Fundamental Forecast for JPY: Bullish

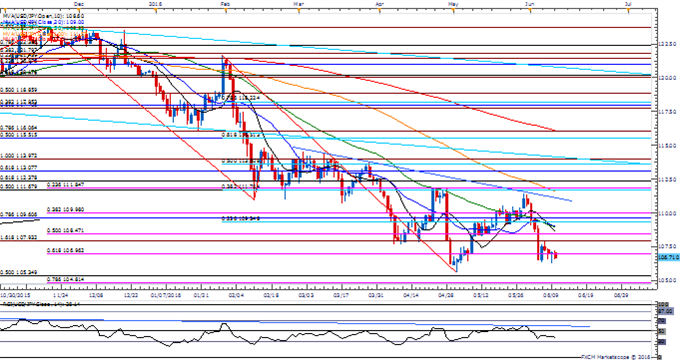

- USD/JPY Oscillating Near Major Market Level

- EUR/JPY Technical Analysis: Stubborn Support Snaring Breakout Victims

- Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

For more updates, sign up for David's e-mail distribution list.

USD/JPY is poised to face increased volatility over the coming days as market attention turns to the Federal Open Market Committee (FOMC) and the Bank of Japan (BoJ) interest-rate decisions scheduled for the week ahead.

Even though the FOMC appears to be on course to implement higher borrowing-costs in 2016, another 9 to 1 split accompanied by a material shift in the central bank’s economic projections may drag on the dollar as market participants push out bets for the next rate-hike. Indeed, Fed Chair Janet Yellen and Co. may show a greater willingness to further delay the normalization cycle as inflation expectations remain largely subdued, and the central bank may adopt a more dovish outlook for monetary policy in an effort to stem the downside risks surrounding the U.S. economy. As a result, a downward revision in the growth and inflation forecast paired with a reduction in the interest rate dot-plot is likely to produce headwinds for the greenback as market participants reprice the odds for a further adjustment in monetary policy.

At the same time, the BoJ may largely endorse a wait-and-see approach especially as Prime Minster Shinzo Abe delays the sale-tax hike and pledges to take ‘bold’ measures to encourage a stronger recovery, and more of the same from Governor Haruhiko Kuroda and Co. may boost the appeal of the Japanese Yen as market participants scale back bets for more non-standard measures. Moreover, a further deterioration in risk sentiment may also heighten the appeal of the low-yielding currency, and the weakening outlook for global growth may prop up the Yen as Japan returns to its historical role as a net-lender to the world economy.

As a result, a more dovish Fed accompanied by a wait-and-see BoJ may drag on USD/JPY, and the bearish trend from earlier this year may reassert itself over the near to medium-term as market participants revamp their outlook for monetary policy. - DS

original source