Talking Points:

- USD/JPY Risks Further Losses on Widening Japan Current-Account Surplus.

- USDOLLAR Pares Losses on Upbeat NFP Report; Slew of Fed Speeches in Focus.

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

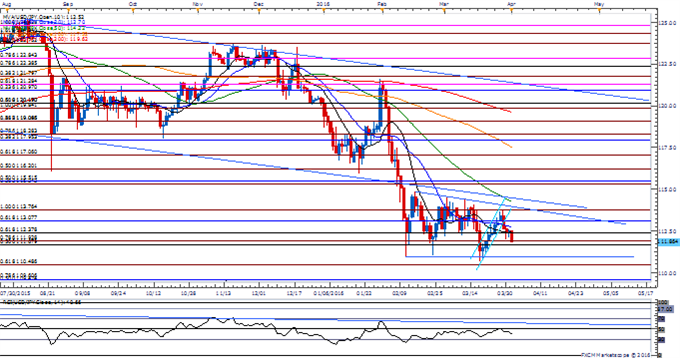

USD/JPY

Chart - Created Using FXCM Marketscope 2.0

- USD/JPY may continue to consolidate within a descending triangle/continuation pattern as market participants mull the outlook for monetary policy; may see fresh comments from Bank of Japan (BoJ) Governor Haruhiko Kuroda boost expectations for additional monetary support as the central bank pledges to whatever it takes to achieve the 2% target for inflation.

- Despite the downtick in the Tankan survey, an marked expansion in Japan’s Current Account surplus may heighten the appeal of the Yen amid the weakening outlook for the global economy.

- The failure to test the March high (114.55) may produce a further decline in the week ahead especially as the pair struggles to retain the near-term series of higher highs & lows from 110.66.

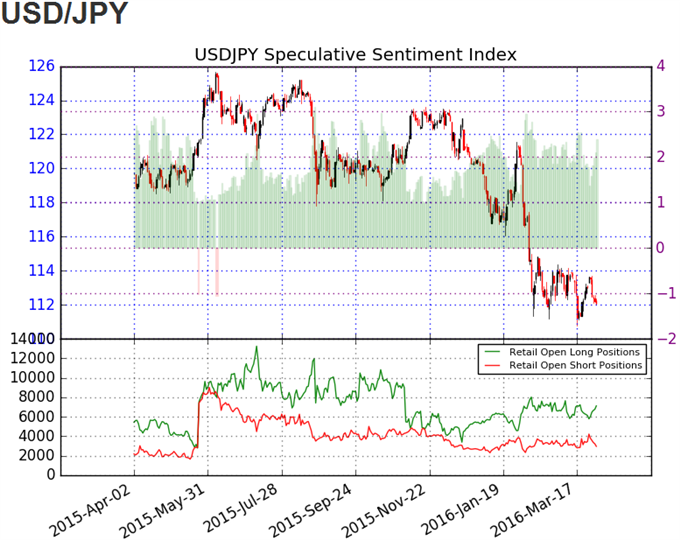

- The DailyFX Speculative Sentiment Index (SSI) shows the retail FX crowd remains net-long USD/JPY since January 29 even as the pair slipped to a fresh 2016 low in March, with the ratio hitting an extreme reading in February as it climbed to +3.00.

- The ratio appears to be working its way back towards recent extremes as it climbs to +2.02, with 67% of traders currently long, while open interest stands a marginal 0.2% above the monthly average.

Why and how do we use the SSI in trading? View our video and download the free indicator here

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

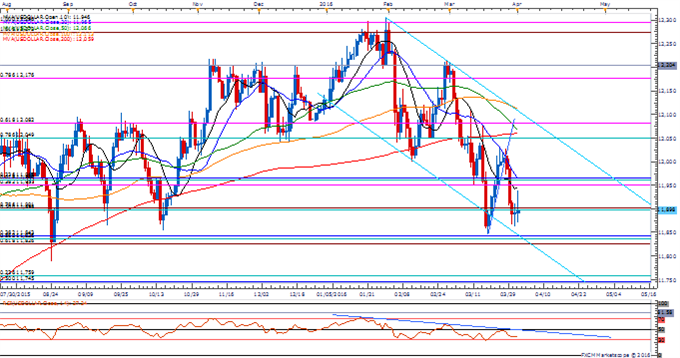

USDOLLAR(Ticker: USDollar):

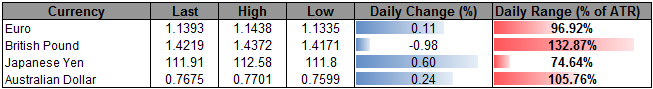

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 11898.81 | 11940.94 | 11873.49 | 0.05 | 103.88% |

Chart - Created Using FXCM Marketscope 2.0

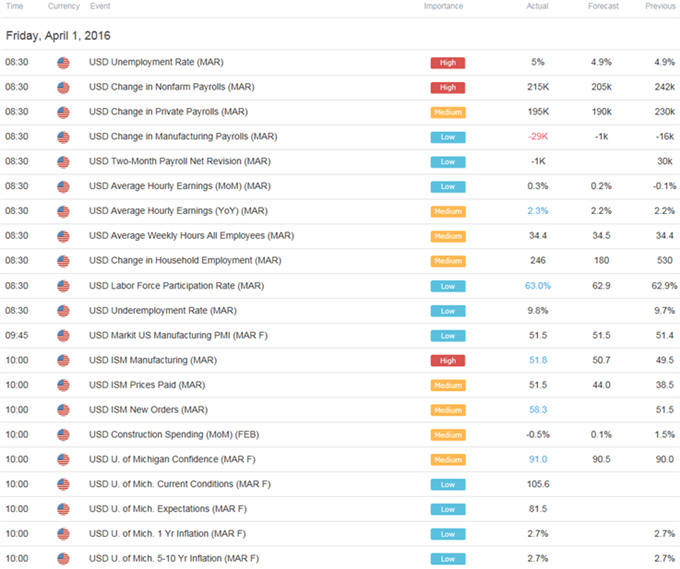

- USDOLLAR pares the decline from earlier this week following the better-than-expected U.S. Non-Farm Payrolls (NFP) report, with the economy adding 215K jobs in March, but stagnant wage growth may keep the Federal Open Market Committee (FOMC) on the sidelines at the April 27 interest-rate decision as central bank officials highlight the downward tilt in inflation expectations.

- Will keep a close eye on the slew of central bank rhetoric on tap for the week ahead as Boston Fed President Eric Rosengren, Minneapolis Fed President Neel Kashkari, Chicago Fed President Charles Evans, Cleveland Fed President Loretta Mester, Dallas Fed President Robert Kaplan, Kansas City Fed Esther George and Chair Janet Yellen come on the wires.

- Despite the rebound, the near-term outlook for the USDOLLAR remains tilted to the downside especially as the RSI preserves the bearish formation from earlier this year, with the next downside hurdle coming in around 11,826 (61.8% expansion) to 11,843 (38.2% retracement).

Click Here for the DailyFX Calendar

Read More:

USD/MXN – Big Support Test Coming Up

USD/CAD Technical Analysis: All Eyes on 1.2835

COT-Small Trader Net Long Position in AUD is Largest Since July 2014

USD/JPY-More at the 110.66 Low Than You Might Think

Get our top trading opportunities of 2016 HERE

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

original source