Talking Points

- EUR/USD Technical Strategy: Sidelines Preferred

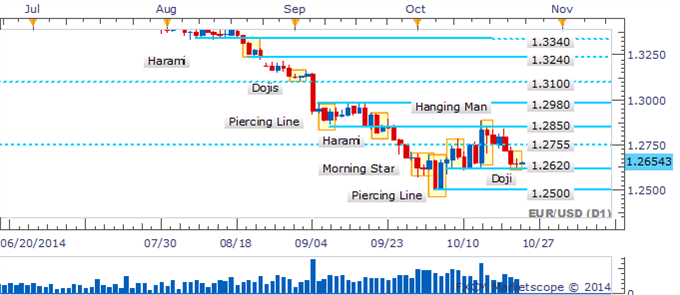

- Doji Suggests Reluctance From The Bears Near 1.2620

- Bullish Reversal Signals Absent In Intraday Trade

EUR/USD has regained its footing at the 1.2620 barrier as a Doji denotes indecision from traders. Yet with bullish reversal signals absent a close beneath the 1.2620 barrier would open a descent on 1.2500. A clean run lower may prove difficult given recent ‘messy’ price action.

EUR/USD: Awaiting Break Of 1.2620 To Open 1.2500

Daily Chart - Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

The four hour chart tells a similar narrative to the daily. A parade of short body candles and Doji formations suggests reluctance from traders to lead the pair in any direction. Yet an absence of bullish candlestick patterns suggests a recovery over the session ahead may prove difficult. Clearance of the 1.2600/20 region would pave the way for a push towards the 1.2500 floor.

EUR/USD: Intraday Recovery Questionable Amid Void Of Bullish Candlesticks

4 Hour Chart - Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

By David de Ferranti, Currency Analyst, DailyFX

Follow David on Twitter: @Davidde

To receive David’s analysis directly via email, please sign up here.

Learn how to read candlesticks to help identify trading opportunities with the DailyFX Candlesticks Video Course.

original source