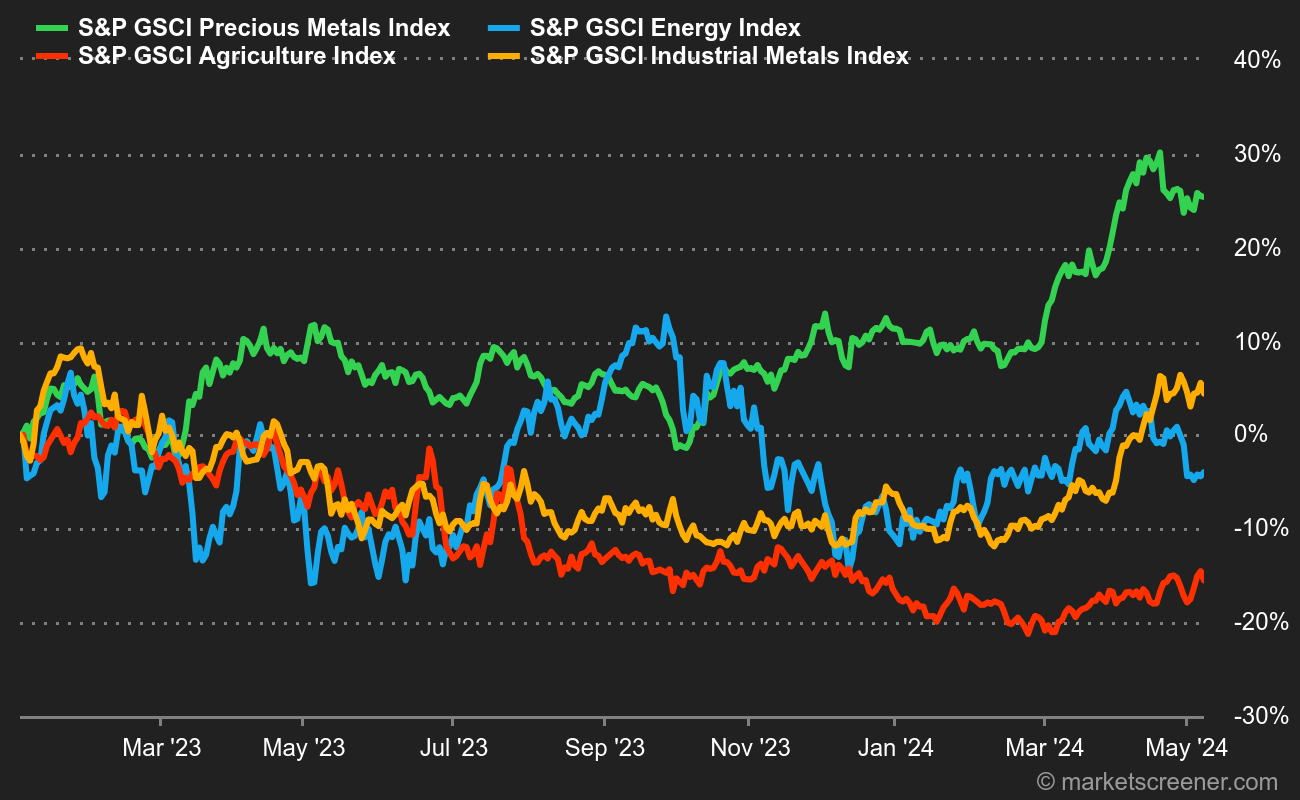

Energy: Oil prices are on a rollercoaster ride. The price of Brent crude fell to as low as USD 81.70 last week, a price movement caused by statements by Russian Deputy Prime Minister Alexander Novak, who suggested that OPEC+ might increase its production. This statement, which was quickly denied, came as a surprise, since it is a safe bet that the enlarged organization should maintain its production quotas, which, let's not forget, represent 2.2 million barrels per day, given the weakness of oil prices. In other news, US inventories fell again last week, and the US Department of Energy still estimates that the US will produce 13.2 million barrels per day this year. In terms of prices, Brent crude is trading at around USD 82, while WTI is trading at around USD 77.70.

Metals: The tonne of copper is rising in London. China provides strong support, as the Asian giant reported solid trade data for April. Beijing also lifted restrictions on housing purchases in certain major cities. Spot copper is trading at USD 10185 on the London Metal Exchange. In precious metals, the ounce of gold is back on the rise at USD 2360.

Agricultural products: You need a strong heart to follow the roller-coaster ride of cocoa prices. Prices, which gave up more than 30% in just two weeks, have recovered around 10% in five days. However, on the fundamentals front, nothing has really changed: the outlook is gloomy on the global supply side, which will mean a significant deficit this year. In Chicago, wheat is gaining ground at 670 cents a bushel, while corn is treading water at 460 cents.

By

By