Block 1 : The essential news

- US to tax bitcoin miners up to 30% of their income

The White House is considering taxing Bitcoin miners in the U.S. for 30% of the electricity they use to offset the economic and environmental costs they impose on society, including the rising cost of electricity for households. The measure, proposed as part of the 2024 Budget, would apply to all miners under the name "Digital Asset Mining Energy (DAME) excise tax." The U.S. government believes that the mining industry, and implicitly cryptocurrencies, do not sufficiently benefit the community and do not generate the expected benefits. If approved, the tax could generate $3.5 billion in revenue over ten years and potentially cause a further exodus of miners to other less hostile countries.

- Google partners with Polygon Labs

Google Cloud is partnering with Polygon Labs - the company developing the Polygon blockchain - to make it easier to build and deploy decentralized applications (dApps) on the Polygon blockchain (MATIC) and Polygon zkEVM. This partnership will help developers by providing resources, additional capital, and full control over the hosting of deployed nodes. The collaboration aims to increase transaction throughput for gaming, supply chain management, and decentralized finance (DeFi).

- Binance Continues to Build on its Leadership Position

A study by CoinGecko reveals that Binance dominates the cryptocurrency spot trading market with 62 percent market share in March. The platform recorded $559.8 billion in volume during that period. Against Binance's dominance, other platforms are struggling to gain traction, with Upbit in second place, having recorded $64.3 billion in volume in March. Other exchanges, such as Coinbase, Huobi and KuCoin, are showing declining volumes and market share. In the wake of FTX's fall in November 2022, Binance is recording 32 percent volume growth between the last quarter of 2022 and the first of 2023.

- Mastercard rolls out new Web3 solutions

Mastercard introduced Mastercard Crypto Credential, a suite of solutions focused on identification and transparency in blockchain technology. One of the solutions replaces public addresses, which are a long series of numbers and letters, with an alias in the format "alias.mastercard". To deploy its infrastructure, Mastercard has partnered with players in the cryptocurrency ecosystem, such as Lirium, Mercado Bitcoin, Polygon Labs, Ava Labs, Aptos Labs and the Solana Foundation. The U.S.-based company notes that the technology aims to bring value to different areas such as NFTs, ticketing and payment solutions.

At #Consensus23 , we announced how we are instilling trust in the blockchain ecosystem through Mastercard Crypto Credential. With crypto wallet providers @Bit2Me_Global, @LiriumAG, @MercadoBitcoin and @UpholdInc and public blockchain network organizations @AptosLabs,... pic.twitter.com/P33mtDVAas

- Mastercard News (@MastercardNews) April 28, 2023

Block 2: Crypto Analysis of the week

Last Sunday, US authorities orchestrated a financial rescue mission with two banking behemoths, while the Bitcoin network was busy setting records, processing more daily transactions than at any time since its inception in 2009.

Meanwhile, JPMorgan Chase bought First Republic after regulators seized the troubled bank's assets, recording one of the largest bank failures in US history in the process.

While there may not be a direct link between Bitcoin's record-breaking and the banking fiasco, their curious synchronicity puts Bitcoin in the spotlight in an increasingly stressed U.S. economy. As lawmakers and regulators work to curb the encroachment of cryptocurrencies on the broader financial ecosystem, the private banking sector continues to get its feet wet.

After weeks of uncertainty, First Republic was bought out by the Federal Deposit Insurance Corporation (FDIC) in a desperate attempt to prevent a bank run and out-of-control contagion. The federal banking supervisor moved quickly to turn over "all of [First Republic's] deposits and substantially all of its assets" to JPMorgan Chase, the largest U.S. bank, which received a cool $50 billion to seal the deal.

JPMorgan CEO Jamie Dimon, known for his criticism of bitcoin, said, "Our government invited us and others to step in, and we did." While First Republic's management can be blamed for the failure, many of the economists believe that the bank's downfall is partly due to rising interest rates and the Federal Reserve's expansionary monetary policy, which also contributed to the collapse of Silvergate, Silicon Valley and Signature banks earlier this year.

This highlights a broader political realignment toward populism, where the authority of central banks and established powers is often questioned. The cryptocurrency craze is just one part of a broader political shift toward populism. Bitcoin, and the entire community behind it, is not alone in challenging central banks and the established powers, as many will view the First Republic bailout as another case of privatizing profits and socializing losses.

Nevertheless, if the price of bitcoin rose during the latest banking fiasco related to the collapse of Silicon Valley Bank, this does not mean that, on the one hand, Satoshi Nakamoto's creation is a "guarantee" or a "hedge" against financial disasters, and on the other hand, that people are definitely opting for "untrusted" systems rather than for increasingly untrustworthy banks. As a reminder, Bitcoin has emerged as a rival, or at least alternative, monetary force, with some speculating that it could become a global reserve currency, like the U.S. dollar. Its appeal stems in part from Bitcoin's unwavering commitment to pre-established rules and a fixed currency issuance schedule, unlike the greenback.

Returning to the record number of Bitcoin transactions, this phenomenon is actually a pure coincidence. Bitcoin transactions have been on the rise since the introduction of Bitcoin Ordinals, which allowed the network to support non-fungible tokens (NFTs).

More than 2.39 million NFTs Ordinals have been "registered" to date. Although Bitcoin NFTs now account for about half of the network's transactions (which increases miners' transaction costs and potentially guarantees Bitcoin's long-term "security budget"), they are not the only ones. s long-term "security budget"), not all Bitcoin enthusiasts agree with this feature.

Many Bitcoin purists believe that the network should be reserved for monetary purposes and view digital collectibles as mere trinkets. Unfortunately for them, Bitcoin is an open-source network, so everyone is free to use it as they see fit.

As the U.S. government continues to bail out banks and crypto-fans argue over the "proper" use of Bitcoin, one thing is clear: the financial landscape is changing, and it is often as unpredictable as the weather. Since traditional banks stumble and crypto-currencies like bitcoin chart their own course, the line between comedy and tragedy in the financial world is becoming increasingly blurred.

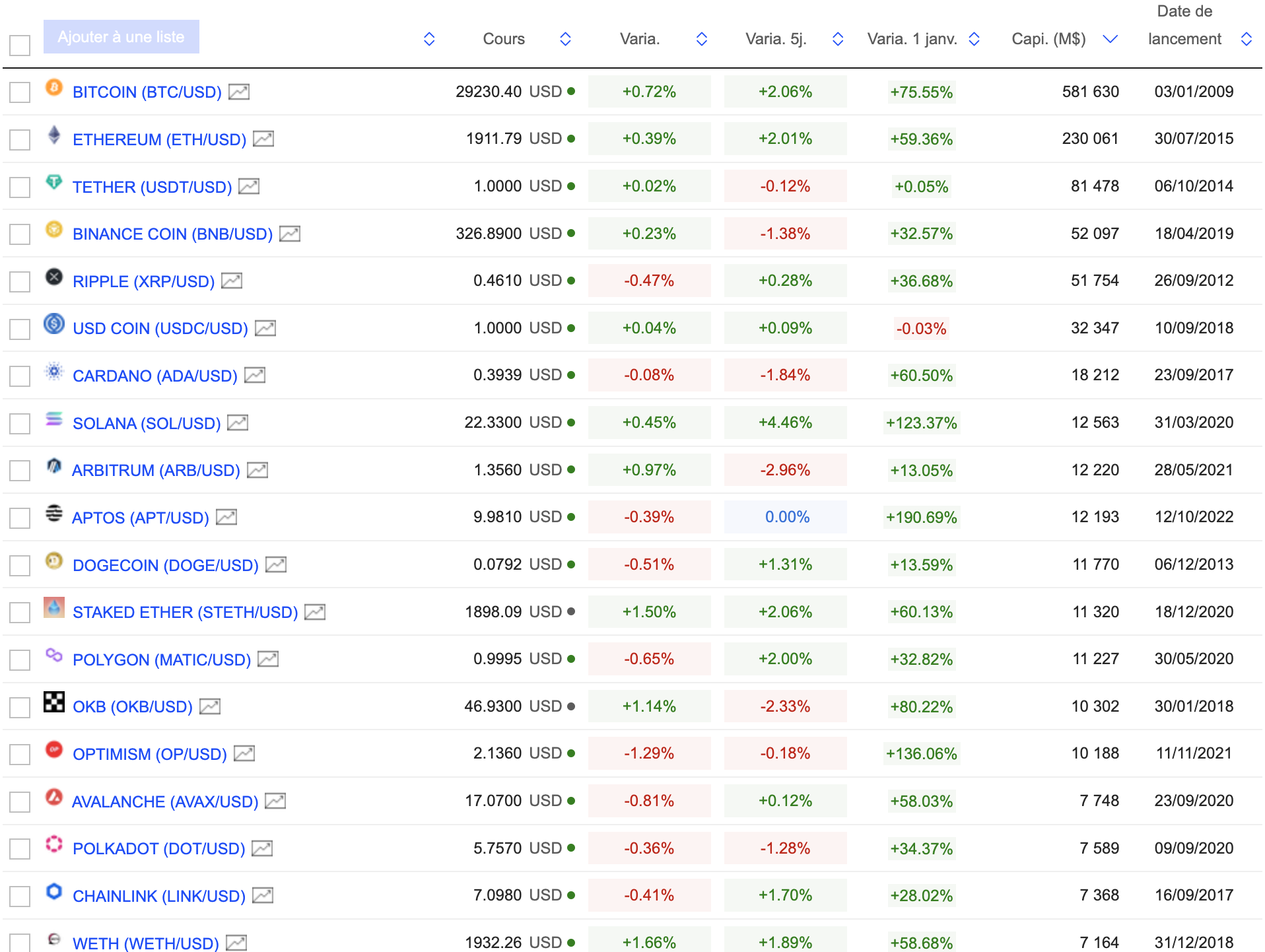

Block 3: Gainers & Losers

Cryptocurrencies chart

(Click to enlarge)

Block 4: Things to read this week

Is the federal government trying to kill crypto? (NY Mag)

FTX-ed crypto investors return to hardware wallets (Wired)

Kids have been interacting in the metaverse for years - what parents need to know to keep them safe (The Conversation)

Quantum computing could break the internet. Here's how (Financial Times)

By

By