To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- USD/JPY Technical Strategy: Flat

- Sellers Retake Initiative After Prices Retest Broken Trend Line

- Waiting for Correction Lower to Yield Long Trade Opportunity

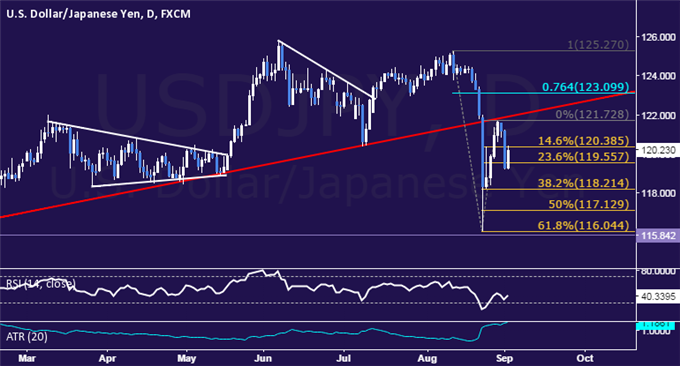

The US Dollar is once again on the defensive against the Japanese Yen, with sellers reclaiming a foothold below the 120.00 figure. Prices swiftly recovered after dropping to within a hair of the 116.00 mark last week having plowed through trend line support set from mid-January. That bounce now appears corrective, with the pair seemingly resuming the nascent down trend after retesting support-turned-resistance.

Prices are attempting an intraday recovery to test the 14.6% Fibonacci expansion at 120.39, with a break back above this barrier on a daily closing basis exposing the August 28 high at 121.73. Alternatively, a move back below the 23.6% Fib at 119.56 opens the door for a challenge of the 38.2% expansion at 118.21.

Positioning is inconclusive at this point. The velocity of the rebound following the break below of 120.00 casts doubt on near-term downside follow-through, taking the pair back through immediate support-turned-resistance (119.56). Furthermore, the long-term uptrend set from September 2012 remains in play, suggesting current weakness is corrective. With that in mind, we will stand aside and wait for a buying opportunity to present itself after current volatility to plays itself out.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

original source