Talking Points

- NZDUSD attempting break-out of multi-month formation

- Updated targets & invalidation levels

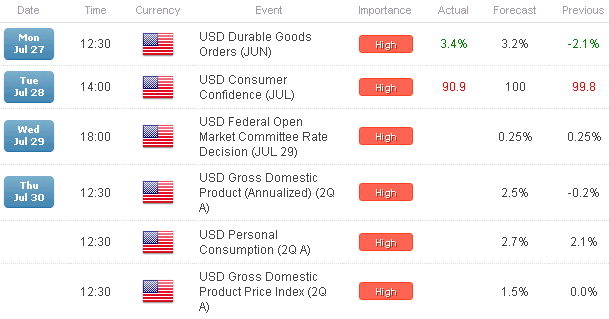

- Event Risk on Tap This Week

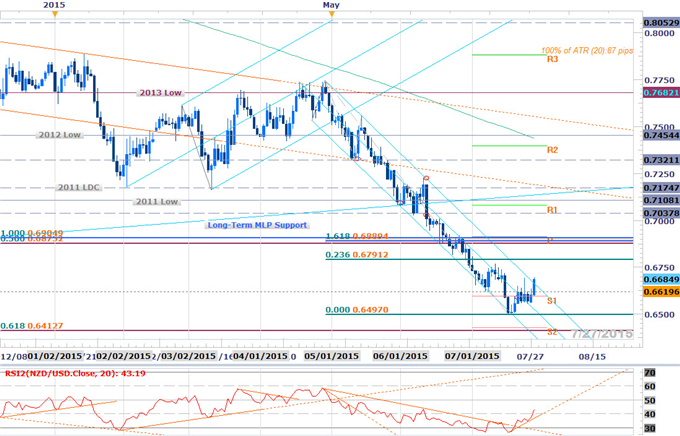

NZDUSD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- NZDUSD testing upper median-line parallel / last week’s high- breach would be bullish

- Interim resistance 6762 & 6790 – Key resistance 6875-6905

- Interim support 6620 backed by 6595

- Daily RSI resistance trigger breach last week

- Momentum breaches 40 first time in over a month- constructive

- Event Risk Ahead: FOMC Interest Rate Decision tomorrow & US Advanced 2Q GDP on Thursday

NZDUSD 30min

Notes: Kiwi has broken through the upper MLP of a formation dating back to the April highs with adherence to the proposed ascending formation off last week’s lows putting topside scalps in focus. The pair is now testing the ML / last week’s highs with a breach targeting the 100% extension at 6751 backed by the 23.6% retracement of the decline at 6790.

We’ll look to buy pullbacks / resistance triggers while above the highlighted region into the lower MLP around 6620 (bullish invalidation) with a break below 6597 needed to shift the focus back to the short-side. A quarter of the daily average true range yields profit targets of 21-23 pips per scalp. Caution is warranted heading into key US event risk this week with the FOMC rate decision and the second read on 2Q GDP likely to fuel added volatility in dollar crosses into the end of the week / month.

For updates on this scalp and more setups throughout the week subscribe to SB Trade Desk

Relevant Data Releases

Other Setups in Play:

- Webinar: Key USD Scalp Levels For Month End- GBP Crosses in Focus

- GBPJPY Defends Monthly Open- Weekly Range Break to Validate Long Bias

- Webinar: Euro Faces May Lows- USD Outlook Murky at Three Month Highs

- Key EURUSD Levels to Know Ahead of the ECB, US CPI

- AUDJPY Rebound Faces First Hurdle- Long Scalp Favored Above 91.24

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex,contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFXat 12:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video

original source