To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- USD/CAD Technical Strategy: Flat

- US Dollar Looks to Rebuild Rally After Pullback to Channel Floor

- Waiting for Passage of Event Risk Before Re-Entering Long Trade

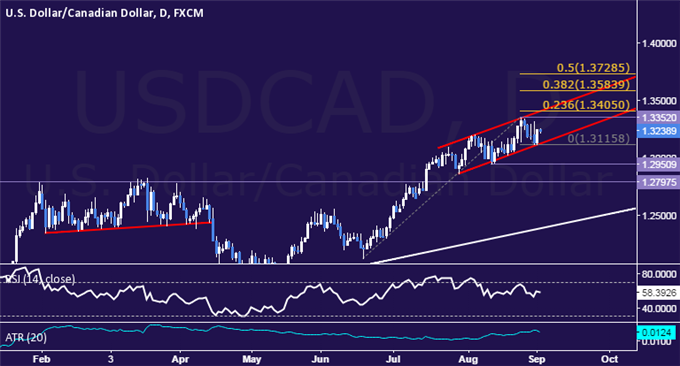

The US Dollar is attempting to rekindle upward momentum against its Canadian namesake after prices pulled back to channel support above the 1.31 figure. Our long position from 1.3247 was stopped out earlier in the week as the Loonie found support in a knee-jerk jump in oil prices but the move proved to be short-lived, as expected.

From here, near-term resistance is in the 1.3352-1.3405 area, marked by the August 25 high, the 23.6% Fibonacci expansion and a rising channel top. A daily close above this barrier exposes the 38.2% Fib at 1.3584. Alternatively, a move below 1.3116 – the August 31 low and the channel floor – opens the door for a test of the August 12 swing bottom at 1.2951.

Re-entering the long trade is a tempting proposition. Risk/reward considerations appear manageable the long-term trend continues to favor the upside. We will tactically opt to wait for now however. The pair’s sensitivity to oil-related news flow argues against committing to a directional bias considering recent volatility in crude and the looming release of weekly inventory data.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

original source