- Australia Retail Sales to Increase for 10th Consecutive Month

- Rise of 0.3% Would Mark the Slowest Rate of Growth Since July

Trading the News: Australia Retail Sales

Another rise in Australia Retail Sales may prompt a bullish reaction in the AUDUSD as it raises the fundamental outlook for the $1T economy.

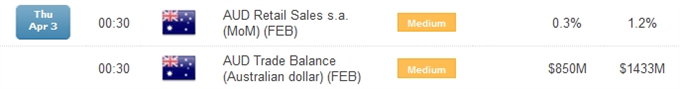

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

The ongoing expansion in private sector consumption may encourage the Reserve Bank of Australia (RBA) to halt its easing cycle sooner rather than later, but it seems as though Governor Glenn Stevens is becoming rather cautious towards the region as the central bank head continues to see higher unemployment paired with subdued waged growth.

Expectations: Bullish Argument/Scenario

Release | Expected | Actual |

Employment Change (DEC) | 15.0K | 47.3K |

Private Sector Credit (MoM) (FEB) | 0.4% | 0.4% |

New Motor Vehicle Sales (MoM) (FEB) | -- | 0.1% |

Faster job growth paired with the expansion in private sector credit may generate a positive print, and a marked rise in retail sales may prompt fresh highs in the AUDUSD as it raises the outlook for growth and inflation.

Risk: Bearish Argument/Scenario

Release | Expected | Actual |

AiG Performance of Manufacturing Index (MAR) | -- | 47.9 |

Westpac Consumer Confidence s.a. (MoM) (MAR) | -- | -0.7% |

NAB Business Confidence (FEB) | -- | 7 |

Nevertheless, household spending may disappoint amid the downturn in consumer confidence along with the slowdown in business outputs, and a dismal release may spark a larger pullback in the aussie-dollar as it remains capped by former support (0.9290-0.9300).

How To Trade This Event Risk(Video)

Bullish AUD Trade: Retail Sales Climb 0.3% or Higher

- Need green, five-minute candle following the release to consider a bullish Australian dollar trade

- If market reaction favors a long aussie trade, buy AUDUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit

Bearish AUD Trade: Household Consumption Falters

- Need red, five-minute candle to look at a bearish AUDUSD position

- Implement the same setup as the long AUD trade, just in reverse

Potential Price Targets For The Release

Join DailyFX on Demand to Cover Current Australian dollar Trade Setups

AUDUSD Daily

Chart - Created Using FXCM Marketscope 2.0

- Remains Limited by Former Support & RSI Stalls at 70; High in Place?

- Interim Resistance: 0.9270 (78.6% expansion) to 0.9290 Pivot

- Interim Support: 0.8980 (38.2% expansion) to 0.8990 Pivot

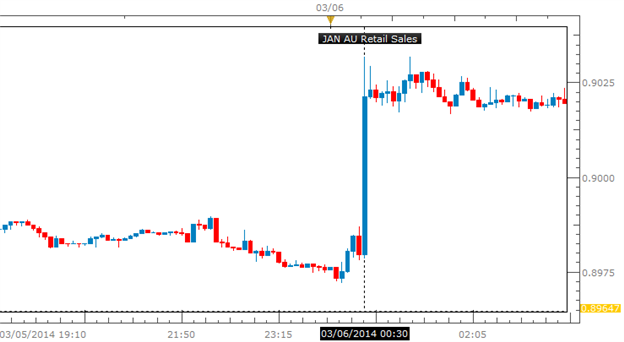

Impact that Australian Retail Sales had on AUD during the release

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

JAN 2014 | 03/06/2014 0:30 GMT | 0.4% | 1.2% | +45 | +125 |

January 2014 Australia Retail Sales

Last month’s blowout print sent AUD flying above the .90 level and the AUDUSD pair ended up 125 pips higher on the day from the release. Since then we have seen the Australian Dollar climb to highs not seen since November of last year and with AUDUSD failing at the 0.93 handle on April 1st, this crucial retail sales print comes at an important juncture. Over the last three years we have only seen the MoM figure over 1% a handful of times, so it seems appropriate that consensus for the February read is much lower.

--- Written by David Song, Currency Analyst and Gregory Marks

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

By

By