Total Liquidations Futures Market

Source: Coinglass

Wednesday, January 5 was another dark day for leveraged trading. Over $600 million was liquidated yesterday, one of the largest liquidations in recent months. Moreover, it is noticeable that over the last few weeks, liquidations have had a direct impact on the price of cryptocurrencies as the low, if not non-existent, volume on the traditional market does not compensate for these chain reactions of selling on the futures contracts of exchange platforms.

If leverage makes some traders dream of quick profits and the life of a pasha, it is through this technique that trading platforms make a large part of their income. So don't count on them to turn you away from this ruthless trading method for the uninitiated. Now that we understand that the bloodbath has taken place in the futures market, what about the traditional market?

Wait-and-see

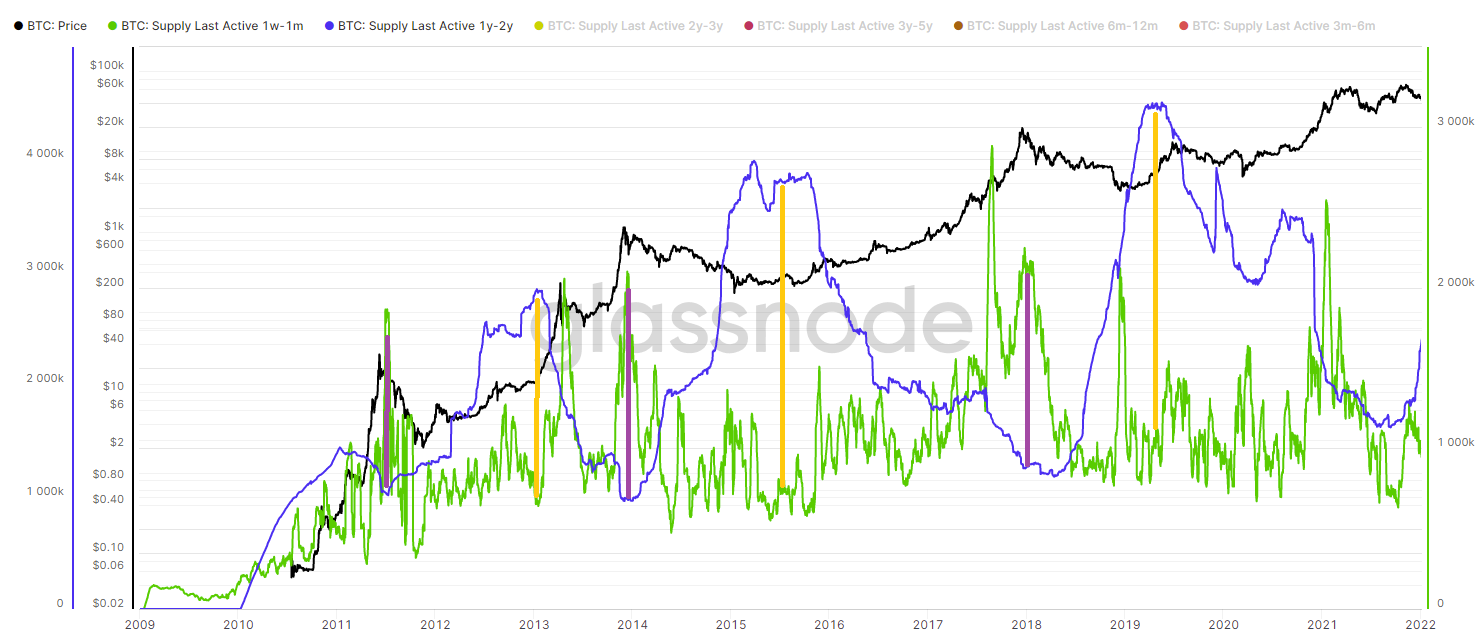

Looking at the psychology and behavior of short and long term investors is essential to understanding the price fluctuation of a digital asset. The graph below highlights the proportion of the supply of old coins (1 year - 2 years, blue curve) to compare it to the supply of younger coins (1 week - 1 month, green curve). Interesting trends can be observed.

Comparison of the supply of older coins (1-2 years) and the supply of

younger coins (1 week - 1 month) / Bitcoin price

Sources: Glassnode

In bull markets (purple vertical bar): the supply of young coins is higher than the supply of old coins. In other words, new young speculators enter the market while old speculators sell their old coins during this bullish euphoria.

In bear markets (yellow vertical bar): the supply of young coins is lower than old coins. In other words, the old hands are accumulating supply much more strongly than the young hands.

This is obvious from this chart. Older coins (blue curve) represent an increasingly important part of the total supply of coins in circulation at the time of writing. The opposite is true for young coins. There is a well-known behavior of traditional finance that applies to the world of cryptocurrencies. Smart money accumulates supply during periods of decline while young speculators buy the historical highs. Bitcoin's on-chain data allows for direct observation of these behaviors by highlighting, to some extent, the psychology of investors.

You might be thinking that all you have to do is simply follow the movements of the old hands by replicating their trades. However, the demons of greed and FOMO (Fear Of Missing Out) shake investors when markets take off. Managing emotions in a market as volatile as digital assets turns out to be a real duel with oneself. Let's go a little further into understanding this aging of the coins.

Bitcoin: Percent of Supply Last Active 1+ Years Ago

Source: Glassnode

This graph shows the percentage of coins that are older than 1 year. In other words, of all the coins currently in circulation, 67% of them were purchased more than a year ago. A percentage that has been increasing in recent days, which proves the increased conservation of coins. We can interpret this retention of coins as the confidence of old hands in the current price of bitcoin.

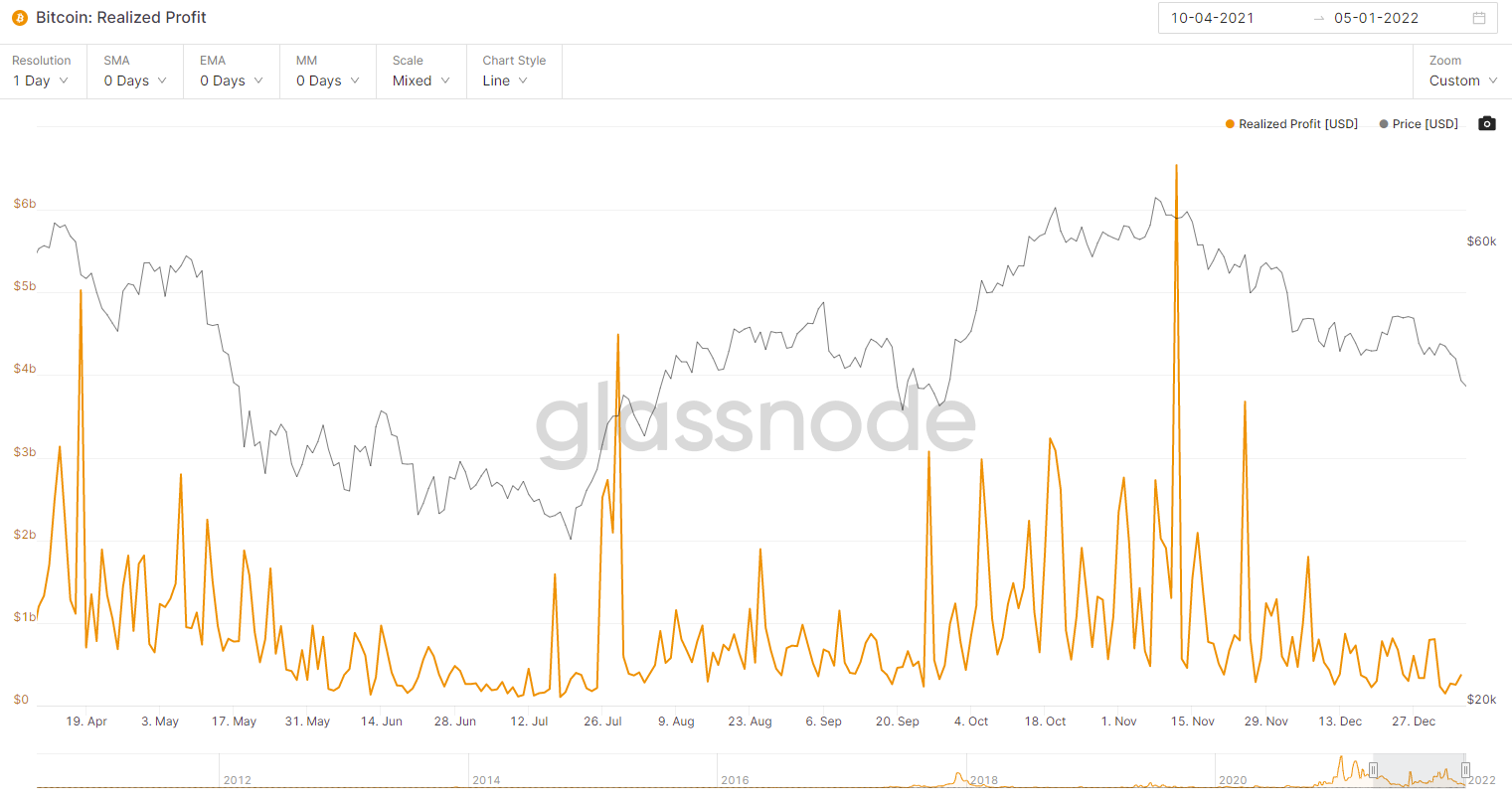

Bitcoin: Realized Profit

Source: Glassnode

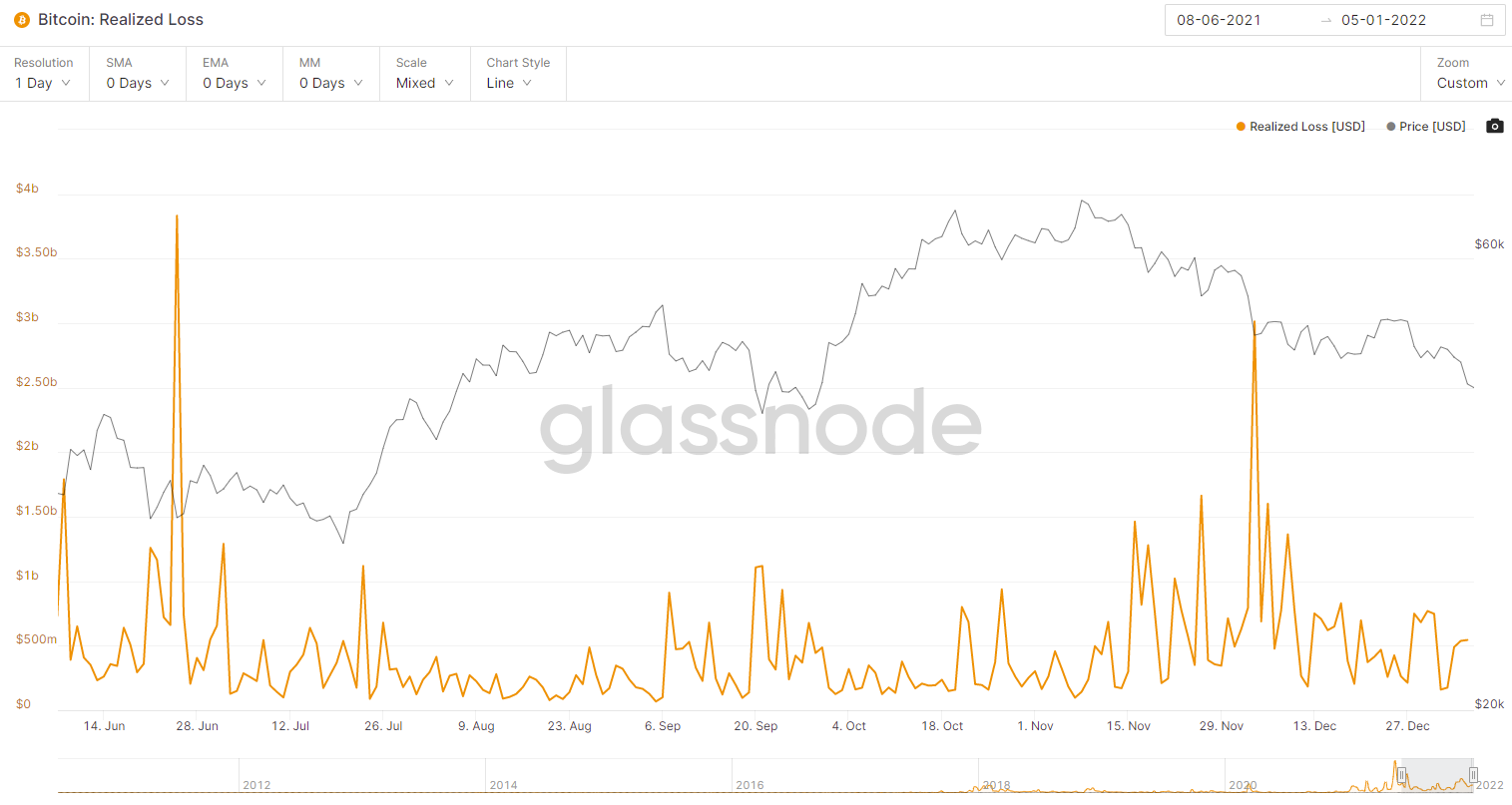

Bitcoin: Realized Loss

Source: Glassnode

The number of coins sold at a loss, while higher than the number of coins sold at a profit, is also at very low levels compared to the last few weeks. In other words, the coins that are currently being sold on the network are mainly coins that were purchased at a higher price than the current price. It is understandable that investors who took positions on the historical highs of $69,000 are starting to get nervous after a decline that is trending towards -40% since those highs.

What can we infer from the recent decline? On the one hand, leveraged traders are being punished by the decline in prices, which is causing a chain reaction of position liquidations. This situation can continue in the short to long term. On the other hand, the coins being put back into circulation are mainly coins sold at a loss by players who took positions at a higher price. The debate rages on about "bear market or not?", in other words, are we entering a bear cycle? I am watching the evolution of the tokens like milk on the stove in order to publish soon a new article on MarketScreener.

By

By