Halving Day

One of Bitcoin's many unique features is its process of halving the BTC reward passed on to miners. This process, called "halving day", has always been followed by a large bullish move and preceded by a bearish consolidation.

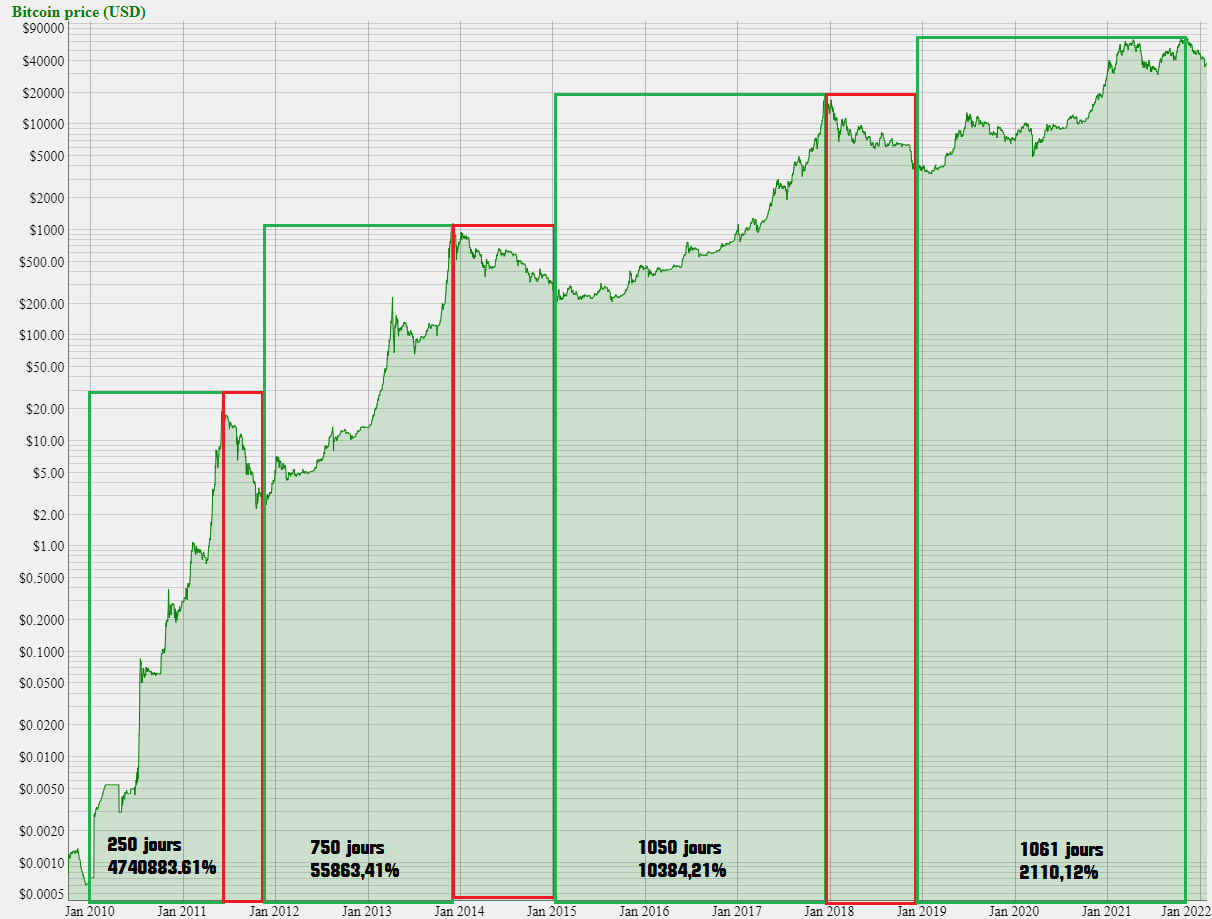

Graph of halving days

Source: bitcoin.com

To put it simply, a halving day is an event that occurs once every four years (i.e. every 210,000 blocks on Bitcoin) and which reduces the reward for miners for validating a block on the network by half. After the last reduction on May 11, 2020, the reward is now 6.25 BTC per validated block. It is awarded to the first miner who solves a mathematical algorithm and deciphers the hash (a mathematical function that allows a block to be closed and move on to the next).

Bitcoin's halving days have been a way, in the past, to measure cycles not from an absolute minimum, but from the point of view of supply and demand. It is clear from the above chart that the halving day process has always been followed by a stratospheric upward movement. Will this trend continue forever? Let's take a look at a calculation model that has proven to be terribly effective so far.

Stock-to-Flow (S2F)

In 2019, a former Dutch professional investor, PlanB, published an article titled: "Modeling Bitcoin Value with Scarcity." It presents how we can quantify the scarcity and value of bitcoin.

Quite simply, the Stock-to-Flow (S2F) model represents the ratio of an asset's stock to its annual output. We could use it for various precious metals with a limited amount of predefined resources. Yes, because as a reminder, the number of bitcoins mined is limited by the Bitcoin code to 21 million units. At the moment almost 19 million bitcoins have been mined, but with the halving day reducing the daily production of BTC, the last bitcoin mined is expected to be in 2140. In other words, few of us will be around to see it... Let's get back to our model.

To study the value of bitcoin through the prism of its scarcity, Plan B has integrated the different halvings and thus the amount of bitcoins mined over time. What is striking is that the S2F model highlights the price zones where bitcoin is considered under or overvalued as a function of Stock-to-Flow (i.e., as a function of Bitcoin production), and if we look closely, we notice at a glance that the peaks and troughs in the price of Bitcoin are, historically, relatively well correlated with the halving day.(In the chart below, the change from blue to red indicates the halving day.)

Stock-to-Flow

Source: stats.buybitcoinworldwide

You're not hallucinating! According to his model, the price of bitcoin is expected to reach over $1 million by 2026. While scarcity is the fundamental pillar of the model, it is obviously not the only factor in determining the value of bitcoin. Regulations, news, institutional interest, the arrival of retail and professional investors, internet coverage, mining conditions and the installation of Bitcoin ATMs, among others, are all variables that can positively or negatively influence demand. If we enter a down cycle, as bitcoin has already experienced, S2F would have failed for the first time. This is because the price would not have risen in proportion to its scarcity over this cycle.

As crypto-investors or just observers, we are inevitably attached to the intrinsic reactions that these sudden changes in market sentiment can bring. However, in times of volatility, it is crucial to keep in mind and remember the adage "when in doubt, zoom out".

Bitcoin is still by far the best performing asset of the last decade and its value proposition remains fundamentally unchanged. On the other hand, we can observe that the cycles, materialized by an absolute price low and an all-time high, tend to get longer, which increasingly challenges the Stock-to-Flow and thus the supercycles that digital gold has experienced.

Bitcoin's supercycles

The hypothesis of lengthening Bitcoin cycles assumes that each successive cycle lasts longer. By measuring the performance and number of days between the absolute low of the price to the absolute high of the BTC price, we can see this.

For example:

The current cycle, which started with a low of $3122 on December 15, 2018, has reached a longevity of 1061 days if we estimate that the price peak was reached on November 10 at $69,000. The cycle could eventually get longer. But what about the past? Cycles are getting longer and longer with "less and less stratospheric performance."

https://bitcoin.zorinaq.com/price/

These increasingly long periods between lows and highs coincide with the "lengthening cycle" theory popularized by Benjamin Cowen, renowned crypto analyst and founder of Into The Cryptoverse . Overall, this theory suggests that Bitcoin's market cycles lengthen while producing diminishing returns. Incredible as it may seem today, this implies that Bitcoin's volatility will increasingly tend toward 0 in 10 to 15 years. In order for Bitcoin to remain consistent with the theory of a lengthening cycle, it must undergo even more massive adoption before it stabilizes. This assumption naturally leads us to Everett Roger's Diffusion of Innovation theory.

The theory of innovation diffusion

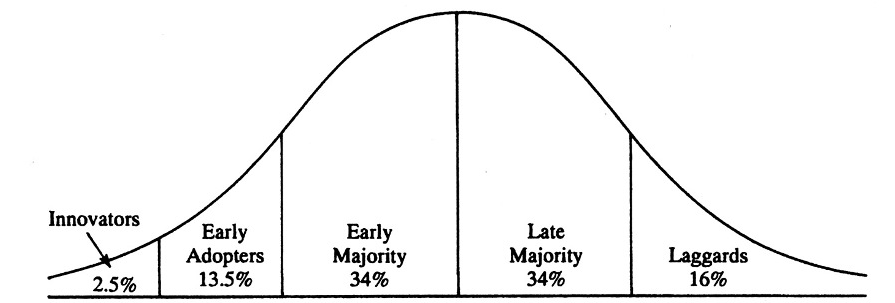

If we focus on Everett Roger's theory of innovation adoption, the diffusion of a disruptive innovation depends strongly on its human capital component. In this framework, the percentage of customers who adopt a disruptive innovation over time can be divided into 5 distinct categories:

According to many experts, crypto asset adoption is nearing the end of the early adopter phase as it tests the entry into the early majority phase. As adoption moves along the curve, volatility decreases, creating a potentially more stable bitcoin over time. It will likely take decades for the asset to fully stabilize. As Bitcoin's market capitalization increases, as does its liquidity, volatility should naturally continue to decrease.

If we go back to Benjamin Cowen, he believes that the reason for the longer cycles is the increased influx of money from different parts of the globe. Countries like India, El Salvador, Vietnam among others, have become huge crypto centers in 2021. This rise in government initiatives are playing into the growth of the digital currency. In addition, a number of celebrities have backed NFT projects and DeFi (decentralized finance) platforms, and major companies like Mastercard, Microsoft, Expedia, Meta, PayPal and even Google have moved into crypto territory to develop crypto-blockchain-nft solutions. Finally, with the support of Elon Musk and Michael Saylor, Bitcoin has seen an influx of billions of dollars. All of these factors are also supporting bitcoin and in turn other crypto-asset projects.

The typical four-year cycle that most analysts use to predict bullish and bearish prices for bitcoin will most likely be replaced by a less volatile and less cyclical market. And as we've seen, the transition is in order with bitcoin flattening in both performance and cycles.

.

By

By