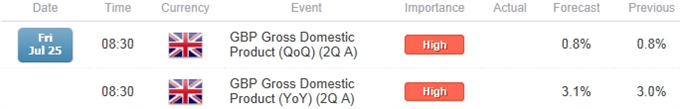

- U.K. Economy Expected to Grow Another 0.8% in 2Q 2014.

- GDP Higher Than 0.8% Would Mark Fastest Pace of Growth Since 2Q 2010.

Trading the News: U.K. Gross Domestic Product (GDP)

The U.K.’s 2Q Gross Domestic Product (GDP) report may spur a larger correction in the GBP/USD should the print drag on interest rate expectations.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Despite expectations of seeing another 0.8% advance in the growth rate, we may need a strong GDP print to prop up the GBP/USD as the Bank of England (BoE) continues to gauge the spare capacity in the U.K. economy. With that said, the advanced growth reading may also heavily influence the policy outlook as there appears to be a growing dissent within the Monetary Policy Committee (MPC).

For Real-Time Updates and Potential Trade Setups on the British Pound, sign up for DailyFX on Demand

Expectations: Bullish Argument/Scenario

Release | Expected | Actual |

Jobless Claims Change (JUN) | -27.0K | -36.3K |

Markit Purchasing Manager Index- Construction (JUN) | 59.8 | 62.6 |

Total Business Investment (QoQ) (1Q F) | 2.7% | 5.0% |

The ongoing improvement in the labor market along with the expansion in the U.K. housing market may generate a better-than-expected GDP print, and a marked uptick in the growth rate may heighten the appeal of the sterling as it raises the BoE’s scope to lift the benchmark interest rate later this year.

Risk: Bearish Argument/Scenario

Release | Expected | Actual |

Retail Sales inc. Auto Sales (MoM) (JUN) | 0.3% | 0.1% |

Average Weekly Earnings inc. Bonus (3Moy) (MAY) | 0.5% | 0.3% |

Mortgage Approvals (MAY) | 61.8K | 61.7K |

Nevertheless, subdued wages paired with the slowdown in private sector consumption may drag on the growth rate, and a dismal 2Q release may generate a larger correction in the GBP/USD as market participants push back bets of seeing the central bank normalize monetary policy.

Read More:

Price & Time: EUR/USD Bounce?

EURAUD Risks Near-Term Reversal Heading Into H&S Target, Key Support

How To Trade This Event Risk(Video)

Bullish GBP Trade: U.K. Economy Growths 0.8%+

- Need green, five-minute candle following the release to consider a long British Pound trade

- If market reaction favors buying sterling, go long GBP/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish GBP Trade: 2Q GDP Falls Short of Market Expectations

- Need red, five-minute candle to favor a short GBP/USD trade

- Implement same setup as the bullish British Pound trade, just in reverse

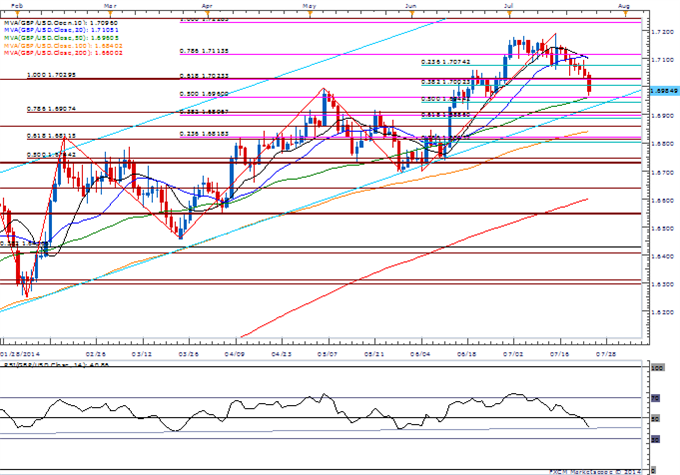

Potential Price Targets For The Release

GBP/USD Daily

Chart - Created Using FXCM Marketscope 2.0

- Break of bullish momentum in Relative Strength Index (RSI) raises risk for near-term reversal

- Interim Resistance: 1.7200 Pivot to 1.7220 (100.0% expansion)

- Interim Support: 1.6890 (38.2% expansion) to 1.6900 (61.8% expansion)

Impact that the U.K. GDP report has had on GBP during the last release

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

1Q 2014 | 04/29/2014 8:30 GMT | 0.9% | 0.8% | -17 | -7 |

1Q 2014 U.K. Gross Domestic Product (GDP)

The U.K. economy grew another 0.8% during the first three-months of this year after expanding 0.7% during the fourth-quarter of 2013, but the lackluster GDP print may undermine the bullish sentiment surrounding the British Pound as it limits the Bank of England’s (BoE) to normalize monetary policy sooner rather than later. The sterling struggled to hold its ground following the weaker-than-expected GDP print, with the GBP/USD slipping below the 1.6800 handle, but the sterling firmed up during the North American trade to end the day at 1.6825.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source