Talking Points

- USD/JPY Technical Strategy: Longs Preferred

- Bulls Cautiously Return Following Lack Of Reversal Signals

- Daily Close Above 109.40 Opens Advance On 110.65

USD/JPY’s thrusters have reignited after showing signs of faltering near 109.40. An ascent towards the August ’08 high at 110.65 still appears achievable with key reversal candlesticks lacking. Yet some caution may be warranted given a pair of short body sessions suggests some reluctance by the bulls to lead the pair higher.

USD/JPY: August ’08 High In The Crosshairs As The Hunt Resumes

Daily Chart - Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

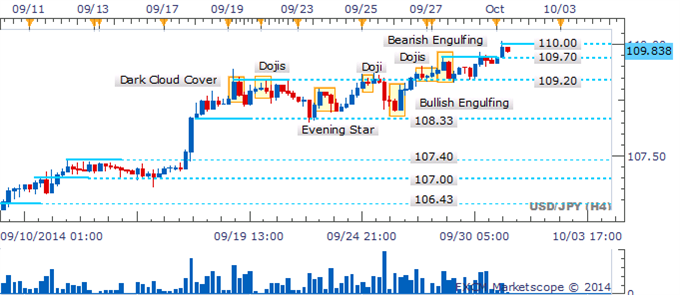

The four hour chart tells a similar tale to the daily. Short body candles suggest a cautious crawl rather than a charge by the USD/JPY bulls. However, with reversal signals lacking a close above the 110.00 ceiling may open the next leg higher for the pair.

USD/JPY: Awaiting Climb Over Intraday Resistance Amid Absence of Reversal Candles

Four Hour Chart - Created Using FXCM Marketscope 2.0,Volume Indicator Available Here

By David de Ferranti, Currency Analyst, DailyFX

Follow David on Twitter: @Davidde

To receive David’s analysis directly via email, please sign up here.

Learn how to read candlesticks to help identify trading opportunities with the DailyFX Candlesticks Video Course.

original source