Love is in the air as engagement season starts on Thanksgiving and continues through Valentine’s Day. As these starry-eyed couples tie the knot, one thing that’s clearly in focus is their finances, according to TD Ameritrade’s latest survey.

This press release features multimedia. View the full release here: http://www.businesswire.com/news/home/20171113005160/en/

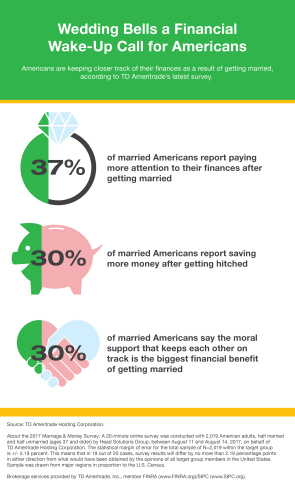

Marriage and Money survey infographic. (Graphic: Business Wire)

TD Ameritrade’s Marriage & Money survey of 1,000 married and 1,000 unmarried adults (ages 37 and older) reveals that getting married can serve as a trigger for Americans to focus more on their finances, particularly for men. In fact, nearly four in ten (37 percent) married Americans report paying more attention to their finances after getting married. Married couples also report additional shifts in perspective and habits:

- A third (33 percent) of married men and 28 percent of married women report saving more money after getting hitched;

- 32 percent of married men and 28 percent of married women started to worry more about the future;

- Three in 10 (30 percent) married individuals rely on their spouses to help manage their savings and investments (39 percent of females vs. 19 percent of males); and

- 30 percent of married Americans say the moral support that keeps each other on track is the biggest financial benefit of getting married

“For many Americans, wedding bells serve as a wake-up call to get their finances in order as they now have a partner to think about,” said JJ Kinahan, chief market strategist and managing director at TD Ameritrade. “Having a spouse, and perhaps for some a family, can encourage better financial habits, deter overspending, and keep long-term goals in focus.”

It’s Not All Wedded Bliss

While marriage often serves as an

incentive to financial responsibility, it also has its challenges.

One-third (34 percent) of married Americans report that they are not

always “financially faithful” with their spouse, and nearly four in ten

(39 percent) don’t believe their spouse is entirely financially faithful

with them. On average, married Americans report having argued with a

spouse about money 4.3 times in the past year.

Planning for the Golden Years Together

When it comes to

retirement, nearly three in 10 (28 percent) married Americans have

downsized, or expect to downsize their home in retirement, while singles

are more likely to stay put. And, the destination of choice – warmer

climates, according to one in five (20 percent) married Americans.

On average, married Americans expect to live 23 years in retirement, and men largely anticipate their wives to have the upper hand in terms of life expectancy. More than half (53 percent) expect their wives to outlive them, vs. just 18 percent of married females who said the same about their husbands.

Sorry kids …

One-third (34 percent) of married Americans say

leaving an inheritance is “not at all” a priority for them. In fact,

having a spouse to enjoy retirement with makes married couples more

inclined to say they’re likely or very likely to spend what they’ve

saved – on trips, property, motor vehicles, etc. – rather than pass it

on to their children (44 percent married vs. 29 percent unmarried).

“It’s important for married couples to have a shared vision for the future, whether that includes spending your money or saving it for future generations,” says Kinahan. “Being upfront with each other about finances and having frequent conversations about your desired retirement lifestyle will help couples be better prepared for what lies ahead.”

About TD Ameritrade Holding Corporation

Millions of

investors and independent registered investment advisors (RIAs) have

turned to TD Ameritrade’s (Nasdaq: AMTD) technology, people and education to

help make investing and trading easier to understand and do. Online or

over the phone. In a branch or with an independent RIA. First-timer or

sophisticated trader. Our clients want to take control, and we help them

decide how - bringing Wall Street to Main Street for more than 40 years.

TD Ameritrade has time and again been recognized

as a leader in investment services. Please visit TD Ameritrade’s newsroom

or www.amtd.com for

more information, or read our stories at Fresh

Accounts.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org)/SIPC (www.SIPC.org).

Survey conducted by Head Solutions Group

Head Solutions

Group (U.S.) Inc., is a leading market research partner for Financial

Services companies in North America. With offices in New

York, Toronto and Montreal, Head delivers the deep customer insights

that increase institutional knowledge and propel business action. TD

Ameritrade and Head Solutions Group are separate and unaffiliated firms

and are not responsible for each other’s services or policies.

About the 2017 Marriage & Money Survey

A 20-minute

online survey was conducted with 2,019 American adults aged 37 and older

by Head Solutions Group, between August 11 and August 14, 2017, on

behalf of TD Ameritrade Holding Corporation. The statistical margin of

error for the total sample of N=2,019 within the target group is +/-

2.19 percent. This means that in 19 out of 20 cases, survey results will

differ by no more than 2.19 percentage points in either direction from

what would have been obtained by the opinions of all target group

members in the United States. Sample was drawn from major regions in

proportion to the U.S. Census.

Source: TD Ameritrade Holding Corporation

View source version on businesswire.com: http://www.businesswire.com/news/home/20171113005160/en/