Block 1: Key news

MicroStrategy buys bitcoins (again and again)

MicroStrategy, headed by Michael Saylor, recently acquired a further 3,000 Bitcoins, bringing its total investment in BTC to over $10 billion, with a reserve of 193,000 Bitcoins. This marks the firm's second major acquisition in February, at an average price of $51,813 per BTC. With these purchases, MicroStrategy consolidates its leading position among companies investing in Bitcoin, despite an unrealized gain of over $4 billion. Meanwhile, MicroStrategy's share price (MSTR) has risen by 200% over the past year, reflecting the correlation between Bitcoin's price and the company's stock market value.

Game over for FTX Europe

FTX has sold its European subsidiary, FTX Europe, for $32.7 million, well below the $376 million paid when it was acquired in 2021 by Sam Bankman-Fried via Alameda Research. This sale was part of a dispute concerning a "massive overpayment" of $323 million. Resolution of this dispute led to a compromise, avoiding prolonged and significant legal costs. This transaction comes at a time when Sam Bankman-Fried is facing major criminal charges, with a ruling on March 28 that could see him sentenced to many years in prison.

Binance: A record fine of $4.3 billion

Binance has entered into a plea agreement with the US justice system, agreeing to pay a record $4.3 billion fine for anti-money laundering offences . This sanction, one of the largest ever imposed in the US in this area, follows the admission of guilt of former CEO Changpeng Zhao. Binance is also committed to strengthening its compliance tools, in particular the Know Your Customer (KYC) process, and must implement an external compliance audit for three years.

Kraken stands up to the SEC

The U.S. Securities and Exchange Commission (SEC) is facing resistance from cryptocurrency exchange Kraken, which is challenging a lawsuit initiated by the SEC for alleged violations of the Exchange Act. Kraken rejects the charges, pointing to a lack of clear SEC guidance and an abuse of power in its fight against the cryptocurrency sector. The platform relies on arguments similar to those used in the case against Ripple, claiming that cryptocurrencies are not intrinsically financial securities under the Howey test. The final decision now rests with the U.S. District Court for the Northern District of California.

Block 2: Crypto Analysis of the week

Bitcoin has taken the vertical since Monday. The digital currency has risen by over 20% in the last 72 hours and by over 40% in February. Trading above $62,000, bitcoin is less than $7,000 away from its all-time high of $69,000 in November 2021.

Zonebourse

This kind of performance is rare on traditional financial markets, especially if there's no obvious catalyst such as an earnings announcement or M&A deal. But being in the crypto sphere, why has bitcoin been appreciating rapidly in recent weeks?

The obvious answer, of course, is that the marketing of bitcoin spot ETFs has created strong demand for the asset. Now, many institutional investors and retail investors, wary of taking on cryptocurrency platforms, can finally gain direct exposure to bitcoin via more traditional means. Yesterday, these exchange products recorded net inflows of $576 million. ETFs have also officially passed the $6 billion mark in cumulative net inflows since their launch. BlackRock 's fund leads the way with $8 billion in assets, and 5 ETFs have at least $1 billion in assets under management.

SoSo Value

As noted by Bitmex Research, capital flows into Bitcoin Spot ETFs represent 9,510 bitcoins of net inflows. To put this into perspective, the bitcoin network produces 900 net new bitcoins per day.

In addition, the total volume of deposits and withdrawals on cryptocurrency platforms, such as Coinbase or Binance, continues to rise, reaching a staggering daily volume of $5.57 billion in and out, rivaling the activity seen during the market ATH in 2021.

Glassnode

In addition, short-term bitcoin holders (BTC acquisition date less than 155 days) have been steadily depositing over $2 billion per day in volume since mid-January, while also setting a new high of $2.46 billion in total deposited volume. This underlines the high degree of speculative interest within the current market structure.

Glassnode

Bitcoin is also highly dependent on the global money supply. The increase in the total global money supply, also known as M2, has historically supported the price of bitcoin and cryptocurrencies more generally. M2 is the U.S. Federal Reserve's estimate of the amount of money in circulation, including cash held by individuals and money held in savings and checking accounts, as well as other short-term liquid instruments such as certificates of deposit.

Over the past decade, the Bitcoin price has seen notable increases during periods of rapid M2 growth, supported by lower interest rates, quantitative easing and fiscal stimulus. Conversely, during periods of monetary tightening by central banks, the cryptocurrency market has often struggled to maintain an upward trajectory. Notably, the 2021 bull market corresponded to overall M2 growth of 6% or more at the world's major banks, including the Fed, European Central Bank, Bank of Japan and People's Bank of China. Prospects of rate cuts in the coming months in the US and Europe are playing into bitcoin's hands.

MacroMicro

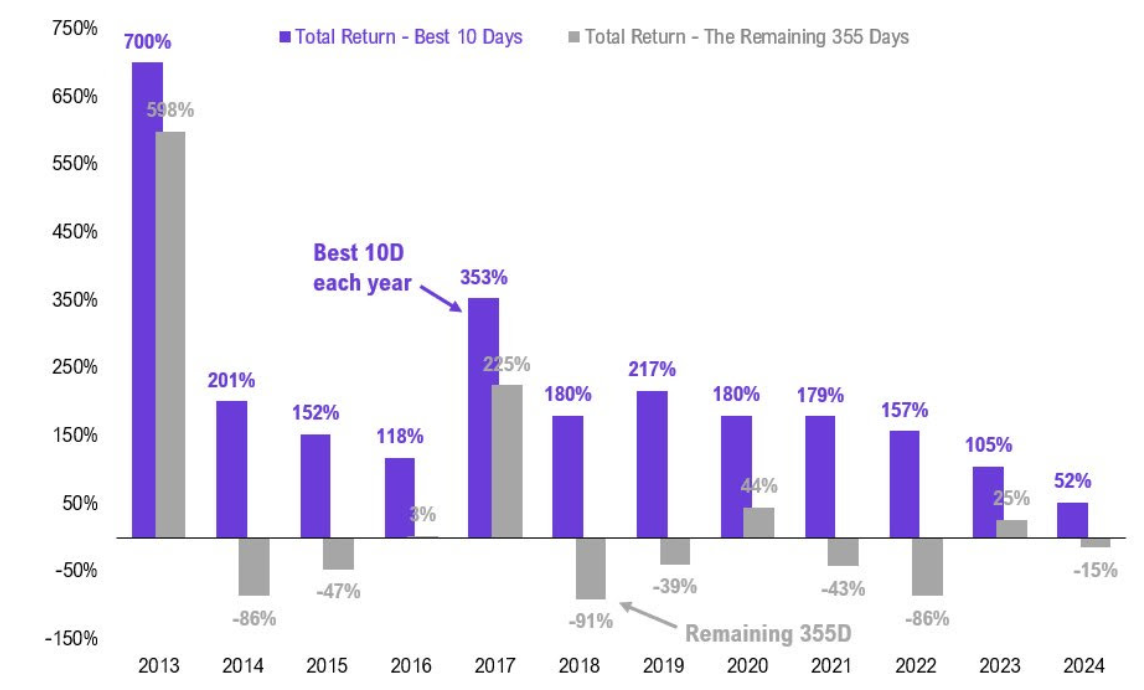

Finally, as a bonus, according to Fundstrat's Tom Lee, if you miss bitcoin's top 10 return days each year, you're missing the majority of the return. The ultimate example of "time in the market is more important than market timing" is truer than ever in the case of bitcoin.

Block 3: Gainers & Losers

Crypto chart(Click to enlarge)

Block 4: Things to read

Bitcoin royalty goes down in Satoshi Nakamoto trial (Wired)

A pilot stablecoin project in China (Project Syndicate).

Layer 2 is no magic spell (Bitcoin Magazine)

By

By