Sign Up for a Free Yen Trading Guides Here

Talking Points:

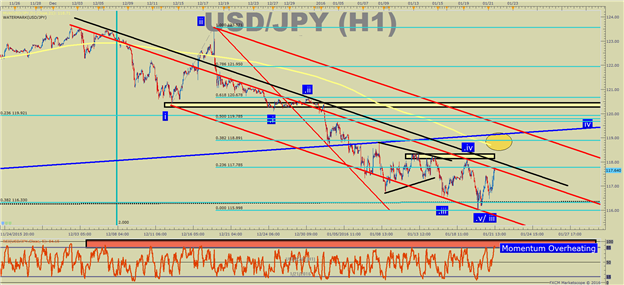

- USD/JPY Technical Strategy: ST Bounce Provides Tighter Risk on Short Trades

- 21-DMA & 38.2% Fibo of Dec-Jan Range as Resistance

- JPY Clearly Strongest Currency Pair in 2016 That Should not be sold

The Japanese Yen has had a banner start to 2016. Commodity currencies like the AUD & NZD have lost over 6% to the Japanese Yen since the start of trading on January 4. The Canadian Dollar has fared better only recently thanks to a CAD-supporting BoC announcement and a nice ST bounce in WTI Crude Oil into $32bbl resistance.

A channel drawn off key pivots in December show resistance is near ahead. Specifically, the 21-DMA at 118.71 & the 38.2% Fibonacci retracement level at 118.89 could prove to be too tall a wall to climb for USDJPY. What makes USDJPY interesting now is that weakness in the US Dollar is starting to show up, which could allow for bigger downside moves.

ST Bearish USDJPY Set-Up Developing

USDJPY is strongly correlated to risk sentiment, and the direction of broader markets will likely determine the overall direction of USDJPY. A risk-off move in equities would likely pull USDJPY convincingly through the longer-term head & shoulders neckline to lower levels.

There was a mention yesterday of the BoJ monitoring the markets, but any outright intervention seems unlikely at such elevated levels. In recent months, we have heard from some Japanese corporations who said that their “sweet-spot” on USD-JPY was in the 115-125 range. Therefore, a strengthening of the JPY would not like prompt BoJ action until the 105-110 zone, if that.

T.Y.

To see how FXCM traders are positioned, click here.

Interested In Learning the Traits of FXCM’s Successful Traders? If So, Click Here

original source