In May, the Investor Movement Index® rose for the first time in five months, increasing to 5.06, TD Ameritrade, Inc.1 announced today. The Investor Movement Index, or the IMXSM, is a proprietary, behavior-based index created by TD Ameritrade that aggregates Main Street investor positions and activity to measure what investors actually were doing and how they were positioned in the markets.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180604005472/en/

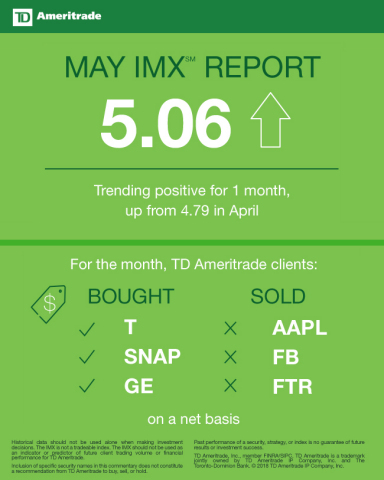

TD Ameritrade May 2018 Investor Movement Index (Graphic: TD Ameritrade)

May IMX

The May 2018 Investor Movement Index for the four weeks ending May 25, 2018 reveals:

- Reading: 5.06 (compared to 4.79 in April)

- Trend direction: Positive

- Trend length: 1 month

- Score relative to historic ranges: Moderately Low

As market volatility settled in May, TD Ameritrade clients dialed-up their overall equity exposure. Net buying activity, including buying in equities with higher relative volatility, pushed the IMX slightly higher for the second time this year.

“For the first time this year we saw clients taking on more exposure to the market, with millennials increasing their exposure at a faster rate than the rest of our client base,” said JJ Kinahan, chief market strategist at TD Ameritrade. “As market levels stablilized following an early May rally, clients were mostly net buyers the last two weeks of the month.”

TD Ameritrade clients were net buyers during the May IMX period. Top buys include:

- AT&T Inc. (T), after reaching a 52-week low during the period.

- Sprint Corporation (S), following news of a proposed merger with T-Mobile US, Inc. (TMUS).

- Snap Inc. (SNAP), which traded lower after an earnings miss and analyst downgrade.

- General Electric Company (GE), after announcing it would merge its transportation unit with Westinghouse Air Brake Technologies Corporation (WAB).

- The Walt Disney Company (DIS), which experienced volatility after Comcast Corporation (CMCSA) announced it is considering and preparing an offer for certain assets of Twenty-First Century Fox, Inc.(FOXA) that Walt Disney has agreed to buy.

- iQIYI Inc. (IQ), as the Chinese video game streaming company announced its first offline on-demand movie theatre.

Despite being net buyers, TD Ameritrade clients found equities to sell during the period, including:

- Apple Inc. (AAPL), which reached an all-time high after the company announced a $100 billion share buyback.

- Facebook, Inc. (FB), which increased after reaching yearly lows in March.

- Valeant Pharmaceuticals International, Inc. (VRX), following better-than-expected earnings.

- Frontier Communications Corporation (FTR), which was net sold for a second month after the stock traded higher early in the period.

- Macy’s Inc. (M), which reached a 52-week high after reporting better-than-expected sales to international tourists.

Major market indices moved higher at the start of the May period in part due to a strong earnings season. While a stronger U.S. dollar and geopolitical fears pushed the Russell 2000 (RUT) index to its highest level ever, the Cboe Volatility Index (VIX) traded in the low teens. The yield on the 10-year Treasury note also reached multiyear highs, and oil prices rose above $70 per barrel for the first time since 2014. However, the Dow closed lower at the end of May following newly imposed U.S. tariffs, which sparked geopolitical tensions and fears of political uncertainty.

“The Fed is expected to raise rates at its June meeting, and investors will want to hear what they have to say about expectations for future rate hikes,” said Kinahan.

About the IMX

The IMX value is calculated based on a complex proprietary formula. Each month, TD Ameritrade pulls a sample from its client base of more than 11 million funded accounts, which includes all accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly IMX.

For more information on the Investor Movement Index, including historical IMX data going back to January 2010; to view the full report from May 2018; or to sign up for future IMX news alerts, please visit www.tdameritrade.com/IMX. Additionally, TD Ameritrade clients can chart the IMX using the symbol $IMX in either the thinkorswim® or TD Ameritrade Mobile Trader platforms.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold.

Past performance of a security, strategy, or index is no guarantee of future results or investment success.

Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The IMX is not a tradable index. The IMX should not be used as an indicator or predictor of future client trading volume or financial performance for TD Ameritrade.

For the latest TD Ameritrade news and information, follow the company on Twitter, @TDAmeritradePR.

Source: TD Ameritrade Holding Corporation

About TD Ameritrade Holding Corporation

TD Ameritrade provides investing services and education to more than 11 million client accounts totaling $1.2 trillion in assets, and custodial services to more than 6,000 registered investment advisors. We are a leader in U.S. retail trading, executing an average of more than 940,000 trades per day for our clients, nearly a quarter of which come from mobile devices. We have a proud history of innovation, dating back to our start in 1975, and today our team of 10,000-strong is committed to carrying it forward. Together, we are leveraging the latest in cutting edge technologies and one-on-one client care to transform lives, and investing, for the better. Learn more by visiting TD Ameritrade’s newsroom at www.amtd.com, or read our stories at Fresh Accounts.

1TD Ameritrade, Inc. is a broker-dealer subsidiary of TD Ameritrade Holding Corporation. Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) /SIPC (www.SIPC.org).

View source version on businesswire.com: https://www.businesswire.com/news/home/20180604005472/en/