To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

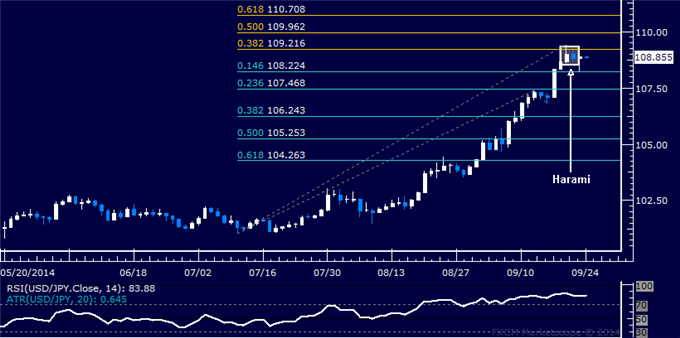

- USD/JPY Technical Strategy: Flat

- Support: 108.22, 107.47, 106.24

- Resistance: 109.22, 109.96, 110.71

The US Dollar could be carving out a top against the Japanese Yen marked by the formation of a bearish Harami candlestick pattern. Near-term support is at 108.22, the 14.6% Fibonacci retracement, with a break below that on a daily closing basis exposing the 23.6% level at 107.47. Alternatively, a push above the 38.2% Fib expansion at 109.22 clears the way for a test of the 50% threshold at 109.96.

Taken in isolation, a Harami formation does not amount to an actionable trade signal. With that in mind, we will stand aside for now pending further confirmation, waiting for an actionable setup to present itself.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

Daily Chart - Created Using FXCM Marketscope 2.0

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

original source