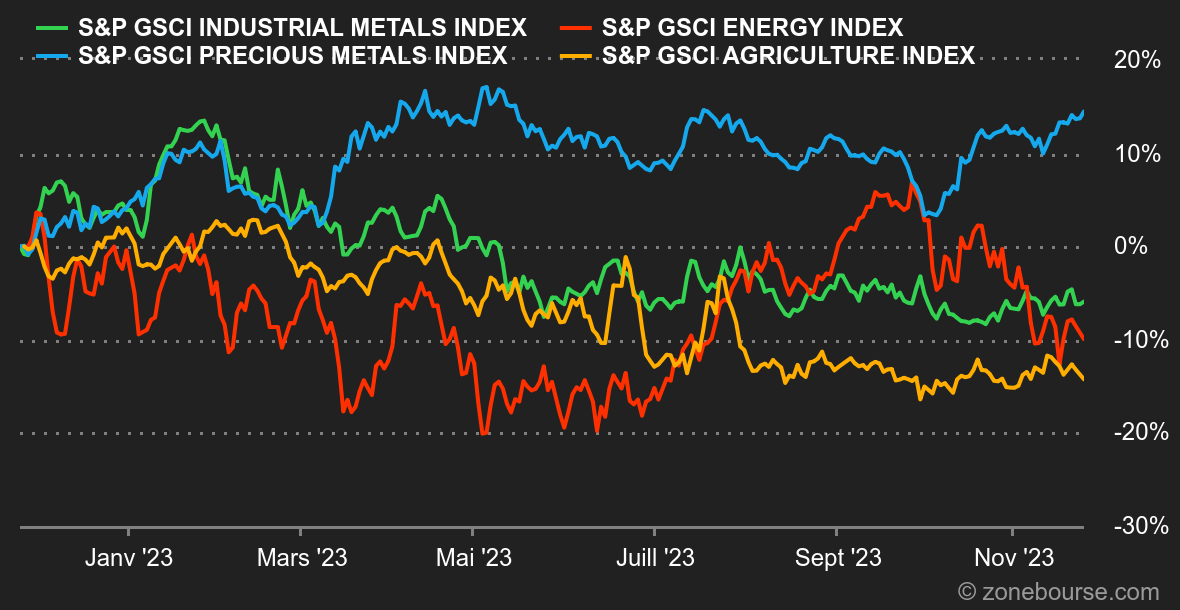

Energy : Doors are slamming and dishes are breaking at OPEC+, which is torn by disagreements within the alliance over production targets. Saudi Arabia is reportedly pressuring the group to increase production quotas, an extra effort that is not going down well with some producer countries, such as Nigeria. These differences led to the postponement of the meeting, initially scheduled for November 26 in Vienna, to November 30, virtually. An impasse on the future policy of the enlarged organization represents a major unknown for the market. The last thing OPEC+ wants is to find itself deadlocked at a meeting, so oil prices retreated last week, but even so, the weekly balance is fairly neutral. The sharp rise in weekly US inventories (+8 million barrels) also weighed on the trend.

Metals : A period of consolidation for industrial metals, with the exception of copper, which continued its advance in London to USD 8,300. Aluminum lost ground, penalized by a report from the International Aluminium Institute, which showed a 3.9% year-on-year increase in production in October. Zinc, too, was weighed down by a rise in LME inventories. As for gold, the precious metal is once again attempting to break through the USD 2,000/oz barrier. Is this the right attempt? Probably, since an ounce of gold is currently trading at around USD 2040.

Agricultural commodities : The performance gap between cocoa and the rest of the agricultural commodities segment is widening, with cocoa continuing its advance to over USD 4,100 per tonne. At the same time, grain prices did not fluctuate much. A bushel of wheat is still trading at around 580 cents in Chicago. Corn is trading at around 490 cents per bushel. In Ukraine, although the Department of Agriculture is optimistic about the winter wheat harvest, the level of shipments remains uncertain given Russian harassment of its port facilities.

By

By