Talking Points:

- USD/JPY Rebound Gathers Pace as Greek Deal Fuels Risk Appetite.

- GBP/USD Pares Advance Ahead of U.K. Consumer Price Index, (CPI), BoE Testimony.

- USDOLLAR to Eye Fresh July High on Strong U.S. Advance Retail Sales Report.

For more updates, sign up for David's e-mail distribution list.

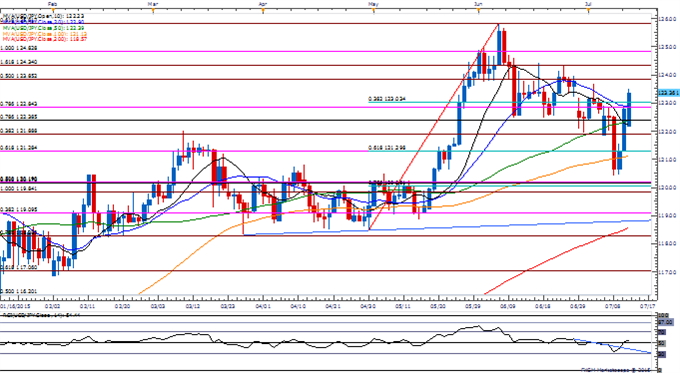

USD/JPY

Chart - Created Using FXCM Marketscope 2.0

- USD/JPY extends the rebound from the previous week as the Greek deal fuels risk sentiment; but the failure to break the opening monthly high (123.71) may produce a near-term consolidation in the exchange rate especially as the Bank of Japan (BoJ) is expected to retain its current policy at the July 15 interest rate decision.

- Even though the BoJ sticks to its quantitative/qualitative easing (QQE) program, the fresh batch of central bank rhetoric may boost the appeal of the Japanese Yen should Governor Haruhiko Kuroda talk down speculation for a further expansion in the asset-purchase program.

- The DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long USD/JPY since June 8, but seeing the ratio come off of recent extremes as it currently sits at +1.43.

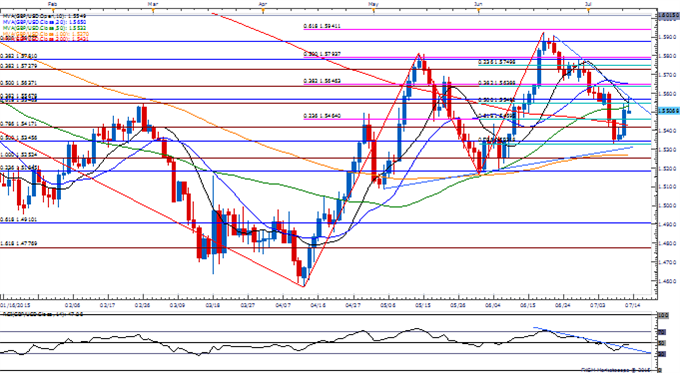

GBP/USD

- GBP/USD may largely retain the bearish trend carried over from June should the Bank of England (BoE) show a greater willingness to retain its current policy throughout 2015 while testifying in front of the House of Commons Treasury Committee.

- Even though the headline reading of the U.K. Consumer Price Index (CPI) is expected to hold flat in June, stickiness in the core rate of inflation may limit the downside risk for the sterling as BoE Governor Mark Carney anticipates faster price/wage growth in the second-half of the year.

- Failure to break trendline resistance along with the lack of momentum to close above 1.5540 (50% retracement) to 1.5570 (38.2% retracement) may produce range-bound prices in the coming days.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: Kiwi UnlovedThe Weekly Volume Report: High Turnover Euro Capitulation

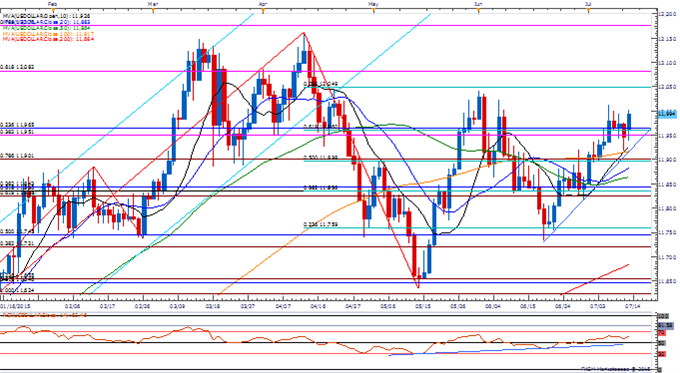

USDOLLAR(Ticker: USDollar):

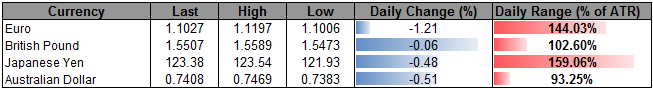

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 11994.49 | 12002.58 | 11938.29 | 0.39 | 113.04% |

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar may preserve the upward trend from the previous month & mount a larger assault at 12,049 (78.6% retracement) as U.S Advance Retail Sales are expected to show another 0.3% rise in June; may fuel speculation for September liftoff as Fed Chair Janet Yellensees scope for a rate hike in 2015.

- However, market participants may show a more meaningful reaction to the Consumer Price Index (CPI) as Fed officials highlight the disinflationary environment; stronger price growth may boost interest rate expectations as the Fed remains on course to normalize monetary policy.

- Will keep a close eye on the June high (12,043), with a break above exposing the April high (12,162).

Join DailyFX on Demand for Real-Time SSI Updates!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source