Talking Points:

- CanadianGDP came up short with a headline reading of +2.5% versus +2.8% expected.

- Weak growth disappointing in context of surprising manufacturing data in July.

- USDCAD trades above C$1.1200 for the first time since March 25.

Canadian Gross Domestic Product came up short of consensus estimates of +2.8% y/y, according to a Bloomberg News survey, with a headline reading of +2.5% y/y. Needless to say, this is a significant fall in Canadian growth from just the prior month reading of +3.1%. The headline reading was little changed most likely due to a greater than expected drop in oil and gas production, which effectively offset the surprise gains in manufacturing.

According to Statistics Canada, the output remained approximately C$1.63 trillion in July, which was the predecessor to six consecutive monthly increases. Oil and gas extraction fell by approximately -1.6% in July, which caused a relative fall of -0.9% in support activities associated with the industry.

Here’s a summary of the data this morning that’s stoked the USDCAD rally:

- CAD Gross Domestic Product (JUL): 0.0% versus +0.3% expected, from +0.3% (m/m).

- CAD GDP (JUL): +2.5% versus +2.8% expected, from +3.1% (y/y).

- CAD Industrial Product Price (AUG): +0.2% versus -0.2% expected, from -0.3% (m/m).

- CAD Raw Materials Price Index (AUG): -2.2% versus -1.5% expected, from -1.4% (m/m).

See the DailyFX economic calendar for Tuesday, September 30, 2014.

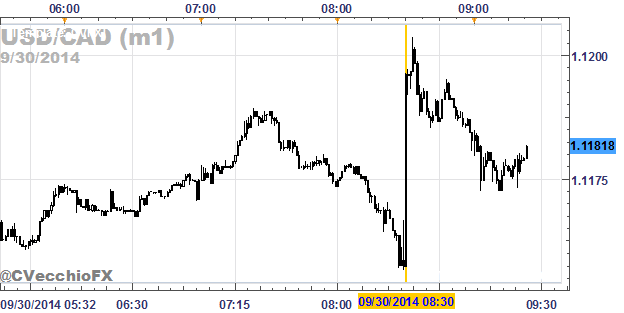

USDCAD 1-minute Chart: September 30, 2014 Intraday

Charts Created using Marketscope – prepared by Tyler Amend

USDCAD ran to a six-month high of C$1.1203 before beginning to fade back from the initial shock of the headline reading. The pair made a charge of approximately +46 pips before meeting any resistance on the back of the weaker Canadian GDP data. At the time this report was written, USDCAD was trading at C$1.1182.

Read more: Next EUR/USD Leg Lower Begins; Trade Opportunities in EUR/AUD, EUR/GBP

--- Written by Christopher Vecchio, Currency Strategist and Tyler Amend, DailyFX Research

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

original source