Talking Points:

- USDOLLAR Continues to Show Limited Reaction to U.S. Data.

- Bullish AUD/USD at Risk on Slowing China 1Q GDP.

- USD/CAD Limited by Former Support Ahead of BoC Interest Rate Decision.

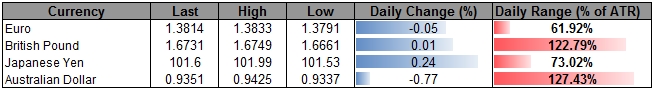

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 10449.12 | 10460.37 | 10436.3 | 0.12 | 72.19% |

The Dow Jones-FXCM U.S. Dollar Index (Ticker: USDollar) continued to show a limited reaction to the positive developments coming out of the world’s largest economy, and the bearish sentiment surrounding the greenback may gather pace over the next 24-hours of trade should Fed Chair Janet Yellen show a greater willingness to retain the zero-interest rate policy (ZIRP) for an extended period of time.

With that said, we will revert back to the approach of ‘selling bounces’ in the greenback once the near-term correction is complete, and may continue to see a series of lower highs & lower lows as long as price and the Relative Strength Index (RSI) retain the bearish formation from earlier this year.

Join DailyFX on Demandto Cover Current U.S. dollar Trade Setups

Read More:

Price & Time: Second Half of the Week Turn Window for the Yen

Beware of This Pattern Before “Buying Low” on USDJPY

GBP/JPY, GBP/USD Set for Test of Highs or Major Breakdown

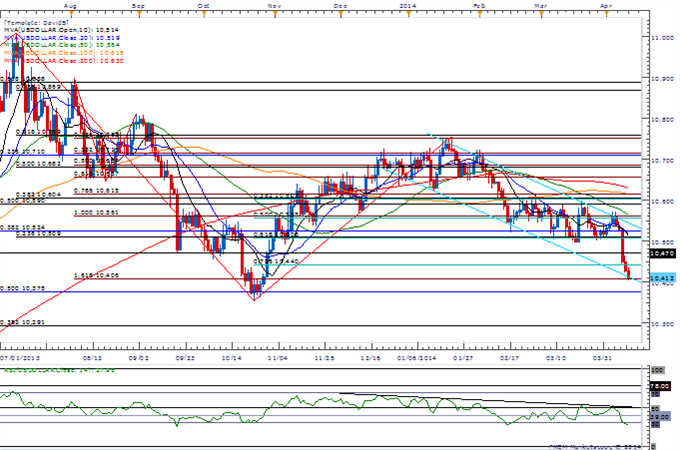

USDOLLAR Daily

Chart - Created Using FXCM Marketscope 2.0

- Appears to Be Capped by Former Support (10,470); 10,508-509 Up Next

- Interim Resistance: 10,602 (38.2 retracement) to 10,615 (78.6 expansion)

- Interim Support: 10,406 (1.618 expansion)

Release | GMT | Expected | Actual |

Fed's Dennis Lockhart Speaks on Financial Markets | 12:30 | ||

Consumer Price Index (MoM) (MAR) | 12:30 | 0.1% | 0.2% |

Consumer Price Index (YoY) (MAR) | 12:30 | 1.4% | 1.5% |

Consumer Price Index ex Food & Energy (MoM) (MAR) | 12:30 | 0.1% | 0.2% |

Consumer Price Index ex Food & Energy (YoY) (MAR) | 12:30 | 1.6% | 1.7% |

Consumer Price Index Core Index s.a. (MAR) | 12:30 | 236.452 | 236.604 |

Consumer Price Index n.s.a. (MAR) | 12:30 | 236.017 | 236.293 |

Fed Chair Janet Yellen Speaks on Financial Stability | 12:45 | ||

Net Long-term TIC Flows (FEB) | 13:00 | $30.0B | $85.7B |

Total Net TIC Flows (FEB) | 13:00 | -- | $167.7B |

NAHB Housing Market Index (APR) | 14:00 | 49 | 47 |

Fed's Charles Plosser Speaks on Financial Stability | 19:00 | ||

Fed's Eric Rosengren Speaks on U.S. Economy | 20:00 |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

By

By