- Canada Gross Domestic Product (GDP) to Slow for Second-Time in 2014.

- Growth Rate to Hold Above 2% for Second Consecutive Quarter.

Trading the News: Canada Gross Domestic Product (GDP)

Canada’s 3Q Gross Domestic Product (GDP) report may generate a near-term bounce in USD/CAD as the growth rate is expected to increase an annualized 2.1% following the 3.1% expansion during the three-months through June.

For more updates, sign up for David's e-mail distribution list.

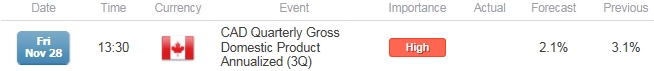

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

A marked slowdown in economic activity may undermine the appeal of the Canadian dollar as the Bank of Canada (BoC) remains reluctant to further normalize monetary policy, and the USD/CAD may continue to track higher in December as Governor Stephen Poloz continues to talk down interest rate expectations.

Expectations: Bearish Argument/Scenario

Release | Expected | Actual |

International Securities Transactions (SEP) | 7.00B | 4.37B |

Housing Starts (OCT) | 200.0K | 183.6K |

Ivey Purchasing Manager Index s.a. (OCT) | 57.3 | 51.2 |

Easing demand for Canadian assets paired with the ongoing slowdown in the housing market may continue to drag on the growth rate, and a dismal GDP print may spur a near-term breakout in USD/CAD as it gives the BoC greater scope to retain a wait-and-see approach for an extended period of time.

Risk: Bullish Argument/Scenario

Release | Expected | Actual |

Retail Sales (MoM) (SEP) | 0.5% | 0.8% |

Manufacturing Sales (MoM) (SEP) | 1.0% | 2.1% |

Net Change in Employment (OCT) | -5.0K | 43.1K |

However, the resilience in private sector consumption along with the pickup in job growth may foster a faster rate of growth, and a better-than-expected GDP figure may generate a further decline in USD/CAD as it retains the descending channel formation from earlier this month.

For LIVE SSI Updates Ahead of Canada’s GDP Report, Join DailyFX on Demand

How To Trade This Event Risk(Video)

Bearish CAD Trade: 3Q GDP Slows to 2.1% or Lower

- Need green, five-minute candle following a dismal GDP report to consider long USD/CAD entry

- If the market reaction favors a bearish Canadian dollar trade, establish long USD/CAD with two position

- Set stop at the near-by swing low/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish CAD Trade: Canada Growth Rate Exceeds Market Forecast

- Need red, five-minute candle following the release to look at a short USD/CAD trade

- Carry out the same setup as the bearish loonie trade, just in the opposite direction

Potential Price Targets For The Release

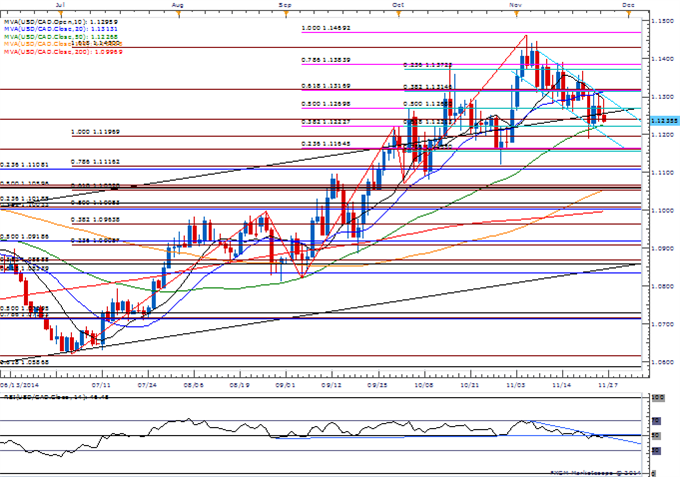

USD/CAD Daily Chart

Chart - Created Using FXCM Marketscope 2.0

- Need a break of the bearish trends in price & the RSI to revert back to the approach of looking for opportunities to buy-dips.

- Interim Resistance: 1.1370 (23.6% retracement) to 1.1380 (78.6% expansion)

- Interim Support: 1.1155 (78.6% retracement) to 1.1165 (23.6% expansion)

Read More:

Gold Rebound Vulnerable Sub $1207- Weekly Opening Range in Focus

Gold Chart Setup Warns of Reversal, SPX 500 Snaps 3-Day Win Streak

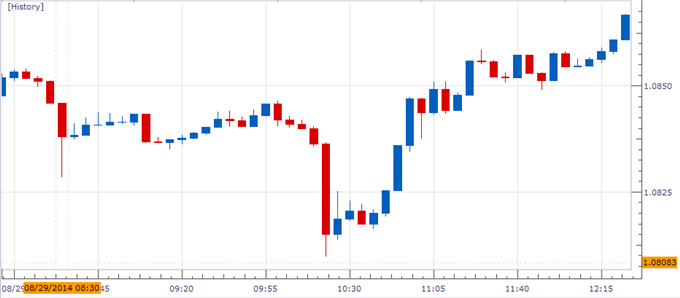

Impact that the Canada GDP report has had on CAD during the previous quarter

Period | Data Released | Survey | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

2Q 2014 | 08/29/2014 12:30 GMT | 2.7% | 3.1% | - 7 | + 30 |

2Q 2014 Canada Gross Domestic Product (GDP)

The Canadian economy grew more-than-expected, with the growth rate climbing an annualized 3.1% in the second quarter after expanding 2.3% during the first three-months of 2014. The larger-than-expected pickup in 2Q GDP showed a broad-based pickup in nearly all segments, especially in exports and consumer spending. As a result, the Bank of Canada (BoC) may come under increased pressure to raise the benchmark interest rate sooner rather than later especially as the region faces the highest rate of inflation amongst the G10 countries. The loonie strengthened against its U.S. counterpart following the release, but the market reaction was cut short during the North American trade as pair ended the day at 1.0876.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source