Talking Points

- USD/JPY probes key trendline

- USD/CAD turning lower from key turn window?

- Unusual cyclical convergence near month-end in EUR/USD

Get real time volume on your charts for free. Click HERE

forex technical analysis,forex analysis,forex trading strategies,forex signals,forex strategies,forex strategy, forex trading

Foreign Exchange Price & Time at a Glance:

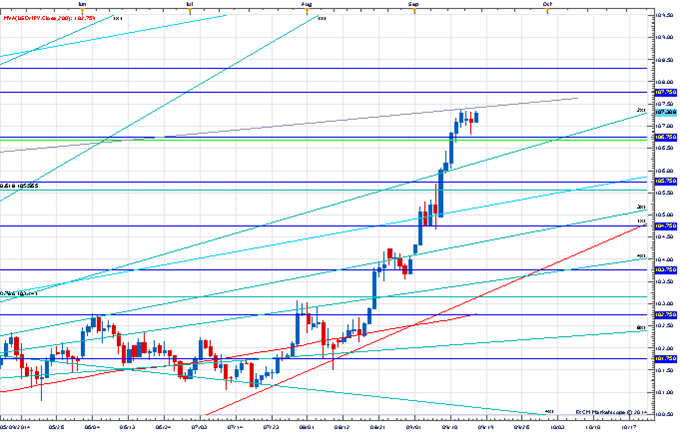

Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/JPY touched an almost 6-year high earlier in the week before stalling near trendline resistance in the 107.40 area

- Our near-term trend bias remains lower in the rate while above 105.30

- Resistance between 107.40 and 108.30 looks formidable and a move through this zone is needed to set off the next impulsive leg higher

- An important turn window is eyed later in the month

- A close below under 105.30 would turn us negative on USD/JPY

USD/JPY Strategy: Like holding reduced long positions above 105.30.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

USD/JPY | *105.30 | 106.20 | 107.30 | 107.40 | *108.30 |

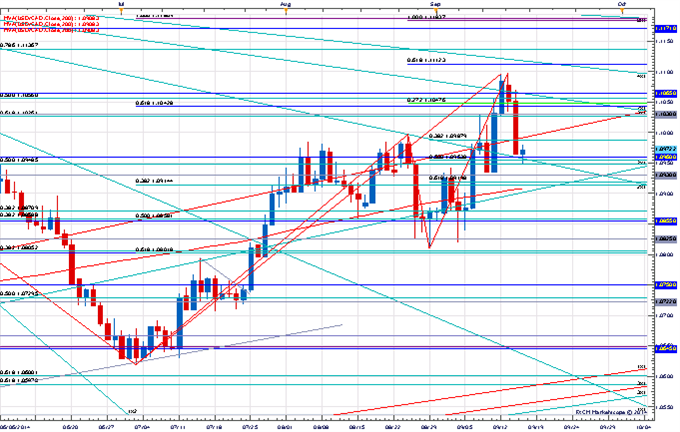

Price & Time Analysis: USD/CAD

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/CAD traded to its highest level since late March at the start of the week before stalling near 1.1100

- Our near-term trend bias is higher in Funds while above 1.0890

- A move back through 1.1030 is needed to re-instill positive momentum to the rate

- An important cycle turn window is seen this week

- A close under 1.0890 will turn us negative on USD/CAD

USD/CAD Strategy: Like holding reduced long positions while above 1.0890.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

USD/CAD | *1.0890 | 1.0920 | 1.0970 | *1.1030 | 1.1065 |

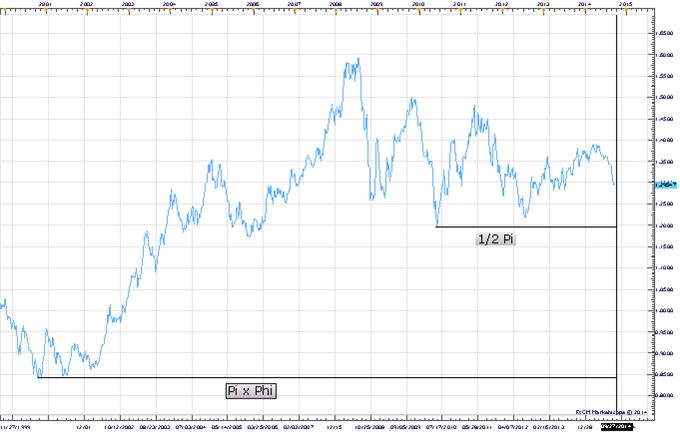

Focus Chart of the Day: EUR/USD

I believe the latter part of this month will prove important for the euro from a timing perspective. Various long-term cyclical relationships should influence around this time with the most important of the lot having ties to the key low in 2010 and the “all-time” low in 2000. The 2010 low occurred on June 7th. During the last week of September that will measure 1,570 calendar days or ½ Pi. I have seen many markets undergo important reversals around this interval through the years and this relationship alone probably warrants some serious attention. However, what makes the last week of the month so potentially interesting to me is that it will also measure 5,083 calendar days (Pi x Phi) from the 2000 all-time low which was recorded on October 27th of that year. Such a long-term cyclical convergence is rare and likely pretty important – at least the way I look at things. Given the lopsided negative sentiment towards the euro of late (DSI fell to just 5% bulls earlier this month) and extreme positioning (IMM small specs recently hit a record amount of shorts) I have to favor some sort of low coming out of it, but two weeks is an eternity in the foreign exchange market and anything can happen before then. I will revisit as the window draws near, but barring a sharp spike over the next few days I like the idea of an important low around month end.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

original source