Talking Points

- USD/CAD Technical Strategy: Sidelines Preferred

- Shooting Star To Warn Of A Correction If Confirmed

- Awaiting Break Of Narrow Range For Fresh Positioning

USD/CAD remains at a crossroads as a Shooting Star formation warns of weakness after failing to close above the 1.1000 barrier. Critically the reversal formation awaits validation from an ensuing down day to confirm the potential for a correction. A pullback would likely be met by buying interest at the 1.0854 floor. Traders should be mindful of the pair’s tendency to whipsaw in recent trade, which warrants a cautious approach to trading an upside breakout.

USD/CAD: Shooting Star Emerges After Failing To Close Above 1.1000

Daily Chart - Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

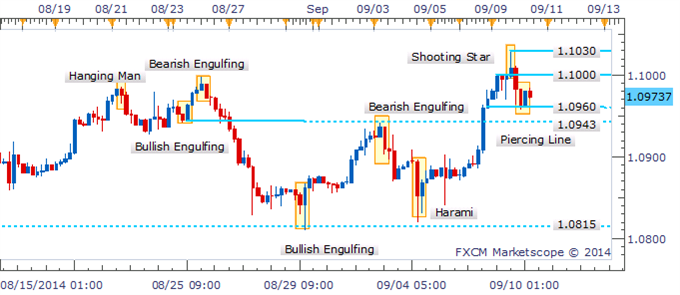

The four hour chart paints a mixed picture as reversal signals emerge amid choppy trading conditions. The latest such pattern (a Piercing Line formation) may struggle to find follow-through with intraday resistance looming nearby at 1.1000.

USD/CAD: Choppy Trading Leaves Mixed Signals

4 Hour Chart - Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

By David de Ferranti, Currency Analyst, DailyFX

Follow David on Twitter: @Davidde

To receive David’s analysis directly via email, please sign up here.

Learn how to read candlesticks to help identify trading opportunities with the DailyFX Candlesticks Video Course.

original source