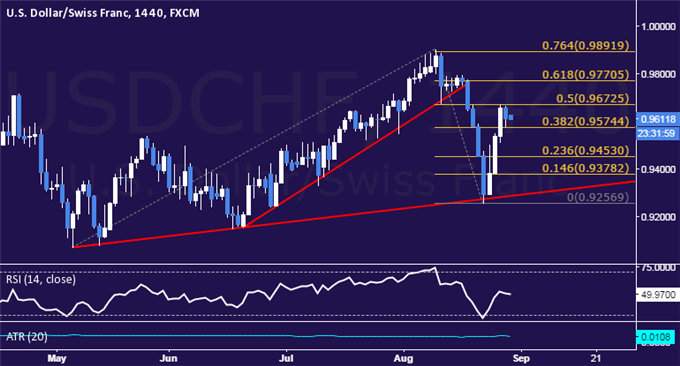

The US Dollar paused to consolidate gains below the 0.97 figure against the Swiss Franc, snapping a three-day winning streak. The pair began a swift recovery after dropping to a two-month low and testing trend support guiding prices higher since early May.

From here, a daily close above the 50% Fibonacci expansion at 0.9673 would expose the next upside barrier at 0.9771, the 61.8% level. The 38.2% Fib at 0.9574 has been recast as support, with a move back below that opening the door for a test of the 23.6% expansion at 0.9453.

Tactically speaking, current positioning does not seem to offer an actionable trade setup. On one hand, the distance between near-term support and resistance makes for a trading range that is smaller than 20-day ATR, skewing risk/reward considerations against committing to either the long or the short side. Furthermore, erratic SNB monetary policy earlier in the year makes us broadly leery of having CHF-based exposure. As such, we will continue to stand aside for now.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

original source