Block 1: Key news

Germany rides the crypto wave

Deutsche Borse, the operator of XETRA in Germany, has launched the Deutsche Borse Digital Exchange (DBDX), a cryptocurrency spot trading platform aimed at institutional investors. This initiative builds on the infrastructure of the Crypto Finance platform, recently accredited by BaFin. Carlo Kolzer, Head of FX and Digital Assets at Deutsche Borse, emphasized the platform's commitment to regulatory compliance, transparency and security. The launch comes at a time when institutional players are showing renewed interest in cryptocurrencies, particularly through ETFs.

Binance.US in PLS

According to a report by the US Securities and Exchange Commission (SEC), in 2023 Binance.US suffered heavy financial losses as a result of the regulator's actions, leading to a 75% drop in revenues and the dismissal of two-thirds of its staff, as well as the departure of Changpeng Zhao and a $4.3 billion fine. The difficulties were exacerbated by a temporary freeze on assets and a billion-dollar capital flight, which severely affected operations and banking relationships, to the point of interrupting fiat currency transactions. Despite these challenges, Binance remains the world's largest cryptocurrency exchange with $106.29 billion in assets under management.

BRICS+ adapt to blockchain

According to Kremlin aide Yury Ushakov, the BRICS+ countries are reportedly planning to launch an innovative payment system that uses blockchain and central bank digital currencies (CBDCs), in order to strengthen their economies independently of the Western model, dominated by the USA. This initiative "seeks to provide an efficient, non-politicized, and accessible payment solution for governments, citizens, and businesses" according to Yury Ushakov. The move is part of a broader de-dollarization strategy and aims to increase the role of the BRICS+ in the international monetary and financial system, particularly in response to current geopolitical tensions and Western sanctions.

Tether: On top of the stablecoin world

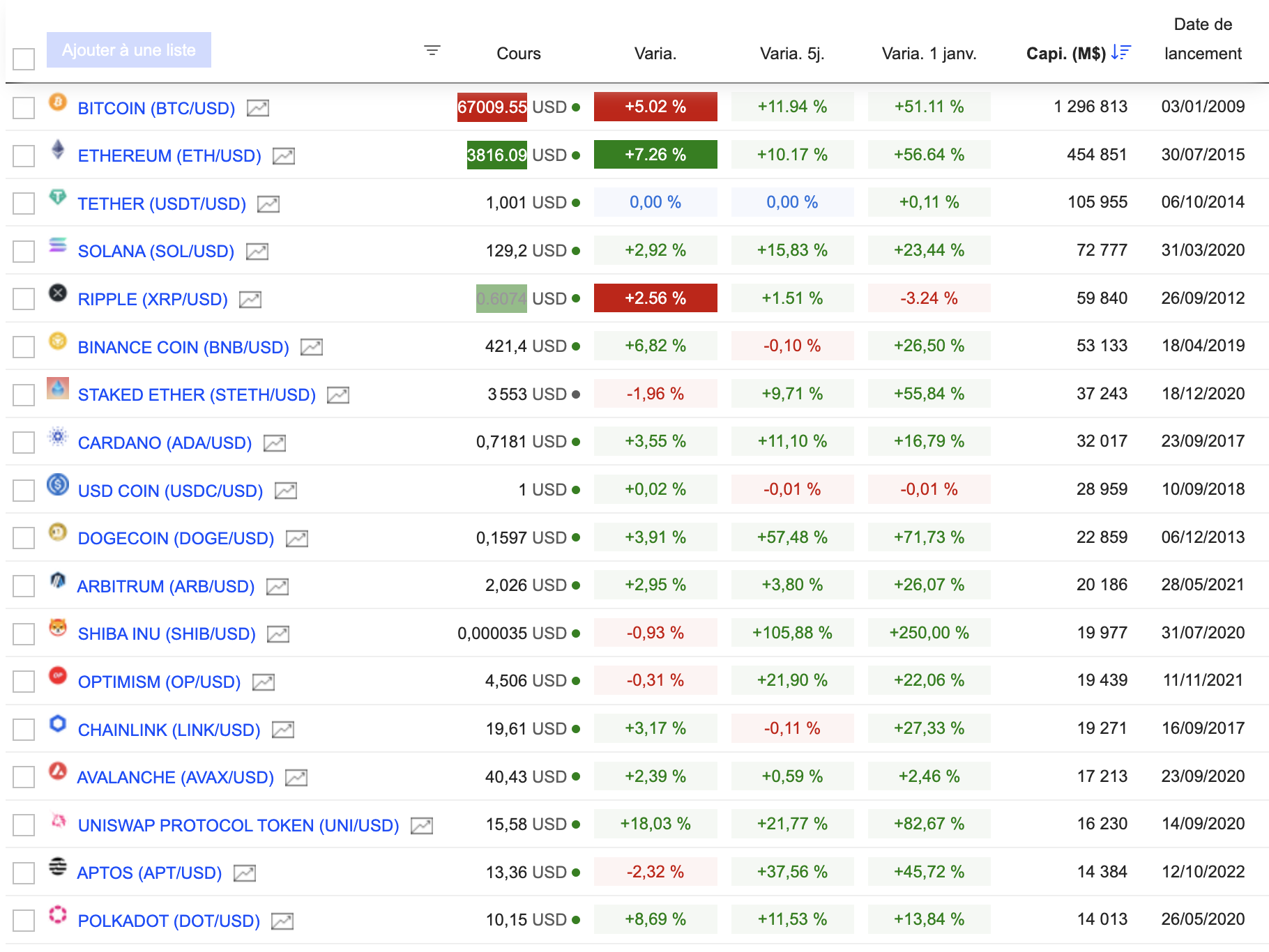

Tether's USDT stablecoin has broken a new record with a capitalization of $100 billion, asserting its dominance in the cryptocurrency ecosystem. This milestone underlines USDT's position as the third most capitalized crypto asset, behind ETH and ahead of BNB, in a context where total cryptocurrency capitalization stands at $2.6 trillion. USDT thus stands out as the undisputed leader in the stablecoin sphere, far outstripping competitors such as USDC and DAI.

Celebrating the 100B Milestone Together?

A Heartfelt Thank You to the Hundreds of Millions of Tether USDt Users Worldwide. pic.twitter.com/7BoObo2xV2

- Tether (@Tether_to) March 5, 2024

Block 2: Crypto Analysis of the Week

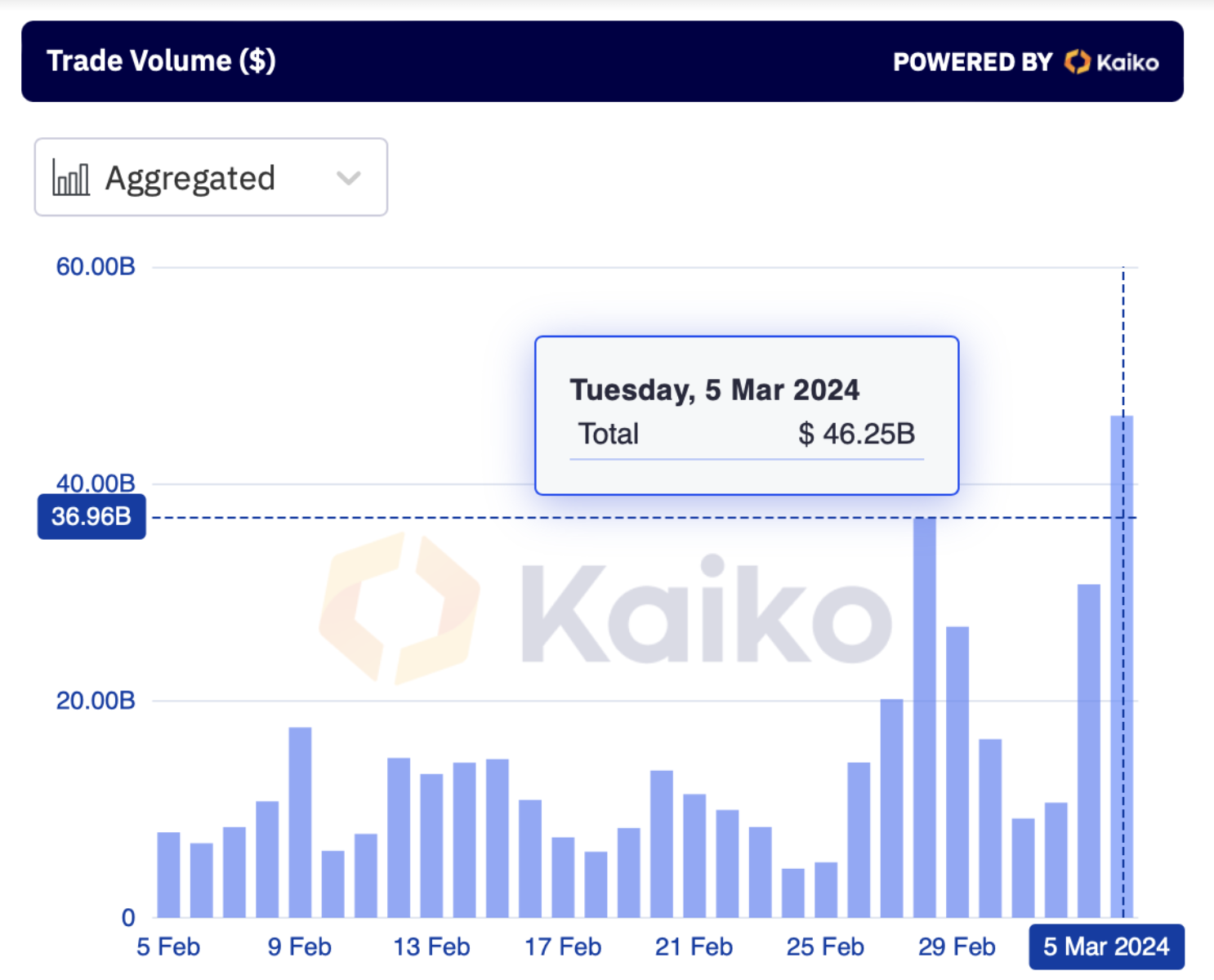

It's a financial feat that has captured the attention of markets around the world: bitcoin momentarily hit a record high of $69,250 on Coinbase on Tuesday, surpassing its November 10, 2021 peak of $68,900. On Tuesday, bitcoin trading volume on centralized exchanges reached $46.25 billion, the highest level since 2021.

Kaiko

This peak proved short-lived, however, as the crypto-asset subsequently fell back to a still-impressive $67,000. But the volatility didn't stop there: the market plummeted to $60,800, leading to liquidations of over a billion dollars. Analysts attribute this movement to a mixture of profit-taking and miners offloading their holdings at peak values. But as proof of its resilience, bitcoin rebounded in the morning in Asia, then spread to Western markets, with BTC now hovering around $66,900.

This surge in bitcoin's value took market observers and insiders by surprise, especially considering the pessimism that prevailed in the crypto sector just a few months earlier. Even Coinbase, the leading cryptocurrency platform in the U.S., was caught off-guard, as a surge in exchange activity caused an application outage earlier this week.

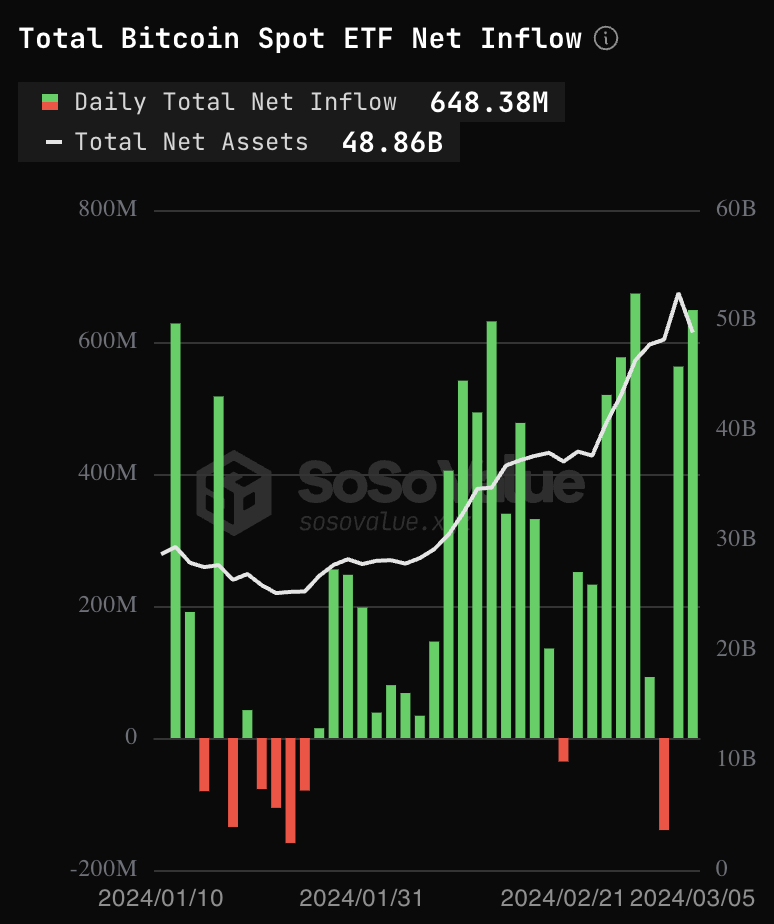

This buzz around crypto-currencies, and bitcoin in particular, is naturally linked to the launch of Bitcoin Spot ETFs.

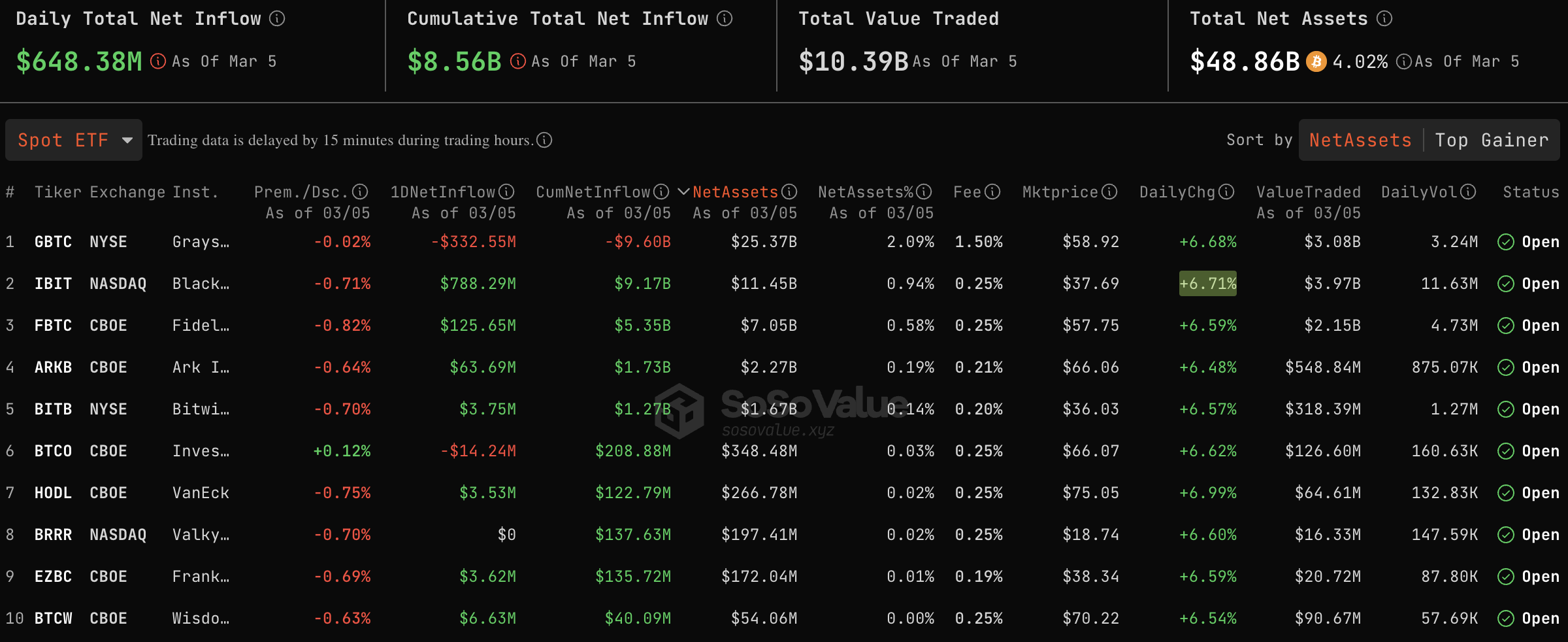

Bitcoin exchange-traded funds (ETFs) have collectively attracted $8.56 billion in net inflows into ten active funds. This development has not only bolstered the legitimacy of cryptocurrencies thanks to the involvement of financial heavyweights such as BlackRock, Fidelity and Merrill Lynch, but has also put strong buying pressure on bitcoin itself.

The rapid growth of BlackRock's ETF (IBIT) , which has reached $10 billion in assets under management, is undeniably a sign of strong demand for bitcoin exposure from a wide range of investors, from individuals to financial institutions.

SoSo Value

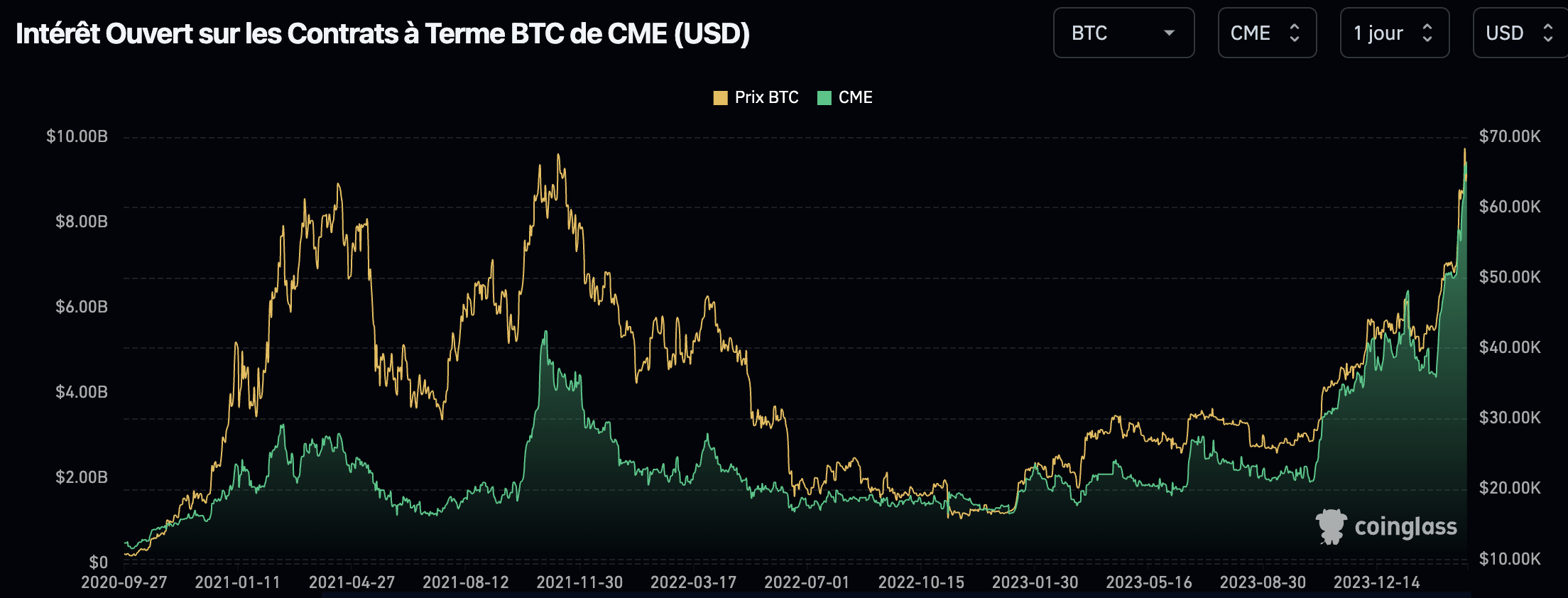

However, the commitment of the traditional financial sector (TradFi) to crypto-currencies extends beyond ETFs. The CME Group's BTC derivatives recorded record trading volumes, reflecting increased interest from institutional investors.

Good news for the cryptosphere, regulatory environments around the world are also adapting, with significant advances such as the EU's crypto-asset market framework (MiCA), the United Arab Emirates' digital asset trading license program and lobbying efforts in Canada, which could soon offer traders more regulated routes into cryptocurrency derivatives. These developments suggest a maturing market that could potentially attract even more participants.

The latest highlight comes (again) from BlackRock, which has applied to include bitcoin exposure in its Strategic Income Opportunities Fund (BSIIX), foreshadowing a sea change in the way traditional investment funds view bitcoin, and cryptocurrencies more broadly. This decision could have a domino effect, prompting other asset managers to consider bitcoin allocations by adding a BTC line corresponding to 1% or 2% in their investment funds.

With investment methods in cryptocurrencies in a state of flux, the market is watching closely as traditional financial institutions such as BlackRock, Fidelity, State Street, Morgan Stanley and others reconsider their stance on the subject. This reappraisal could herald a new era of investment in bitcoin, with bitcoin soon to be integrated into various investment funds, potentially snowballing in value over the medium term.

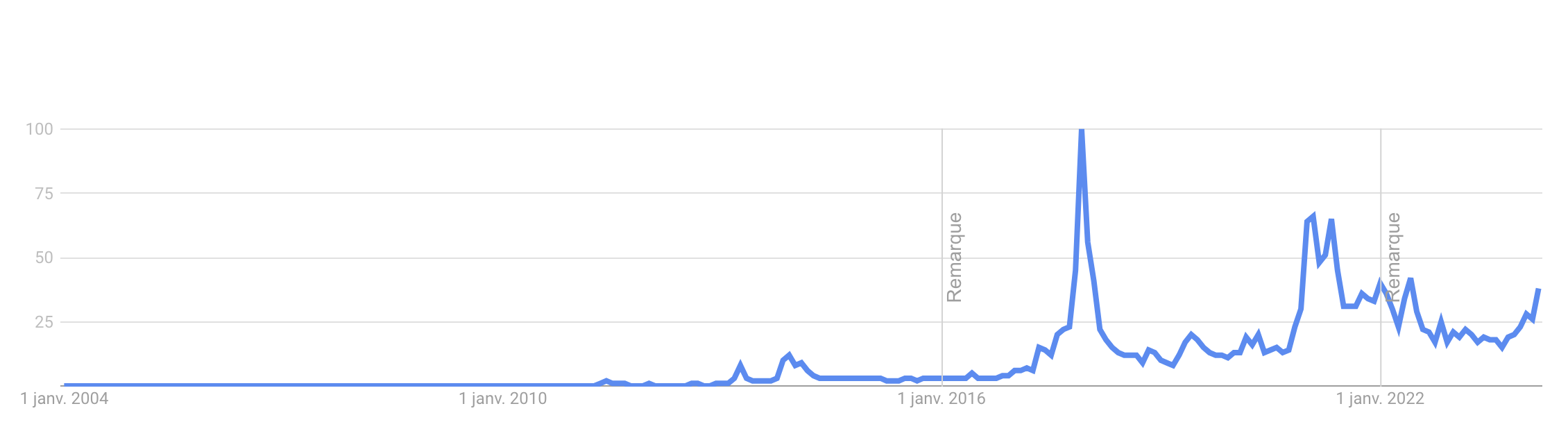

Finally, searches for the word "Bitcoin" on Google have accelerated in recent weeks, providing further evidence of the general public's interest in the market's most highly-valued cryptocurrency.

Block 3: Gainers & Losers

Cryptocurrency charts(Click to enlarge)

Block 4: Things to read this week

For Bitcoin miners in Texas, the honeymoon is over (Wired)

Why crypto simply won't die (The Atlantic).

The crypto lobby's new target (Financial Times)

By

By