Several months ago, we drew your attention to the carry trade opportunities offered by certain currencies. The Mexican peso, Turkish lira and Hungarian forint fall into this category. This week, we're taking stock of the situation, as the going gets a little tougher.

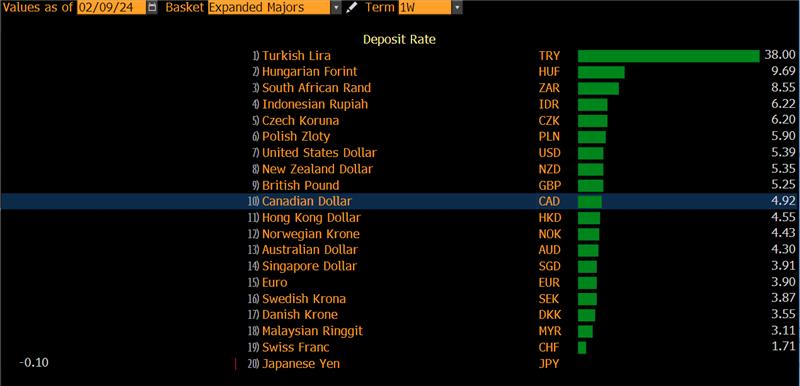

When it comes to the carry trade - a game which, for novices, involves taking positions in currency pairs based on the yield differential between them - the first question to ask is which currencies are the most profitable. The table below gives you an overview of deposit rates on the main countries.

On the podium are the Turkish lira, the Hungarian forint and the South African rand. However, the ranking of the best performers since the start of the year, based on a carry trade, is somewhat different:

Conclusion: don't dive headlong into the adventure solely on the basis of the yield on offer, as the change in the pair can more than offset the interest rate differential. In fact, EURHUF has been one of the worst carry trades so far this year. So, is this just a blip or a turnaround?

Unfortunately, the chart structure presents some dissonant elements. On the one hand, EURHUF has just bumped into a downtrend line in progress since 2023, resisting around 388. On the other, the 200-day moving average is turning upwards and is now around 380, with 377.11 as horizontal support. All in all, the current risk/reward situation militates in favor of a sell position, considering that breaching the blue line, let alone 394.67, will invalidate the downward momentum.

By

By