Talking Points:

- GBP/USD Rebounds From Fresh Monthly Low (1.6600) on BoE Dissent

- USD/JPY to Eye April High (104.11) on Close Above 103.30

- USDOLLAR Threatens Former Support; RSI Pushes Back Into Overbought Territory

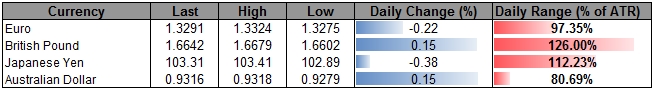

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 10602.65 | 10617.14 | 10593.35 | 0.06 | 82.26% |

GBP/USD:

- Rebounds from 1.6600 as Bank of England (BoE) Minutes shows 7-2 vote count, with Martin Weale & Ian McCafferty dissenting against the majority.

- Despite the greater rift in the BoE, GBP/USD struggles to retrace the decline from the weaker-than-expected U.K. Consumer Price report.

- The DailyFX Speculative Sentiment Index (SSI) suggests that the GBP/USD remains vulnerable to further losses as retail crowd is mostly net-long the dollar, with the ratio standing at +1.52.

USD/JPY:

- Rallies to fresh monthly high of 103.39 after closing above the key 102.80-90 zone, with the Relative Strength Index (RSI) pushing above 70; first overbought reading since December 2013.

- May retrace the entire decline from the April high (104.11) on a break & close above 103.30-50.

- As the upward trending channel taking shape, will look for a higher-low on a near-term correction.

For more updates, sign up for David's e-mail distribution list.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: Cable Undercuts the 200-Day Moving Average

Next GBP Downturn Ready as ST Oversold Readings Cleared after CPI

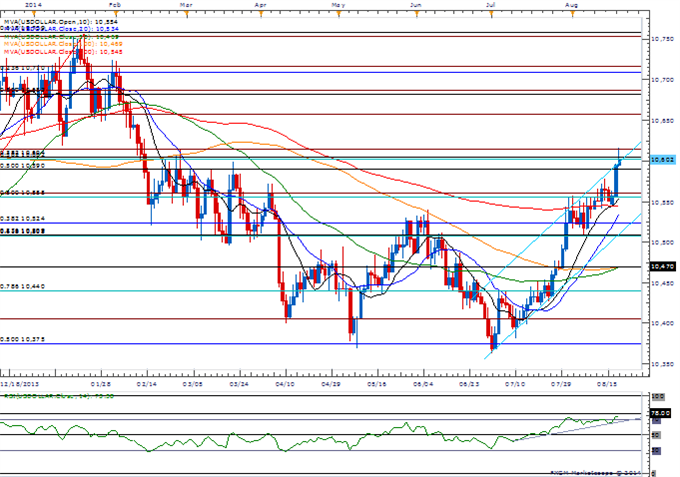

USDOLLAR Daily

Chart - Created Using FXCM Marketscope 2.0

USDOLLAR(Ticker: USDollar):

- Dow Jones-FXCM U.S. Dollar Index climbs to a fresh monthly high of 10,616 after closing above the key 10,590 pivot, with the RSI pushing back into overbought territory.

- May see former support (10,615) act as new resistance, especially if the Federal Open Market Committee (FOMC) Minutes fail to prop up interest rate expectations.

- Need a bearish break in the RSI to look for a more meaningful USDOLLAR correction.

- Interim Resistance: 10,602 (38.2% retracement) to 10,615 (78.6% expansion)

- Interim Support: 10,440 (78.6% retracement) to 10,450 Pivot

Join DailyFX on Demand for Real-Time SSI Updates!

Release | GMT | Expected | Actual |

FOMC Meeting Minutes | 14:00 |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source