Talking Points:

- GBP/USD Outperforms to Kick Off November Trade; Threatens Bullish Momentum Ahead of BoE

- USD/CAD Bullish RSI Break to Favor Topside Targets Ahead of Ivey PMI, Employment.

- USDOLLAR to Face Slowing 3Q GDP & Subdued PCE Inflation.

For more updates, sign up for David's e-mail distribution list.

GBP/USD

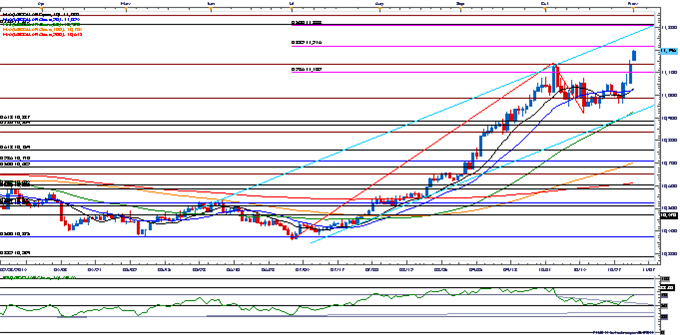

Chart - Created Using FXCM Marketscope 2.0

- GBP/USD outperforms coming into November, but a failure to maintain the bullish momentum in the Relative Strength Index (RSI) would bring the downside targets back on the radar; 1.5900-1.6150 range in focus.

- Bank of England (BoE) widely expected to retain current policy; may continue to see 7-2 split should the committee refrain from releasing a policy a statement.

- Nevertheless, retail-crowd remains net-long GBP/USD from the end of October, with the DailyFX Speculative Sentiment Index (SSI) currently standing at +1.31.

USD/CAD

- After carving higher-low in October, USD/CAD threatens resistance ahead of Canada Employment report, which is expected to show a 5.0K contraction in job growth.

- Despite the more neutral tone from the Bank of Canada (BoC), pair looks poised for a further advance as the RSI breaks out of the near-term bearish trend.

- Want to see a close above 1.1310 (23.6% retracement) to 1.1320 (61.8% expansion) for conviction/confirmation for a higher-high.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: Where To Next For USD/JPY?

Monetary Policy on Trial with RBA, ECB, and NFPs this Week

USDOLLAR(Ticker: USDollar):

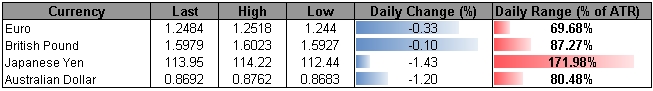

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 11196.6 | 11201.17 | 11153.22 | 0.56 | 74.82% |

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar Index may continue to push fresh highs ahead of the highly anticipated Non-Farm Payrolls (NFP) report as the ISM Manufacturing’s employment component shows a faster rate of growth for October.

- Will keep a close eye on ADP Employment (+220K) and the employment component for ISM Non-Manufacturing to gauge market expectations for NFPs.

- Next topside target comes in at 11,216 (38.2% expansion) following by 11,308 (50.0% expansion)-11,312 (78.6% retracement).

Join DailyFX on Demand for Real-Time SSI Updates!

Release | GMT | Expected | Actual |

Markit Purchasing Manager Index Manufacturing (OCT F) | 14:45 | 56.2 | 55.9 |

ISM Manufacturing (OCT) | 15:00 | 56.1 | 59.0 |

ISM Prices Paid (OCT) | 15:00 | 58.0 | 53.5 |

Construction Spending (MoM) (SEP) | 15:00 | 0.7% | -0.4% |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source