Talking Points

- Crude Oil Prices Rebound After FOMC Keeps Rates Flat

- Key Support for Crude Oil Falls Near $41.75

- If you are looking for more trading ideas for Oilcheck out our Trading Guides

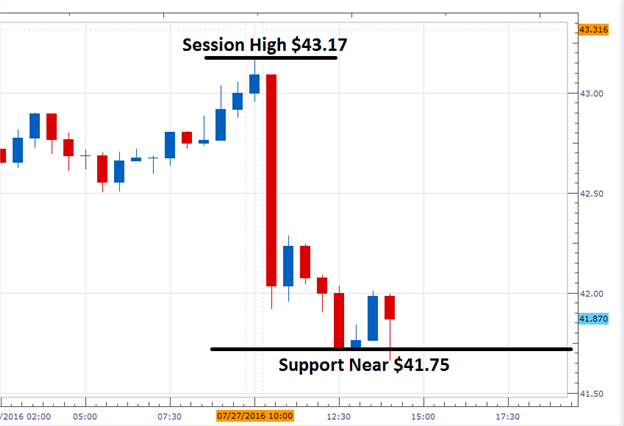

The price of WTI Crude Oil (CFD:USOil) has temporarily found support after this afternoons FOMC rate decision and statement. The event found the FOMC keeping rates unchanged at 0.50%; and key statements read that for the month of June “Market-based measures of inflation compensation remained low.” As such, Crude prices and other commodities such as gold have rebounded from lows put in place during the event. If prices remains supported, it opens Crude Oil up to trade back towards session highs at $43.17. Alternatively, if support falls it would suggest a continuation of the commodities daily decline.

Crude Oil Prices, 4Hour Chart

(Created using Marketscope 2.0)

In the 5-minute graph below, we can see the price of Crude Oil moving off of session lows at $41.66. The Grid Sight Index has indicated that short-term momentum is currently pointing higher through the creation of a series of higher lows. After reviewing 4,451,998 pricing points, GSI has advanced a minimum of $0.14 in 64% of the 379 matching historical events. The first historical distribution line falls at a price of $42.19. A move through this price would suggest the beginning of a bullish daily reversal for Crude Oil. In this scenario, traders should watch for prices to test the last bullish historical distribution at $42.55. From here, traders may begin to target the previously mentioned daily high of $43.17.

It should be noted that the first bearish historical distribution currently resides at $41.37. The Grid Sight Index found that prices declined $.068 or more in just 8% of the matching 379 historical events. A move through this value would suggest a resumption of bearish momentum for Crude Oil on the creation of new daily lows.

Want to learn more about GSI? Get started learning about the Index HERE.

WTI Crude Oil Price 5 Minute GSI Chart

Are FXCM traders long or short the market? Find out here!

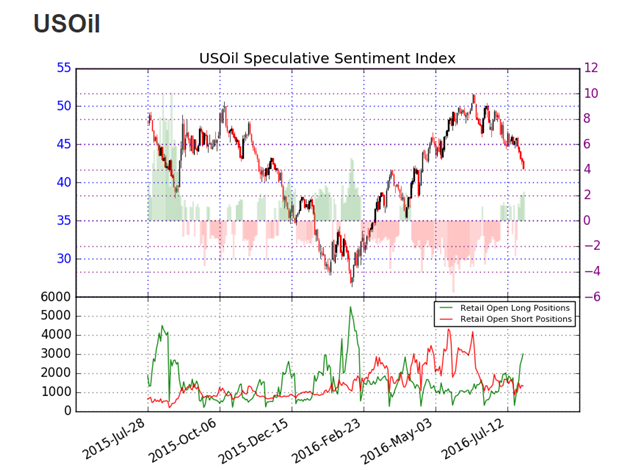

It should be noted that Sentiment for Crude Oil (Ticker: USOIL) has moved to a positive extreme from our last reported SSI reading of +1.43. Currently 69% of positioning long, with SSI reading at +2.28. Typically, an extreme positive reading is indicative of future declines in price. If Crude Oil prices breakout to new lows, SSI would be expected to remain at positive extremes. Alternatively, if prices were to rebound, traders should look for SSI figures to move back towards values that are more neutral.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.

original source